DENVER — The Colorado Department of Revenue said a coding error in an automated system for state electric vehicle tax credits led to new EV owners getting their credits denied.

A spokesman for the Colorado Department of Revenue’s taxation division said the department started reviewing internal processes after a Steve On Your Side story last week questioned several credit denials for consumers who seemed to meet the criteria.

After that story aired, more than 50 other EV owners contacted Steve On Your Side complaining of the same issue.

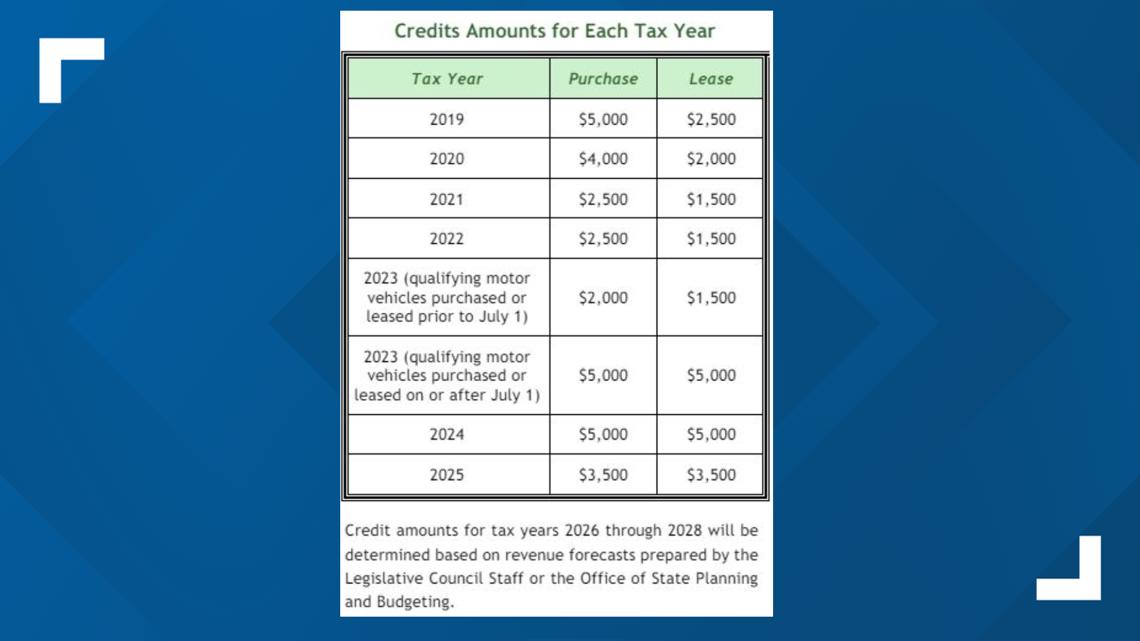

Mark Christensen told 9NEWS Consumer Investigator Steve Staeger he purchased his Hyundai Ioniq 5 specifically knowing that the vehicle would qualify for the state tax credit. His accountant filed for the Innovative Motor Vehicle tax credit on his 2023 tax return.

“I got a letter about two weeks after the file date saying that the rebate was disqualified because the state of Colorado said it was [less than] a 24-month lease,” Christensen said. “And really this car was a 36-month lease.”

“My accountant said it's so funny,” Christensen said. “All six of his clients have the same issue.”

In an initial story about this issue, the Colorado Department of Revenue told Steve On Your Side there was “no systemic issue” causing credit denials. The department did note that it had recently changed from a manual review for Innovative Motor Vehicle credits to an automated system.

After more than four dozen similar complaints to the Steve On Your Side tipline, we asked for comment from the state again. It took about a week, but on Friday, spokesman Derek Kuhn told Steve On Your Side, the error was discovered because of the story.

“The Department is implementing new approaches to automated processing of this tax credit,” Kuhn said by e-mail. “Those automations have already cut the average time to process these credits down from more than 8 months to approximately one month. One such automated process confirms that leased vehicles are on a lease lasting more than two years, as required by statute. That feature had a coding error impacting credits filed for tax year 2023 which may have resulted in the incorrect denial of credits for some leased vehicles.”

Kuhn said the department has now devoted staff to review all denied credits.

“We are contacting taxpayers who purchased vehicles in 2023 directly via letter to ensure they receive the credits they deserve,” Kuhn said.

Chris Walsh, featured in the same Steve On Your Side story, said he filed a protest letter with the state and kept calling the state’s tax advocacy department. He said eventually someone responded and said the department was looking into it. A few weeks later he got notice that he’d be getting his money.

“I think because I reached out, they put my letter at the top of the pile and looked at it and were like, 'okay, yeah, everything's good,'" Walsh said.

Christensen and many others who reached out to the Steve On Your Side tipline said they are still waiting for their money.

“It's still in limbo land somewhere,” he said. “I have no idea where it is.”

“It should not take a big news story for something that simple. It's frustrating that it takes this long and that there is no action by the state of Colorado.”

This story was the result of a tip to Steve On Your Side. Share your consumer problem with 9NEWS Consumer Investigator Steve Staeger.

SUGGESTED VIDEOS: Steve on Your Side