COLORADO, USA — This story is part of a series of statewide ballot issue reviews for Next: We Don't Have To Agree, But Let's Just Vote.

Amendment B is complicated. It doesn't have to be.

Amendment B asks you to repeal the Gallagher Amendment, a law passed in 1982 that deals with assessment rates, part of the calculation that determines a property's tax bill.

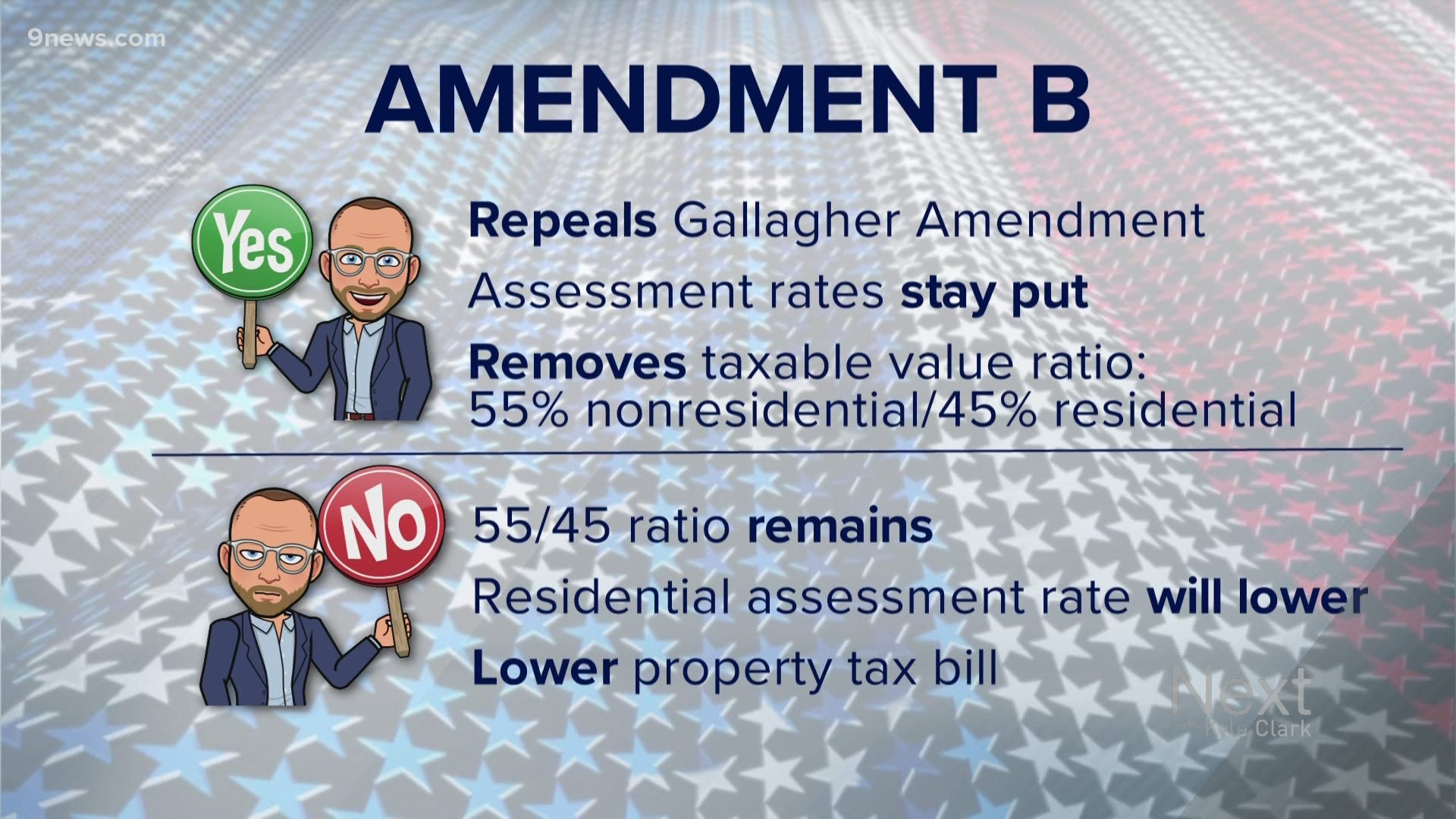

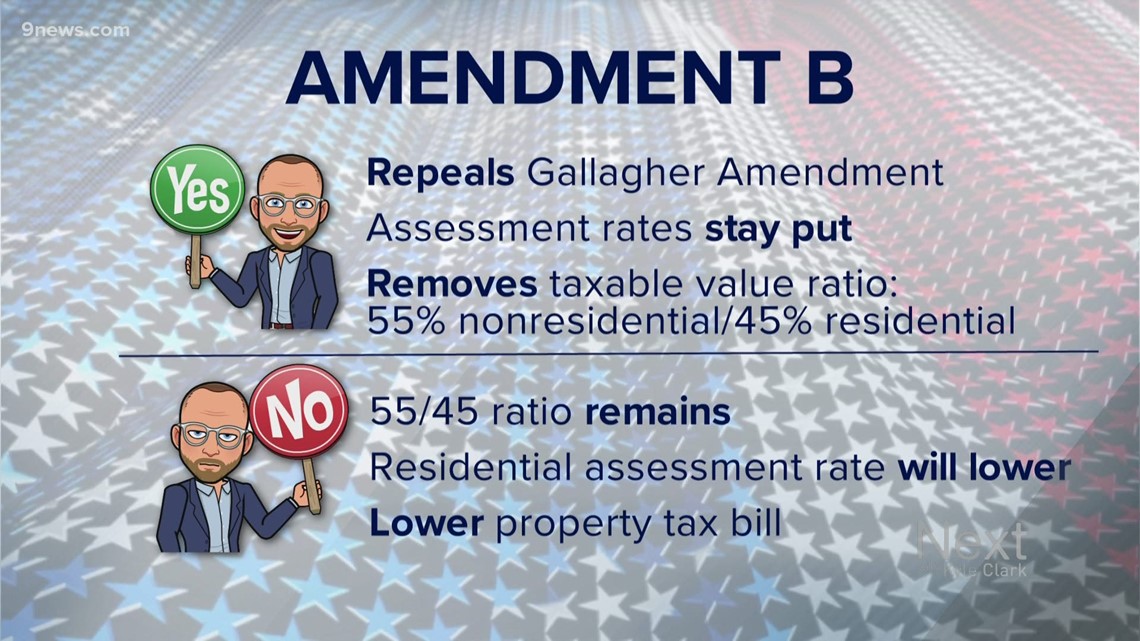

A YES vote means assessment rates stay where they are. Assessment rates are not the final property tax bill, just part of the calculation.

Voting yes gets rid of the 55%/45% ratio that requires nonresidential property to make up 55% of the state's taxable property and 45% from residential property.

A NO vote keeps the Gallagher Amendment. The 55%/45% ratio would remain, and to keep that balance, residential assessment rates will be lowered, resulting in lower property tax bills.

*There is more to your total property tax bill than just the assessment rate, which we will get into in this article

