DENVER — This story is part of a series of statewide ballot issue reviews for Next: We Don't Have To Agree, But Let's Just Vote.

Proposition 120 is about property tax assessment rates. That term should sound familiar because Amendment B on the 2020 ballot also dealt with property tax assessment rates. What makes this proposition unfamiliar is that state lawmakers changed state statute earlier this year that alters who this proposition would impact if it were to pass. Because of that, the supporters of Proposition 120 expect to take this issue to court, if it passes, so that all property owners would experience the lower assessment rate, and not just those isolated by the state legislature earlier this year. Clear as mud? Let's continue.

PROPOSITION 120

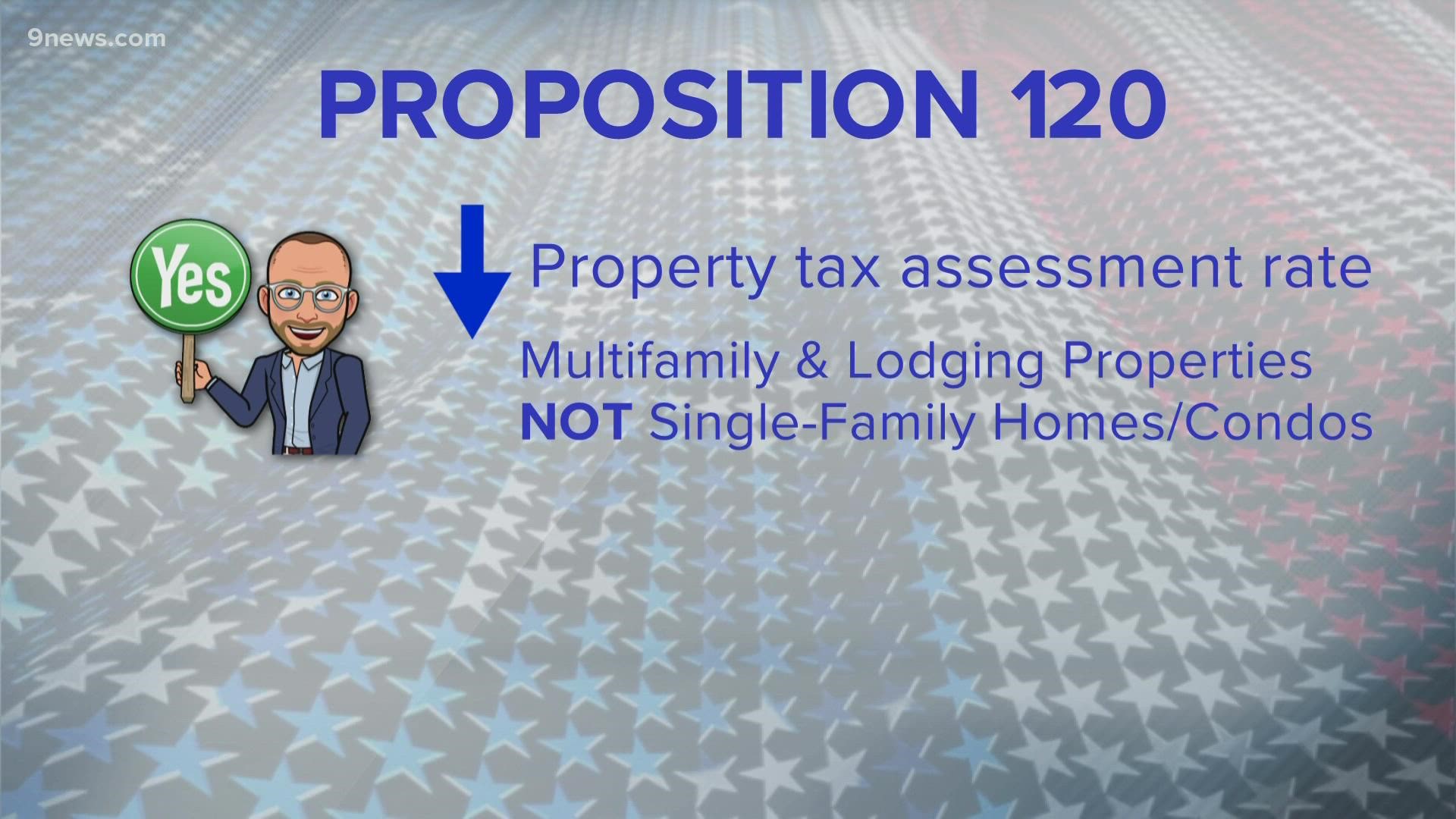

A YES vote means you want to lower the property tax assessment rate. It would drop for certain residential property from 7.15% to 6.5%; and for certain nonresidential property, it would drop from 29% to 26.4%. Although, because of a bill passed by state lawmakers during the 2020 session, this will only lower the assessment rate for certain property owners.

It would lower the rate for multifamily homeowners and commercial lodging properties like hotels, motels and bed & breakfasts.

