COLORADO, USA — TABOR refund checks started arriving this month.

This is the money that the state is required to refund to residents because it collected too much in taxes last year.

According to the Colorado Department of Revenue, 63% of TABOR checks (about 1.5 million) have been redeemed. That accounts for $1.5 billion.

Next with Kyle Clark has heard from multiple Colorado residents who have received a check, but not the funds.

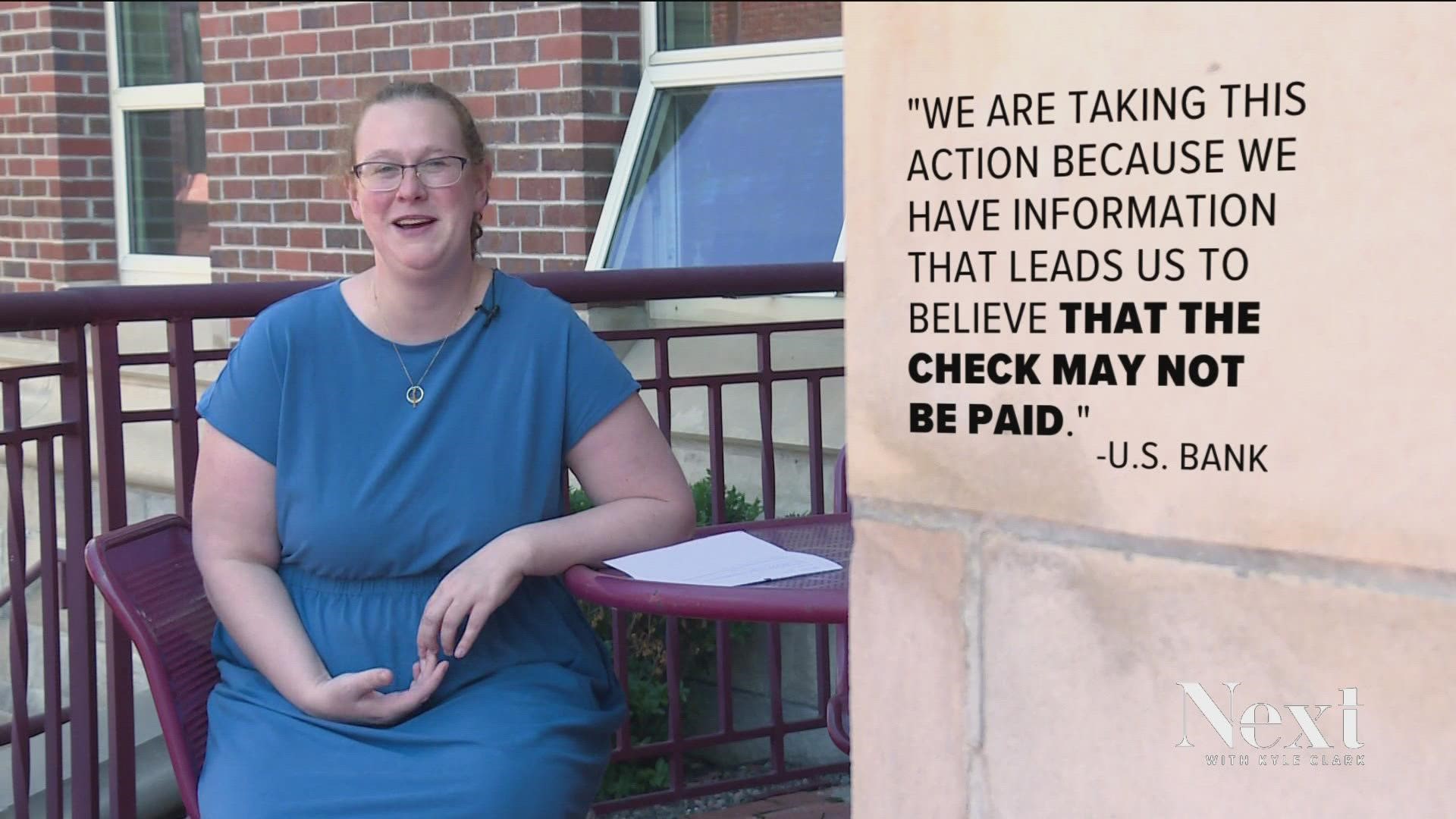

"I deposited it through the U.S. Bank app. In the past, I've never had an issue with a check being rejected or being put on hold," Sara Chatfield said.

We normally talk with Chatfield about politics since she is a political science professor, but for this issue, she is simply a Coloradan seeking her money.

"It is kind of politics, but in a different capacity," Chatfield said.

She has to wait for her TABOR refund, even though she has already deposited her check.

"We deposited our TABOR refund on Aug. 8, and then got a letter from our bank saying that the funds were on hold because the bank believes that the check may not be paid," Chatfield said.

"Here's the letter right here. 'We are going to put a hold on the check. We are taking this action because we have information that leads us to believe the check may not be paid,'" Castle Rock resident Tim Fields read from his U.S. Bank letter.

Fields also did a mobile deposit on Aug. 8, then got a letter telling him that the funds were on hold.

"Boy, this just doesn’t smell right. Why would they hold state funds? I just thought that was odd for a state-issued check," Fields said.

The Colorado Department of Revenue was aware of an issue last week and issued an "Industry Wide Bulletin," letting banks know of certain aspects of the check that are not fraud indicators. One was that the paper the checks are printed on are thinner and lighter weight.

"I still have the check here, it seems normal," Fields said. "We, thankfully, didn't need the money right away, but a lot of people may have needed the money for whatever, it could be food on the table or whatever. In those instances, it would be more than an 'oops.'"

In that bulletin to banks, Department of Revenue Executive Director Mark Ferrandino wrote: "DOR [Department of Revenue] is working to ensure every banking institution understands the legitimacy of these checks and encourages all institutions to cash or deposit these funds."

"If you're going to make a big deal of sending to money to people, and we're calling it the 'Colorado Cashback,' and then if it becomes a chore and people have to go through all these extra steps to figure out where their money is, I can't think that's a good look," Fields said. "In my case, we weren't counting on this money to pay for a major expense, but I feel like a week or more delay in receiving funds from a check that someone deposits could be a huge deal if a person was thinking they were going to use this money for rent or food."