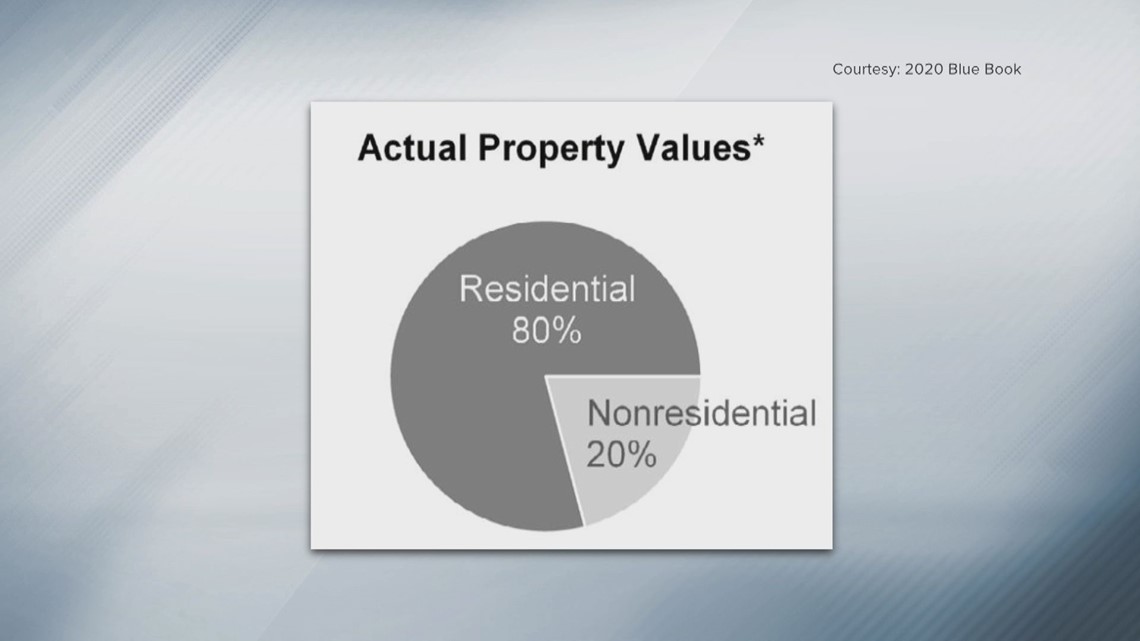

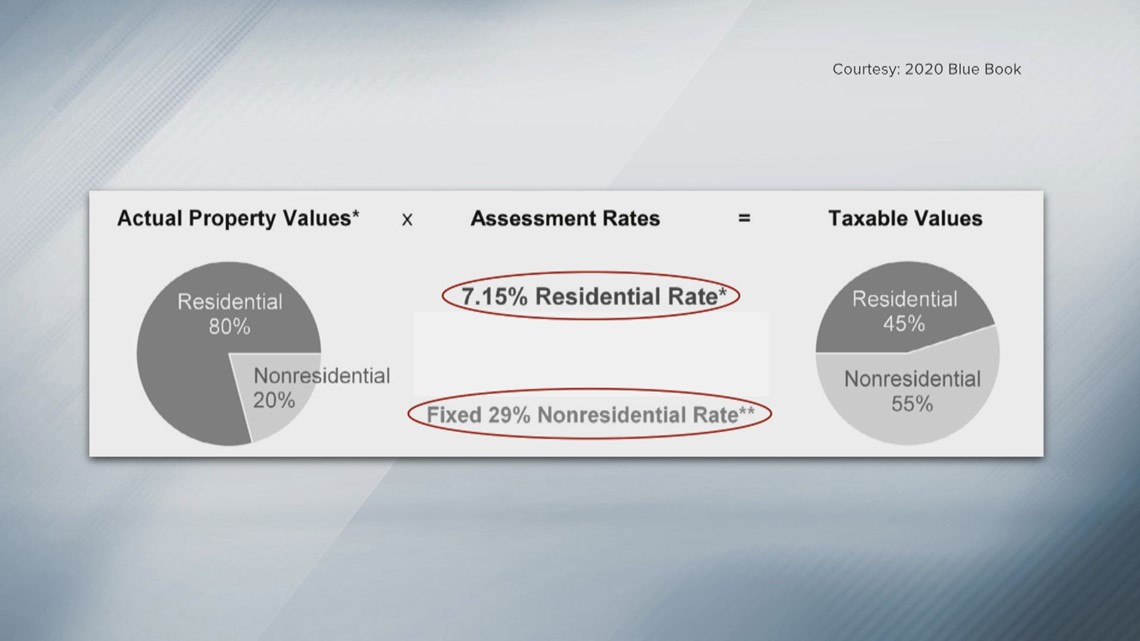

As a result of new home construction and higher residential property values, residences make up 80% of the state's property values.

Businesses and commercial property make up 20%.

However, the Gallagher Amendment requires businesses and commercial property to pay 55% of the state's property taxes.