A YES vote would not lower the assessment rate for single-family homeowners or condo owners because of the change state lawmakers made this year.

However, if this measure were to pass, the supporters of the measure expect to go to court to have a judge implement the lower assessment rate for all property owners as the proposition originally intended.

A NO vote means you do not want to lower the assessment rate. However, because of the bill that state lawmakers passed earlier this year, even if Proposition 120 fails, the assessment rate will drop in 2022 and 2023 for certain multifamily property owners, but then go back up again in 2024.

The assessment rate is part of the equation that determines your property tax bill.

The equation takes your property's value (as determined by the county assessor every other year) multiplied by the assessment rate (7.15% for residential, 29% for nonresidential). That total is your taxable value.

The taxable value of your home is used to determine the amount of money that goes to the city and county services that rely on your property taxes.

PROPERTY TAX DISBURSEMENT EXAMPLE

For example, for a home that is valued at $500,000 in the city of Centennial would have its property tax dollars distributed as follows, based on the mill levy/tax rate for each entity (like school district, parks and recreation district and water district).

Property value = $500,000

Residential assessment rate = 7.15%

$500,000 x 7.15% = $35,750 taxable value

- Cherry Creek School District: $35,750 x .049724 = $1,777.63

- Arapahoe County: $35,750 x .012013 = $429.47

- City of Centennial: $35,750 x .005033 = $179.93

- Arapahoe Library District: $35,750 x .005810 = $207.71

- South Metro Fire Protection District: $35,750 x .009250 = $330.69

- Developmental Disability: $35,750 x .001000 = $35.75

- South Suburban Parks & Rec: $35,750 x .008385 = $299.76

- Southgate Sanitation District: $35,750 x .000465 = $16.62

- Suburban Metro District: $35,750 x .000430 = $15.37

- Urban Drainage & Flood: $35,750 x .000900 = $32.18

- Urban Drainage & Flood (South Platte): $35,750 x .0001 = $3.58

- Willows Water District: $35,750 x .003567 = $127.52

Last year, voters passed Amendment B, which froze the assessment rates at 7.15% for residential and 29% for nonresidential.

WHY DID I GET A HIGHER PROPERTY TAX BILL?

So why did some of you get higher property tax bills this year?

A few reasons.

The first number in the equation, your property value, is reassessed by the county assessor every other year. If the value of your property went up, your property tax total went up.

Also, the individual mill levy/tax rates may have also increased. For example, the mill levy/tax rate for Cherry Creek School District in the above example increase from 46 mills to 49 mills.

For the purposes of Proposition 120, you are being asked to lower the middle part of the equation, the assessment rate.

A lower assessment rate could mean a lower property tax bill for you, and perhaps, less money for all the entities that rely on your property taxes, like school districts, cities, counties, libraries, parks and recreation and sanitation districts. Then again, if your property value increased, those entities received more money than the previous year from your property taxes.

WHY DOESN'T PROPOSITION 120 IMPACT ALL PROPERTY OWNERS?

Proposition 120 was placed on the November 2021 ballot through the initiative process. Colorado Rising Action collected more than the required 124,762 voter signatures to get this on the ballot.

After it was set for the ballot, but before the November 2021 election, state lawmakers passed a bill, that was signed into law by Gov. Jared Polis (D), that created new categories of property.

Before this year, there was simply:

- Residential

- Nonresidential

State lawmakers created new categories for both.

- Residential examples

- Single-family

- Duplex

- Triplex

- Four or more units

- Condominiums

- Nonresidential examples

- Commercial

- Industrial

- Agricultural

- Lodging

Based on the changes made by state lawmakers, Proposition 120 would only lower the assessment rates for multifamily properties, except for condominiums and for nonresidential properties that are for lodging. This would not lower the assessment rate for single-family homes or commercial property that is not for lodging.

WHY WOULD THE ASSESSMENT RATE DROP FOR SOME EVEN IF PROPOSITION 120 FAILS?

As part of Senate Bill 293, lawmakers also approved a temporary drop for multifamily assessment rates.

If Proposition 120 fails, the assessment rate for multifamily homes (except for condominiums) would drop in 2022 and 2023 from 7.15% to 6.8%, and then go back up to 7.15% in 2024.

This would not reduce the assessment rate for single-family homes or any nonresidential property, including lodging properties.

According to the state's property tax administrator, there are 2,139,543 residential units in the state. Of those, only 166,960 would see lower residential assessment rates if Proposition 120 passes, based on the changes made by state lawmakers. Again, if Proposition 120 passes, the supporters of the measure expect to go to court to have a judge decide if all 2 million residential property owners, and all nonresidential property owners, should get the benefit of a reduced rate, as they intended when they put this on the ballot.

If you plan to return your ballot by mail, it is recommended that you mail it back by Monday, Oct. 25, so that it has time to be received by Election Day on Tuesday, Nov. 2. Want to drop your ballot off or vote in-person? Check out every county location in our interactive map.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark