LOUISVILLE, Colo. — Less than two months after the Marshall Fire ripped through Boulder County, the Colorado Division of Insurance has received at least 54 formal complaints from homeowners about insurance companies.

One of those complaints was filed by Andrew and Nicole Malcomson, who lost their home in Louisville and everything they owned. They thought their policy would cover the full cost of a rebuild. Now they say they're $600,000 underinsured.

"The space that was our refuge, our home that we had raised two kids and are continuing to raise three more, can’t be rebuilt based on what insurance is going to provide us with," Nicole Malcomson said.

According to their formal complaint, their Dwelling Coverage A comes out to about $860,000, but after the fire, an adjuster estimated it would cost more than $1.3 million to rebuild their home. The family said the estimates exclude adjusters for updated codes.

"This delta between coverage limits and actual rebuild costs is extraordinarily high and defies rational explanation, particularly given that the policy was originally issued so recently (07/01/20)," said the complaint.

The couple opted out of Boulder County's debris removal program, and crews have finished removing what was left of their home so that they can start to rebuild. The months ahead feel very uncertain, though.

"We may need to leave," said Andrew Malcomson. "Others may need to leave, which would change the fabric of this community of Boulder County in general."

He said he thought they had chosen their best option on a policy.

"They are in the business," he said. "They should know what it does cost, truly, to rebuild a home."

Underinsurance issues are one of the biggest challenges that the state Division of Insurance hears about after wildfires, said Colorado Insurance Commissioner Michael Conway. Not having enough insurance coverage to rebuild a home is a problem that exists throughout the country.

The Division of Insurance is trying to figure out the magnitude of the underinsurance problems after the Marshall Fire. They plan to get some data at the end of this month to help answer that question, Conway said.

"We have to ensure insurance companies are giving good data, good reliable data to their consumers," Conway said. "One of the things you hear from insurance companies is that it's incumbent upon a homeowner to understand what they are being insured for and what they are not being insured for. I do not think that is correct."

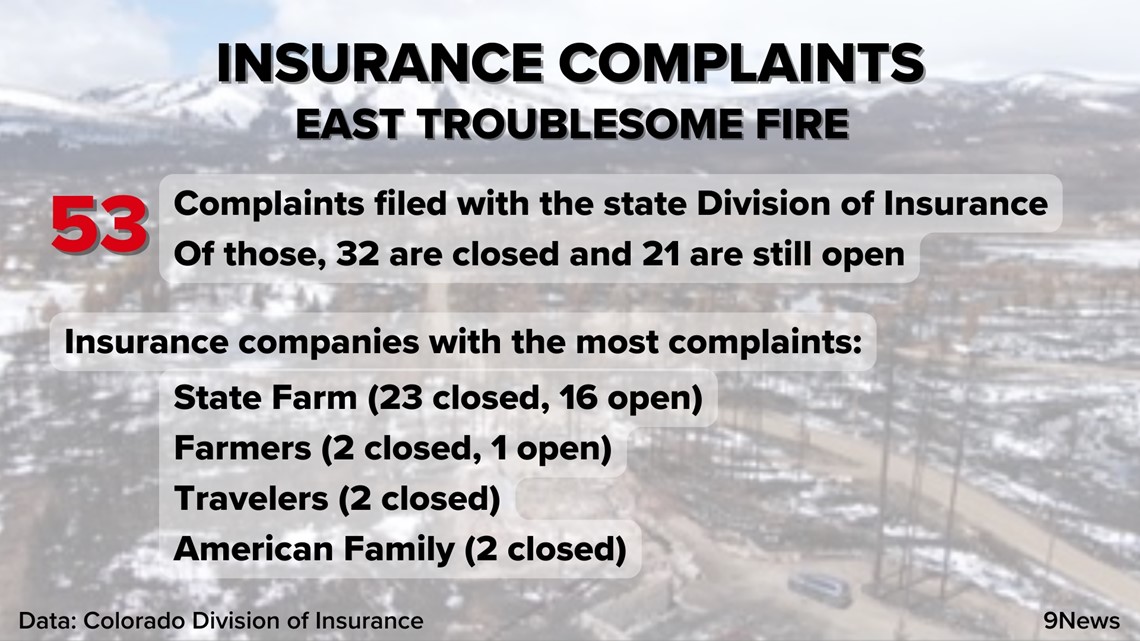

Some of the same issues came up after the East Troublesome Fire in 2020 in Grand County. At least 53 formal complaints were filed to the Division of Insurance for that disaster. The top three issues from that wildfire were adjuster-handling issues, claim delays and unsatisfactory settlement offers.

Inventory list requirements for contents coverage, which falls under claim delays, is a topic that fire survivors bring up frequently, Conway said.

State law requires insurance companies to pay out at least 30% of the contents coverage to consumers without having to fill out inventory. Policyholders have to detail everything that was lost, down to the last spoon, to collect the remaining 70%.

HB-1111, making its way through the state legislature, would bump up the automatic payment to 65%. Conway said he supports that change.

"That really does match the data that we see insurance companies are typically paying out once they work through the entire process," he said.

According to the Division of Insurance, increasing the automatic payment to 65% wouldn't mean a higher premium for consumers. It would mean a larger payment up-front without the documentation requirements, rather than additional coverage.

Conway said he doesn't think the inventory process is necessary because not every insurance company makes their consumers go through it.

More than 70% of formal complaints filed after the East Troublesome Fire were filed against State Farm, which is the biggest carrier for homeowners insurance in Colorado.

"We need to figure out why it is the case that they have the number of complaints for that company," Conway said. "A lot of the issues, candidly, are the issues state Rep. Judy Amabile (D-Boulder) is addressing in her bill, HB-1111."

A spokesperson for State Farm said the company is reviewing their approach to contents advances for Marshall fire claims.

Their statement continued, "State Farm stands with our customers to help them recover from the Marshall Fire, however we believe additional amendments are needed to HB 1111. For example, HB 1111 requires an advance of 65% of contents coverage without an inventory. This would be the largest mandated contents advance without an inventory of any state in the country. We understand this is a difficult time for our customers and we are working with them to make sure they receive all benefits to which they are entitled within the terms of the insurance policy."

The Malcomsons aren't covered by State Farm, but they said they want others who haven't lost a home to know about the challenges they face with insurance.

"I don’t want people to be unaware of the insurance issue," said Nicole Malcomson. "Go look at your policy. Do that for yourself."

Below: Six complaints filed with the Colorado Division of Insurance from the East Troublesome Fire.

SUGGESTED VIDEOS: Marshall Fire Coverage