It also set the nonresidential assessment rate at 29%. So, to get to the 55%/45% ratio, residential property values are multiplied by a lower assessment rate than nonresidential property.

Today, the residential assessment rate is 7.15%.

In 1983, the first year under the Gallagher Amendment, the residential assessment rate was 21%.

If you vote YES on Amendment B, the residential assessment rate will stay at 7.15%, unless reduced by the legislature. Any increase would require a statewide vote.

If you vote NO on Amendment B, the residential assessment rate will drop, likely to 5.88% next year, and would continue to drop as needed to keep the 55%/45% ratio in future years.

How property taxes are calculated

To understand how this will impact you and the amount of money you pay for services in your city and county, you need to understand how property taxes are calculated.

Every two years, in odd years, county assessors determine property values. That assessment is based on comparable sales over the previous year-and-a-half.

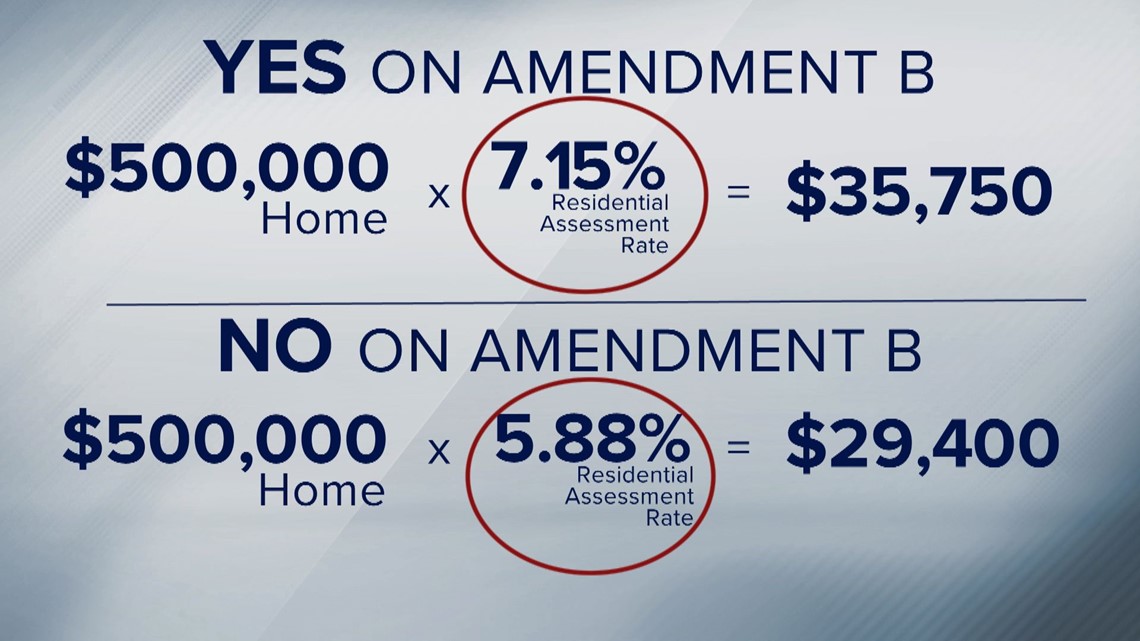

As an example, we'll use a $500,000 home, knowing that your situation may be lower or higher.

The assessed value of your home is multiplied by the residential assessment rate to determine the taxable value of your home.

It's the assessment rate that you're voting on with Amendment B.

Taxable home value = $500,000 (assessed value) x 7.15% (residential assessment rate).

A YES vote on Amendment B keeps the residential assessment rate at 7.15%, so in this example, the taxable value of the $500,000 home is $35,750.

A NO vote on Amendment B would reduce the residential assessment rate, likely to 5.88%, which makes the equation: $500,000 x 5.88% = $29,400.

