DENVER — The most complicated issue on the November 2020 ballot could be coming back again.

The passage of Amendment B will freeze the assessment rate used to determine property taxes.

Voters approved Amendment B with 57.5% of the vote, which will prevent the 7.15% residential assessment rate from dropping. It was likely to become 5.88%.

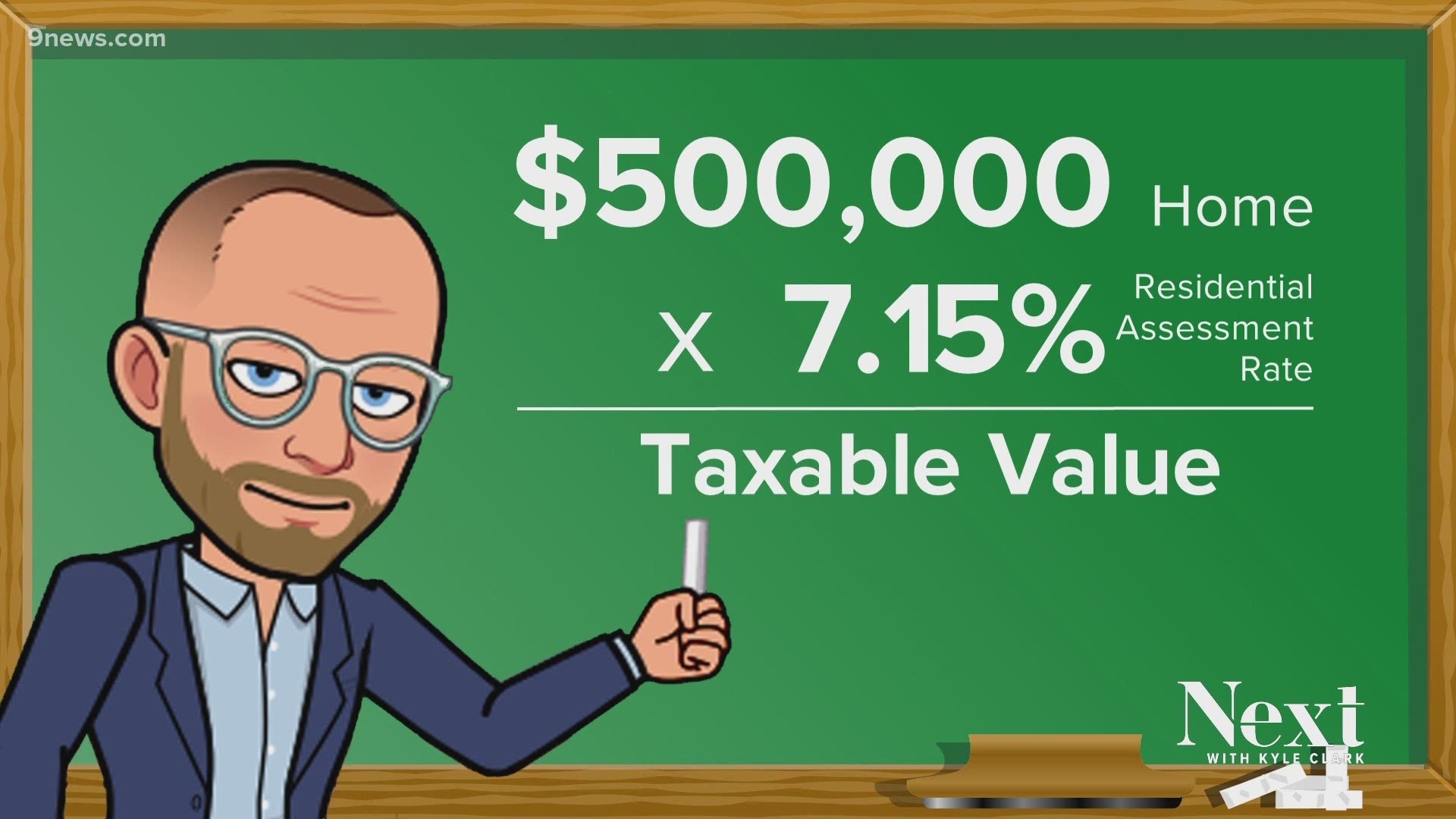

The assessment rate is multiplied by your home's assessed value to determine the taxable value of your property.

Even before property owners see what that means for their bottom line, a conservative-minded group already wants you to vote to reduce the assessment rate, despite voting against that two months ago.

"Even if the assessment rate stays the same, your value of your house goes up and that means that you pay more money," said Michael Fields, executive director of Colorado Rising State Action.

His group campaigned against Amendment B, and now they're already starting the process to qualify a ballot proposal for November 2022, to reduce the residential assessment rate to 6.5%, and the commercial property assessment rate from 29% to 26%.

"We wanted to start early enough, so people could have the discussion, 'is this something they want,' but also put a little bit of pressure on the legislature to come up with a fix before it really hurts homeowners in the upcoming years."

In our "Let's Just Vote" series, we explained how property taxes breakdown based on where you live.

When voters froze the assessment rate, it meant that school districts, cities, counties, police and fire departments, libraries, parks and recreation and other city and county districts would get not see a drop in money as a result of lower property tax payments.

However, even though the assessment rate didn't change, your property tax bill could still change because of other decisions made at the ballot.

Voters in three metro-area school districts approved tax increases on the November 2020 ballot.

Denver, Cherry Creek and Littleton School Districts will receive more money through property taxes.

To illustrate this, we'll use a $500,000 home.

A $500,000 home multiplied by the 7.15% assessment rate has a taxable value of $35,750.

That number, $35,750, is then multiplied by the mill levies (tax rates) for the different taxing districts.

For a home in the Cherry Creek School District before the November 2020 election, the tax rate for the school district was 0.046997.

$35,750 multiplied by 0.046997 equals $1,680.

Since voters approved ballot issue 4A in the Cherry Creek School District, the tax rate is now 0.049724.

$35,750 multiplied by 0.049724 equals $1,778.

Even though Amendment B froze the assessment rate, the tax rate for the school district increased, meaning the property tax bill will also increase.

The same happened for residents who pay property taxes to Denver Public Schools and Littleton Public Schools.

Littleton School voters approved a significant tax rate change.

Before the election, the equation for a $500,000 home was: $35,750 multiplied by 0.059266 equals $2,119.

Now, the tax rate is .064744, so the equation is for a $500,000 home is now: $35,750 multiplied by 0.064744 equals $2,315. That's a change of almost $200 a year.

The change in the Denver Public Schools tax rate changed the payment from a $500,000 homeowner from $1,668 to $1,724.

There is another factor that will change property tax values this year.

Odd years are when county assessors reassess the value of your home. If your home is assessed at a higher value, your taxable value will increase. Even if the assessment rate is unchanged, you might see a change in your property tax bill if the value of your home changes and/or if taxing districts, like school districts, seek a voter change in their tax rate.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark