NEW YORK--Billionaire Louis Bacon's charitable foundation has emerged as the victim of a $25 million fraud that led to the recent arrest of Andrew W. W. Caspersen — adding yet another prestigious name to an alleged swindle that has captivated Wall Street.

The Moore Charitable Foundation is a non-profit focused on environmental conservation. It was founded in 1992 by Bacon, a hedge fund manager who is estimated by Forbes to be worth $1.87 billion.

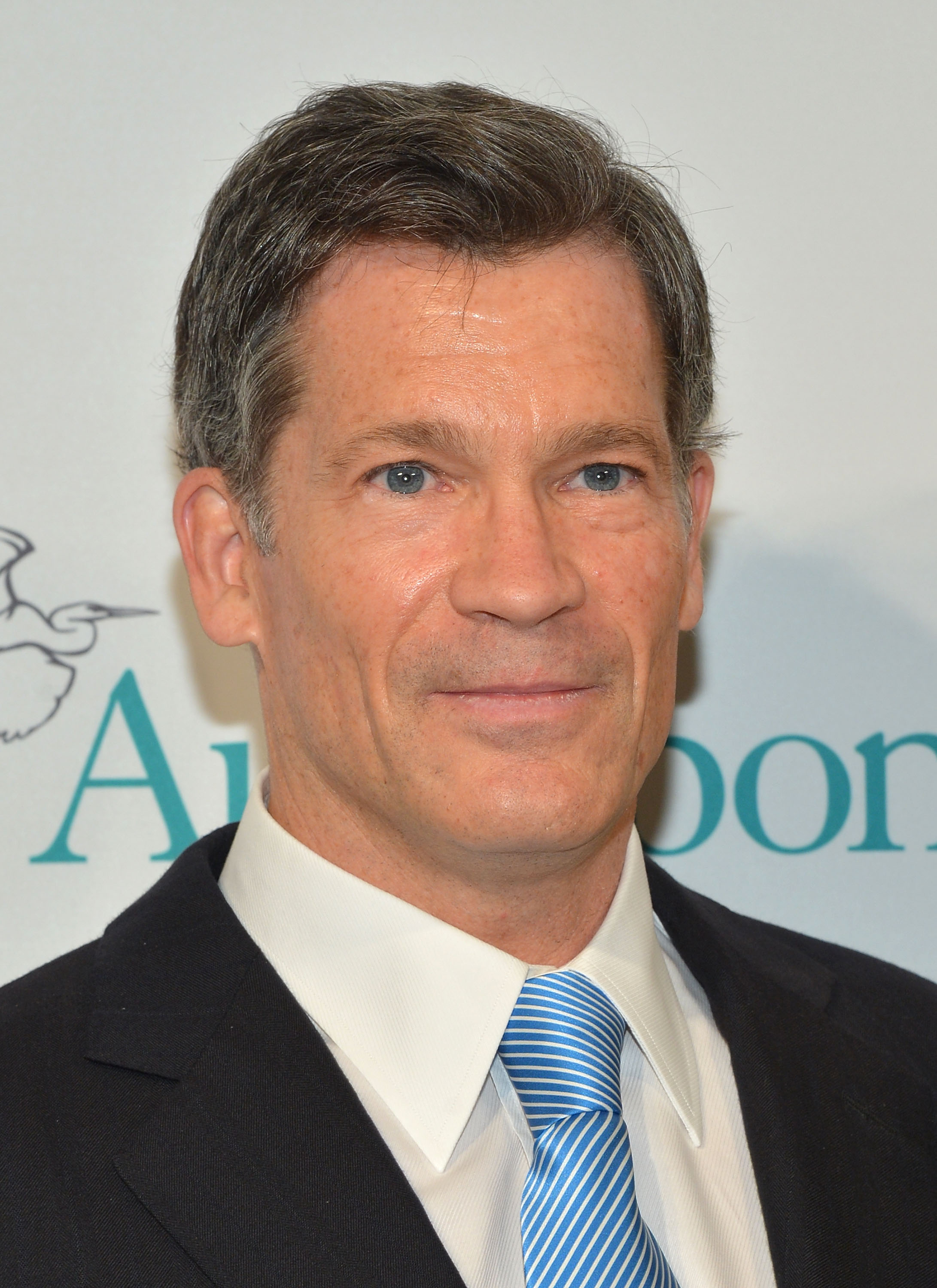

On Monday, Manhattan U.S. Attorney Preet Bharara charged Andrew W. W. Caspersen, a Harvard grad with a pedigreed past, with attempting to defraud investors out of $95 million, including $25 million they said had already been successfully swindled.

![Pedigreed Wall Streeter accused of $95M fraud [oembed : 82420680] [oembed : 82420680] [oembed : 82420680] [oembed : 82420680] [oembed : 82420680] [oembed : 82420680] [oembed : 82420680] [oembed : 82420680]](/Portals/_default/Skins/PrestoLegacy/CommonCss/images/smartembed.png) At the time, prosecutors only said the $25 million came from "a charitable foundation affiliated with a multinational hedge fund based in New York." The hedge fund is now known to be Bacon's $15 billion Moore Capital Management. The Moore Capital employee who made the investment on behalf of the charitable foundation personally lost $400,000, prosecutors said.

At the time, prosecutors only said the $25 million came from "a charitable foundation affiliated with a multinational hedge fund based in New York." The hedge fund is now known to be Bacon's $15 billion Moore Capital Management. The Moore Capital employee who made the investment on behalf of the charitable foundation personally lost $400,000, prosecutors said.

Following his Monday arrest, Caspersen was released on a $5 million bond. His lawyer, Dany Levy, didn't return a request for comment.

Caspersen's arrest made headlines in part because of his pedigreed past. The Caspersen family, including his father and grandfather, ran consumer finance company Beneficial Corporation for decades until it was sold in 1998 for $8.6 billion. Caspersen, 39, graduated from both Harvard Law and Princeton University and, at the time of the alleged fraud, was working for a unit of publicly traded investment bank PJT Partners.

Prosecutors said Caspersen set up fake investments that he claimed were authorized by his employer. He then lost Moore's $25 million trading options and exchange-traded funds, or ETFs, prosecutors said.

PJT's stock has lost close to 8% of its value on the news.

In an emailed statement, the Moore Charitable Foundation said it "was lied to" by Caspersen to put close to $25 million of its endowed funds toward an allegedly fake investment opportunity that Caspersen said was authorized but which was actually controlled by Caspersen.

The Foundation did not wait to recover its investment before contacting PJT Partners, which could have subjected some other innocent victim to Mr. Caspersen’s fraud," the emailed statement said.

Caspersen's father, Finn M. W. Caspersen committed suicide in 2009 while being investigated by the IRS over money they suspected he had stashed in overseas accounts, according to a New York Times post on the suicide.

The elder Caspersen was suspected to owe as much as $100 million in back taxes, and federal authorities had placed liens on the personal trusts of his children, including Andrew W. W. Caspersen, the Times articles reported, citing anonymous sources.