*We recommend finding your property tax information on your county's assessor page to do the following calculations for your home

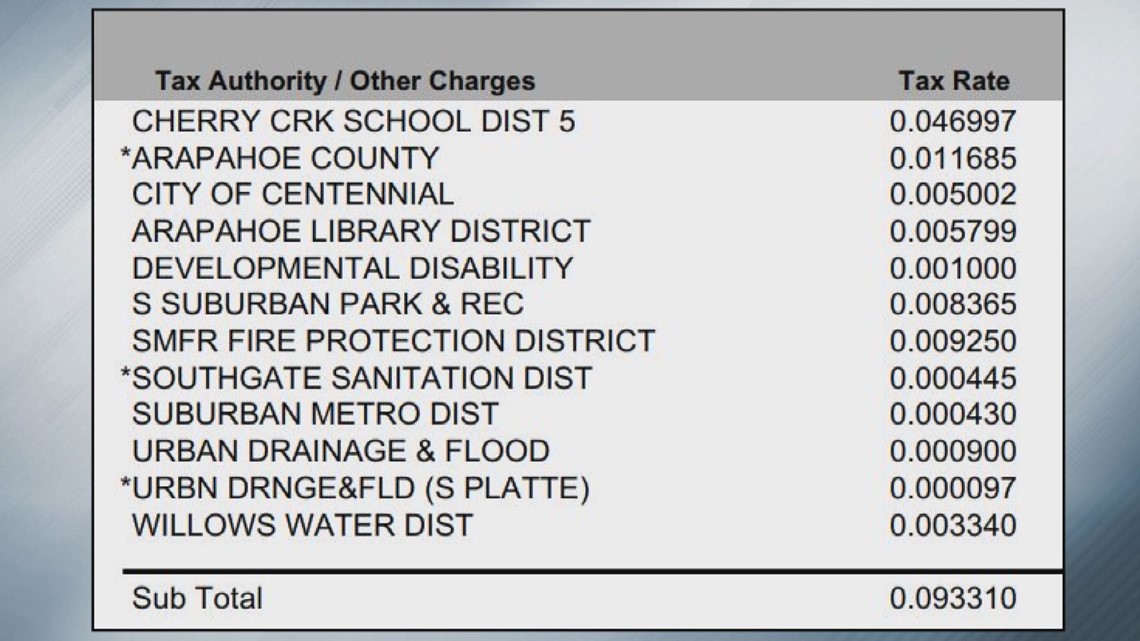

Using this Centennial home's property tax bill as an example, follow along as we detail the difference between a yes and no vote on Amendment B.

If you vote yes and keep the residential assessment rate at 7.15%, you multiply $35,750 by the tax rates listed as follows:

- Cherry Creek School District: $35,750 x .046997 = $1,680

- Arapahoe County: $35,750 x .011685 = $417

- City of Centennial: $35,750 x .005002 = $178

- Arapahoe Library District: $35,750 x .005799 = $207

- Developmental Disability: $35,750 x .001000 = $35.75

- South Suburban Parks & Rec: $35,750 x .008365 = $299

- South Metro Fire Protection District: $35,750 x .009250 = $330

- Southgate Sanitation District: $35,750 x .000445 = $16

- Suburban Metro District: $35,750 x .000430 = $15

- Urban Drainage & Flood: $35,750 x .000900 = $32

- Urban Drainage & Flood (South Platte): $35,750 x .000097 = $3.47

- Willows Water District: $35,750 x .003340 = $119

If you vote no and allow the residential assessment rate to continue to change (likely 5.88%), you multiply $29,400 by the tax rates listed as follows:

