DENVER — Remember that state refund you got back before the November election?

The $750 or $1,500 TABOR refund?

The one that Democrats rebranded, so they could take credit for the refund they wanted voters to let them keep?

They were so proud of getting you money back early, Next with Kyle Clark wanted to know if they were going to do that every year we get a TABOR refund, like the next two years.

It turns out, there is a new effort to end those refunds.

"Until we fund all of the state services that we're supposed to be funding, why are we giving money back to voters? You have roads that are less drivable. You have kids that are less educated," said State Rep. Cathy Kipp (D-Fort Collins).

Kipp, a former member of the Poudre School District School Board, is preparing to introduce a bill at the Colorado State Capitol that would end future TABOR refunds, so the state could keep the money for education spending.

"We need long-term, sustainable funding so we can pay our teachers and do what the people expect," Kipp said.

Kipp and State Sen. Rachel Zenzinger (D-Arvada) are listed as the sponsors of a draft bill entitled "Retain Excess State Revenues For Public Education."

That is a fancy way of saying: "Keeping state TABOR refunds instead of sending them back like the checks you received last year."

"The initiative basically says, yes, we need to use this money to attract and retain teachers and students support staff," Kipp said.

In 2019, voters statewide rejected Proposition CC by eight points. Prop CC would have allowed the state to keep the same TABOR refund money, but that proposal was to spend one-third on K-12 public schools, one-third on higher education and one-third on roads.

Polling by Magellan Strategies last year showed voter support for a statewide ballot issue to spend TABOR refund money on public education. The supporters behind the proposal to do that failed to collect enough signatures to put that on the 2022 November ballot.

"People have been talking about, 'Well, at the point we get to the bottom -- we get to rock bottom and the school districts don’t have any money, blah, blah, blah, then we will solve the problem.' I think we’re there," Kipp said. "We are no longer looking at a theoretical, we’re at the bottom. It’s because schools and school districts have kept on doing more with less."

Because this would be a change to state law, the referred measure only needs a majority of lawmakers to approve to put this on the ballot. It also does not require the signature of Gov. Jared Polis (D) because it would be a ballot issue for voters.

If voters were to approve this measure, if it gets put on the November 2023 ballot, TABOR overage dollars would still be used to fund the senior and veteran property tax exemption and the new affordable housing fund that voters approved this past November.

However, teacher pay is a local school district decision, not one by state lawmakers.

School districts are funded primarily through local property taxes. The district receives money based on a per pupil funding equation. If local property taxes do not get the district to 100% of per pupil funding, the state is supposed to backfill. Since the state has not had enough funding to make all 178 school districts 100%, they reduce state funding to local districts proportionally, using what's called the budget stabilization factor.

