ARVADA, Colo. — Chris Walsh did a lot of research before leasing his Hyundai Ioniq 5 last year. He wanted to make sure the vehicle qualified for both federal and Colorado state tax incentives.

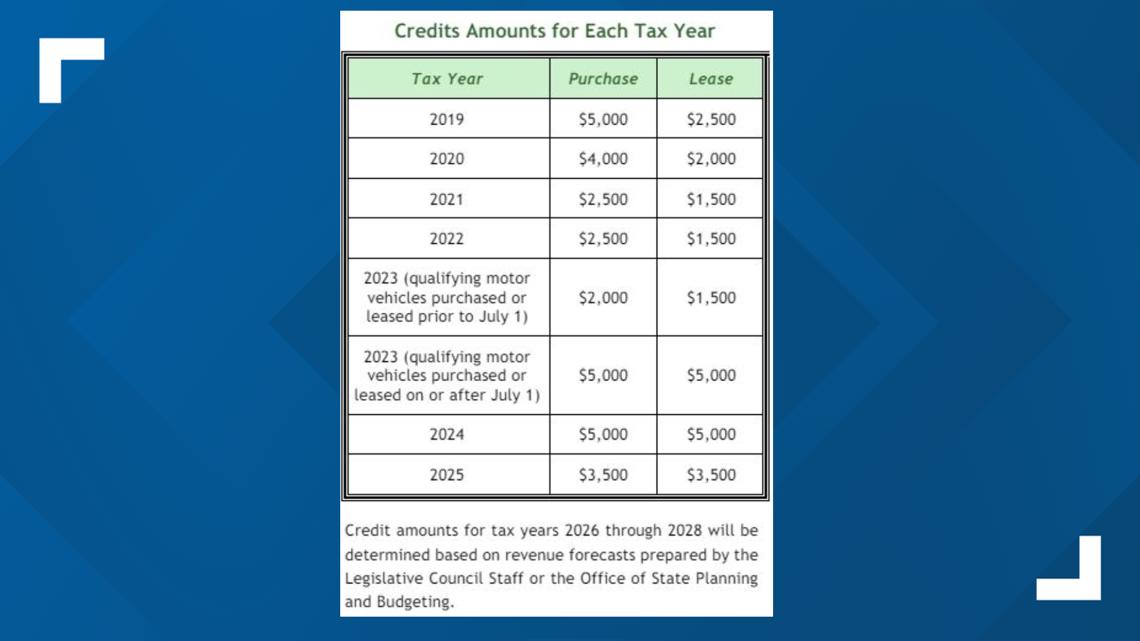

He was shocked when he got a letter last month denying his Colorado $5,000 Innovative Motor Vehicle credit.

“They said, basically, I was rejected because my lease for my car was less than two years,” Walsh said. “They said that their department just had records that it was less than a two-year lease. So my claim got rejected.”

The problem: His lease was for three years. Walsh isn’t sure how the state had an inaccurate record.

The letter said he could file a protest letter to appeal the decision. He said he went to work and spent a lot of time gathering documentation to prove the claim was denied incorrectly. After turning it in, he didn’t hear much right away.

“Day after day [I was] trying to get a hold of someone – did you get my letter?” Walsh said.

Then he did some research on the denial.

“The only thing I could find was a ton of Reddit threads of people that this was happening to,” he said.

Steve On Your Side heard from three other consumers in the same boat. Barry e-mailed the tipline to say the state rejected the credit for his new vehicle, claiming the car wasn’t registered in Colorado. Barry said he submitted his Colorado registration when filing his taxes. He has yet to hear back from the Colorado Department of Revenue (CDOR) about his appeal.

“It just seemed like ... there was a problem,” Walsh said. “And they knew the problem, but they weren't doing anything about it.”

Steve On Your Side asked CDOR if there was systemic issue with processing these Innovative Motor Vehicle Tax Credits.

“There is no systemic issue processing tax returns, including those that claim an innovative motor vehicle (IMV) credit,” spokesman Derek Kuhn wrote in an email. “To date, the Department of Revenue has successfully processed more than 11,000 IMV credits.”

Kuhn said the department’s tax system was not programmed to track disputes or appeals based on a specific tax credit. But he said the department changed from a manual review of IMV credits to an automated process for the 2023 tax year.

He said anyone with a problem should follow instructions to file a dispute.

“If there was an error on our part, we will work judiciously to correct it,” Kuhn said.

Walsh said he was hoping to use the funds to help pay for a trip for his family to celebrate his 40th birthday party.

“While you're sitting there waiting for it, I feel a little bit like, you know, Chevy Chase and National Lampoon,” Walsh said, referencing the scene in "National Lampoon’s Christmas Vacation" when Chevy Chase’s character is waiting for a bonus to build a new swimming pool.

After a few weeks of going back and forth with CDOR’s Tax Help line, Walsh finally got notice that his appeal was successful. He recently got his $5,000.

“They do this really great job of marketing the program, getting people to buy into this idea of EVs,” Walsh said. “The back end process is where it all went wrong.”

Has this happened to you? Get in touch with Steve On Your Side about this or any other consumer issue.

SUGGESTED VIDEOS: Steve on Your Side