- Cherry Creek School District: $29,400 x .046997 = $1,381

- Arapahoe County: $29,400 x .011685 = $343

- City of Centennial: $29,400 x .005002 = $147

- Arapahoe Library District: $29,400 x .005799 = $170.49

- Developmental Disability: $29,400 x .001000 = $

- South Suburban Parks & Rec: $29,400 x .008365 = $246

- South Metro Fire Protection District: $29,400 x .009250 = $272

- Southgate Sanitation District: $29,400 x .000445 = $13

- Suburban Metro District: $29,400 x .000430 = $15

- Urban Drainage & Flood: $29,400 x .000900 = $26.46

- Urban Drainage & Flood (South Platte): $29,400 x .000097 = $2.85

- Willows Water District: $29,400 x .003340 = $98

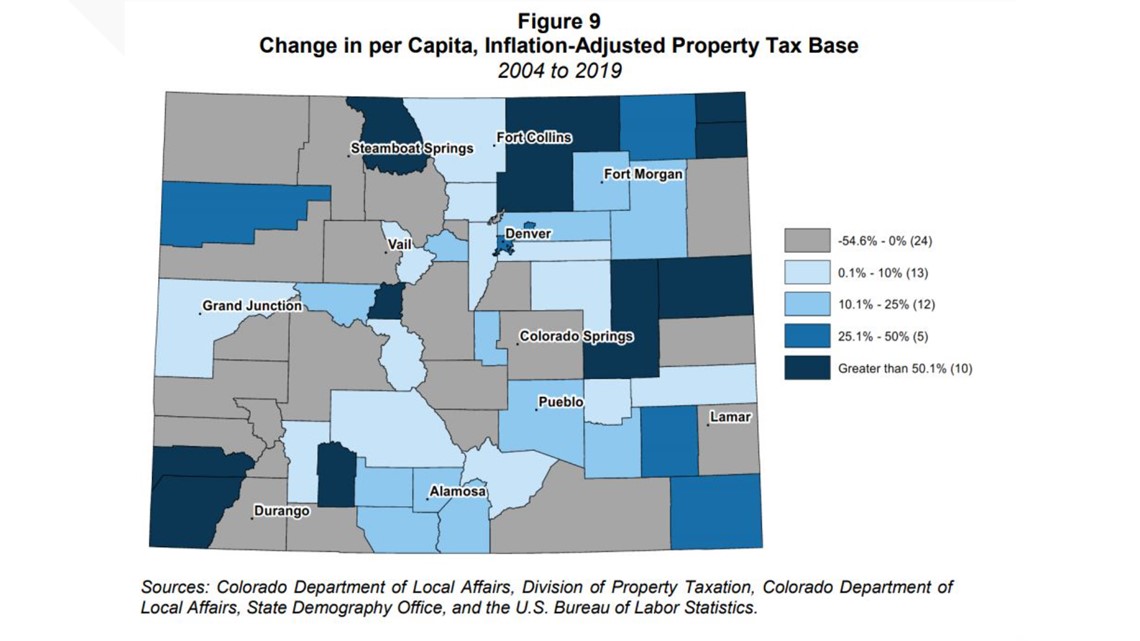

According to analysis done by Marc Carey, an economist with the state's nonpartisan Legislative Council Staff, 24 of Colorado's 64 counties have lower property tax bases per person today, compared to 2004, when adjusted for inflation.

Since we cannot illustrate every situation in every county, particularly rural counties that have differing property tax districts depending on your specific address, we encourage you to look at your personal property tax and do these calculations to determine your impact.

An argument to vote yes for Amendment B is to help local cities, counties, fire, water, library, parks and other districts to not see a reduction in property tax payments.

An argument to vote no for Amendment B is to see your property tax payment lowered.

Amendment B only deals with the assessment rate of the property tax calculation.

There are other factors that determine your property tax payment.

Should your assessed property value go up next year, the base number used in the property tax equation also goes up.

For instance, the $500,000 home from our example above, could be assessed at $520,000.

That would mean the equation to determine taxable value would be:

$520,000 multiplied by either 7.15% or 5.88% (depending on if Amendment B passes or fails).

Taxing districts, like school districts, could also ask voters for a mill levy override and increase the tax rate for that one entity. So, your property tax for that one entity could rise.

How does this impact nonresidential property?

Pass or fail, nonresidential property assessment rates remain at 29%.

The equation provided above can be used for nonresidential property by taking the assessed property value and multiplying it by 29% to get that property's taxable value.

That value can then be multiplied by the different taxing districts tax rate to determine how much each district receives.

Just like residential property, a new assessed value or a request for higher mill levies would impact the property's taxable value, even if the assessment rate remains at 29%.

SUGGESTED VIDEOS: Breaking down Colorado's 2020 ballot