Lawmakers on TABOR questions

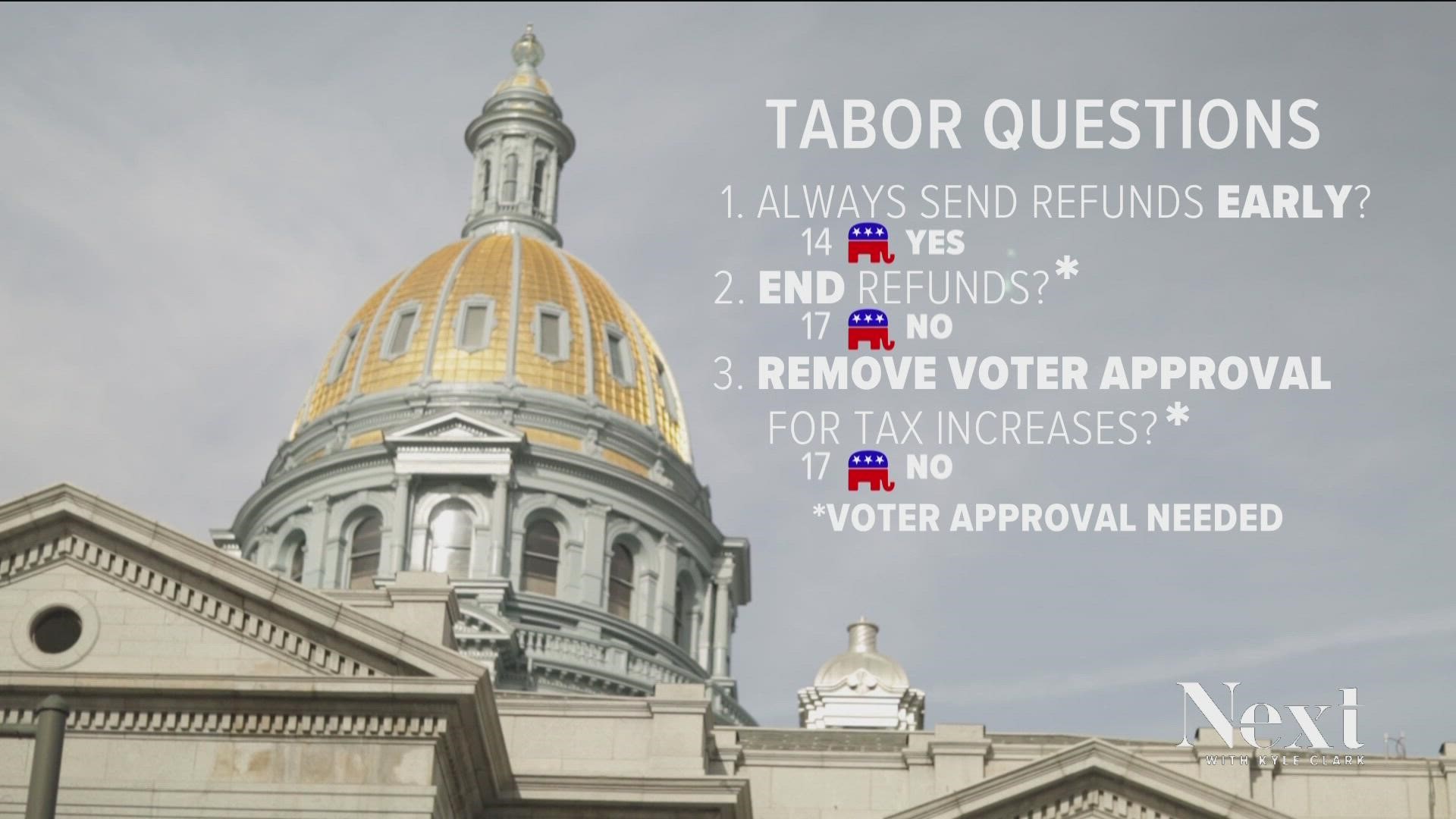

On Jan. 6, three days prior to the start of the legislative session, Next with Kyle Clark emailed all 100 state lawmakers (though, two have resigned since that day). There were three yes or no questions asked:

- Do you want to see TABOR refunds sent back early every year, similar to how some of the TABOR refund was returned to residents early in 2022?

- Do you want to remove the portion of TABOR that refunds money back to residents?*

- Do you want to remove the portion of TABOR that requires a vote on tax increases?*

*Both questions 2 and 3 require voter approval.

Of the 98 lawmakers, Next received responses from 21.

Some answered each question simply with yes or no, others provided a paragraph that summarized the answers, but left some gaps in the answers. And the Bruce, or de-Brucing, you'll see refers to Douglas Bruce, the author of TABOR.

State Rep. Ryan Armagost (R-Berthoud)

Taxpayer Bill of Rights needs to be issued to Coloradans responsibly and transparently. It should not be used as a political/election tool or reward, and should not be misnamed as anything other than Taxpayer Bill of Rights (TABOR) refund. The law set forth in Colorado Taxpayer Bill of Rights should not be changed without being put on the ballot. The refund should not be altered and our taxpayers deserve something back from being overtaxed by our state every year.

State Rep. Nick Hinrichsen (D-Pueblo)

Colorado’s flat income tax creates a real tax rate for middle class families that is higher than the national average, while the real tax rate for the wealthiest Coloradans is among the lowest in the nation. I would like to fully repeal TABOR and replace our flat income tax system with progressive tax tiers that permanently reduce taxes for individuals making less than $100,000 per year, and couples earning less than $200,000.

I sponsored the bill that created the 2022 Colorado Cashback refund mechanism. As long as TABOR is in place, refunds (when triggered) should benefit the working families who are overtaxed, and should be delivered as quickly as responsibly feasible. To that end, I support future refunds being delivered at a flat amount, or an amount that is phased out a a designated income level, depending on the total amount of the refund.

State Sen. Larry Liston (R-Colorado Springs)

- Yes

- No

- No

State Sen. Ken DeGraaf (R-Colorado Springs)

- Yes, but with the recognition that it is a TABOR required return of your money, not some magically conjured "free" money from a benevolent dictator

- No

- No

State Sen. Janice Rich (R-Grand Junction)

- YES, I DO. Those funds belong to the taxpayers.

- NO, I DO NOT. This money belongs to the taxpayers, not State Government.

- NO, I DO NOT. It already costs more to live in this state. Can you imagine what our state would look like? Allowing State Government to have out-of-control spending is irresponsible. Plus, we don’t need to be one of those states that continue to operate in debt.

State Sen. Byron Pelton (R-Sterling)

- As long as the people of Colorado receive their refund, I do not have a preference as to when the refund happens. I don’t think the Governor or the majority party who is in control should take credit for the refund. The People of Colorado voted to implement TABOR on the Government and ultimately it’s their choice to get refunds.

- NO!!!

- NO!!

State Rep. Ty Winter (R-Trinidad)

- Refunds should be sent back early to taxpayers, it is their money and should be available for them to use.

- No.

- No, this is one of the most important components in the The Tax Payers Bill Of Rights. It helps keep government spending in check but more importantly leaves the decision to raise taxes in the hands of the voters.

State Rep. Rose Pugliese (R-Colorado Springs)

- Yes, it is the people’s money and should be returned to them as quickly as possible.

- No, I do not support removing refunds from the Taxpayers’ Bill of Rights or having the state de-Bruce. The purpose of the Taxpayers’ Bill of Rights is to limit the growth of government and it has worked effectively throughout the years to protect Coloradans and our families.

- I chose to move to Colorado because of the Taxpayers’ Bill of Rights. I thought any state that allowed its people to vote on tax increases had to be the most free state. The people of Colorado support voting on tax increases and I support the people.

State Rep. Gabe Evans (R-Fort Lupton)

- Yes. Taxpayer Bill of Rights (TABOR) refunds belong to the people and should be returned quickly.

- No. The State budget has nearly doubled in the past 10 years. The paychecks of Coloradans have not doubled in that same timeframe. The Taxpayer Bill of Rights ensures government growth remains reasonable and excess government funds are returned to Coloradans.

- No. The Taxpayer’s Bill of Rights guarantees voters the right to vote on any tax increase. I support transparency and accountability in government spending. That starts with voters having the final say on any tax increase.

State Sen. Jim Smallwood (R-Parker)

- Yes

- No

- No

State Rep. Lisa Frizell (R-Castle Rock)

- I 100% support refunds per the Taxpayers Bill of Rights. Our citizens deserve a well run State government that Is transparent and accountable. Overages of funds should be returned as soon as possible.

- The Taxpayer’s Bill of Right limits the growth of government and has an established track record of keeping government spending in check. I do not support removing refunds from the Taxpayers’ Bill of Rights or having the state de-Bruce. The purpose of the Taxpayers’ Bill of Rights is to limit the growth of government.

- No, this is the crux of local control — in a free state our citizens should have control over what the government does, and more importantly how their tax dollars are spent.

State Sen. Barb Kirkmeyer (R-Brighton)

I have a long record of supporting TABOR as a meaningful tool to control government growth. TABOR puts the average citizen on equal footing as lawmakers when it comes to taxation. It forces the government to look at spending in a way that is beneficial to the people. Not the old tax and spend methodology and live beyond our means mantra that democrats push forward.

I support TABOR refunds and will oppose attempts to take those refunds for new government spending. The current refund mechanism gives people a refund based on how much they’ve paid in which is absolutely fair.

I also support voters maintaining their right to approve all tax increases. Voters even extended that to vote on big fee increases and enterprises. And voters protected their refunds in 2019.

TABOR is not a regressive tax unlike regressive tax policies passed by the left. What’s regressive is a the new delivery fee. And the new gas tax hike. And the new fee on nicotine. And other taxes/fees that disproportionately impact the poor and hard working families.

Also, our flat income tax rate is a benefit to the state because it helps us remain competitive and attracts people here

State Rep. Mary Bradfield (R-Colorado Springs)

- I do want to see the citizens of Colorado receive their Tax Payers Bill of Rights refunds in a timely manner.

- I do not want to remove the Tax Payers Bill of Rights refunds

- I believe that the portion of the Tax Payers Bill of Rights that deals with any tax increases must be sent to the citizens for their approval.

State Rep. Matt Soper (R-Delta)

“Early refunds ensure Coloradans have their money in a timely manner to be able to spend, save, or invest as they see fit.”

State Sen. Bob Gardner (R-Colorado Springs)

- Yes. The TABOR refunds should be returned as early as possible. The refund money belongs to the people. They should have it as soon as possible to meet spend, save, or use as they wish.

