DENVER — All voters in Colorado will see Proposition CC on their 2019 ballots, and now that those ballots are showing up in mailboxes, we’ve been getting a ton of smart questions about the measure.

Officially, the “yes” or “no” question on the ballot reads:

“Without raising taxes and to better fund public schools, higher education, and roads, bridges, and transit, within a balanced budget, may the state keep and spend all the revenue it annually collects after June 30, 2019, but is not currently allowed to keep and spend under Colorado law, with an annual audit to show how the retained revenues are spent?”

So what does that really mean? Let’s start with…

TABOR

Not every year, but in some years, Colorado must refund you money because of the Taxpayer’s Bill of Rights, which you might know as TABOR.

Voters passed TABOR in 1992. The Constitutional amendment requires the state and local governments to get voter approval before enacting new tax increases or bonds, and it puts a cap on how much tax money Colorado can collect and spend. The rate is based on inflation and population. If the state collects too much, you get back money.

Maybe this initialism, crafted by 9NEWS political guy Marshall Zelinger, will help:

T: Tax increases are put to a vote of the people.

A: Annual spending limits - the state can only keep and spend a certain amount of tax money based on a specific formula.

B: Ballot Language - tax or revenue questions must be worded a specific way in all capital letters.

O: [Um, we didn’t have anything for O.]

R: Refunds - if the state collects more money than the formula allows, residents are given refunds.

WHAT WOULD PROP CC CHANGE?

Simply put, CC asks you to permanently give the state permission to keep the extra money instead. The money would go toward road projects and schools.

If CC passes, the new money that the state gets to keep is split this way:

- 1/3: Transportation

- 1/3: K-12 Public Schools

- 1/3: Higher Education

The one-third for transportation gets split even more. Of that one-third:

- 60%: State Highway Fund - state transportation priorities

- 22%: County road projects

- 18%: City and municipality road projects

And of the 60% that goes to the State Highway Fund:

- No more than 85% for highway-related projects

- At least 15% for transit-related improvements

How it's specifically spent is up to the Colorado Department of Transportation, and local city and county leaders. And since this is a proposition, future legislatures can change how the money gets spent without a vote of the people. What doesn't change, however, is that voters will continue to have a say on new tax increases.

HOW MUCH MONEY ARE WE TALKING HERE?

Let’s start this section by saying CC does not affect the April return you get if you individually pay too much in state taxes.

Secondly, CC doesn’t raise taxes, but some people might consider it a tax increase, since you’ll be forfeiting part of what would be returned to you via tax refund.

And third, there isn’t a simple answer. Because the refunds are based on the formula, it would depend on other factors.

As of September 2019, the state estimated the refunds in 2019-20 and 2020-21 to be $407 million in total. However, in June 2019, the estimate for those two fiscal years was $652 million. It's a moving target, so the total amount could go up or down.

What does it mean for you?

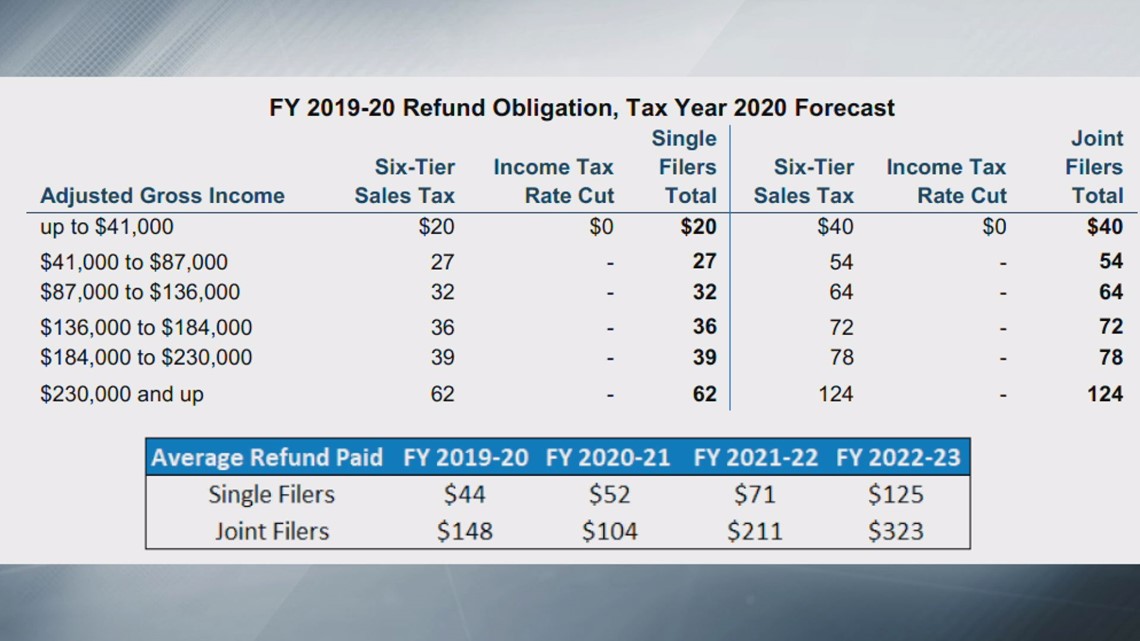

The following estimates (pictured in the top part of the graphic) for 2019-20 are based on the latest report from the legislature. The bottom part of the graphic shows estimates rom the Office of State Planning and Budgeting.

DE-BRUCING?

TABOR is the brainchild of Douglas Bruce, who later, was briefly a state representative.

CC is a statewide measure, but BellPolicy.org reports voters in 51 out of 64 counties have "De-Bruced," or previously eliminated revenue caps, meaning the local governments can keep excess.

RELATED | Tax laws squeeze rural Colorado counties

COMPETING ARGUMENTS

Supporters argue this is a way to provide road and school funding without a tax increase. Historically, Coloradans tend to vote down tax increases.

Opponents say that because this is a proposition, a legislature could amend how the money is spent. State lawmakers could also decrease general fund money going to road or school fixes, since TABOR money might supplement the losses.

Results from a Magellan Strategies poll, released in August, showed the majority of voters polled supported CC.

Have another question for Next with Kyle Clark about your ballots? Email next@9news.com.

SUGGESTED VIDEOS | Full Episodes of Next with Kyle Clark