- No. The refund of excess revenues ensures both that the growth of government is restrained and that individuals and families can keep and use greater portion of their hard earned money for their needs. No, I do not want to de-Bruce.

- Coloradans adopted TABOR for a reason, They want to reserve the right to decide whether Government can increase taxes and essentially grow.

State Rep. Ron Weinberg (R-Loveland)

- Yes, it is the people’s money and should be returned to them as quickly as possible.

- No, I do not support removing refunds from the Taxpayers’ Bill of Rights or having the state de-Bruce. The purpose of the Taxpayers’ Bill of Rights is to limit the growth of government and it has worked effectively throughout the years to protect Coloradans and our families.

- I chose to move to Colorado because of the Taxpayers’ Bill of Rights. I thought any state that allowed its people to vote on tax increases had to be the most free state. The people of Colorado support voting on tax increases and I support the people.

State Rep. Rod Bockenfeld (R-Watkins)

- Generally "No", but it depends upon of the circumstances. The check refund mechanism is the most costly refund mechanism that we have available. The best alternative is not to take more than is neccesary from the start. However if the circumstances warrant it and we need to get money back into the pockets of taxpayers quickly, the check refund mechanism is our best tool in the toolbox.

- Absolutely not. The Taxpayer Bill of Rights has served Coloradoans very well over the past 30 years. I would like to commend the citizens of Colorado for passing this important constitutional measure and keeping common sense, fiscal constraints on this government.

- No. This provision keeps the elected officials accountable to the people. Early on when the Taxpayer Bill of Rights was implemented, scare tactics were used to get Colorado Citizens to de-bruce many government entities. After 30 years establishing that the Taxpayers Bill of Rights was a success, I would like the Citizens to re-evaluate those decisions.

State Sen. Chris Kolker (D-Centennial)

1. The timing depends on our final economic report on revenue. I feel our Joint Budget Committee and Treasurer will have a better understanding of cash flow and access to capital to determine the timing of the refund as needed by the state budget.

2. I believe many if not most local taxing authorities around the state have already de-Bruced because of the need in their budgets to use the excess over their caps. It is an outdated policy that only our state is using. The voters have expressed their will in providing much needed services and support of affordable housing and school lunches while at the same time lowering our state income tax. I hear frequently from my constituents the need to lower class sizes, support our higher education institutions, expand access to mental healthcare, support healthcare for our children, elderly, and poor, reduce crime, support substance abuse recovery, and so much more. De-Brucing is our next best option in supporting these needs. De-Brucing doesn’t mean we will never see refunds, it just provides more flexibility in our budget dependent on annual needs.

3. Again, I believe we are the only state that requires a direct vote of the people. It is something that is better suited for direct democracy instead of the constitutional republic principles intended at the formation of the State of Colorado. Direct democracies are intended for small populations where electing representatives is not needed. To me, it is a philosophical issue and difference between a representative and direct form of government. We elect our representatives based on their values and beliefs with the idea that they will use those in the day to day operation of our government in which most citizens do not have the time or desire to take an in-depth interest. I believe TABOR is the major reason we are one of the worst states in funding public education and behavioral health supports. Two issues that have been at the top of the list of concerns for myself and my constituents since I started running for office in 2017. Why are we the only state limiting ourselves in serving those in the most need?

State Sen. Cleave Simpson (R-Alamosa)

- I support getting taxpayer their refunds back into their hands as soon as possible. I understand the complexities and some of the challenges, but we should work harder to not over collect those taxes to begin with. I have some concerns around the cost of having two different refunds for the same tax year, one as early as practical and one after the final tally for the year is calculated. We could consider a trigger on total of refunds that initiated the early refund, food for thought.

- I don't want to remove the portion of TABOR that mandates a refund of over collection of taxpayer dollars. I don't support the de-Brucing of the state. I support letting the hard-working taxpayers of Colorado keep as much of their earnings as they can.

- No, I don't want to remove the portion of TABOR that requires a vote to increase taxes on the citizens of Colorado.

State Rep. Cathy Kipp (D-Fort Collins)

- Honestly, that costs a little bit more money to get the money out early, so I would think that doing it during the tax refund process, if that’s going to be done, would be the most, probably, appropriate way. Last year was different because we were trying to make sure that post-pandemic people had some help that they needed because a lot of people were still suffering, so that’s kind of where we were.

- (Kipp is proposing a bill to keep TABOR refunds for state education funding)

- You delegate your responsibility to the people, you elect, and then you hold them accountable. So I think that’s the better way to go.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark