DENVER — Hi, my name is. What? My name is. Who? My name is.

Those are the lyrics to start "Slim Shady" by Eminem, also known as Marshall Mathers.

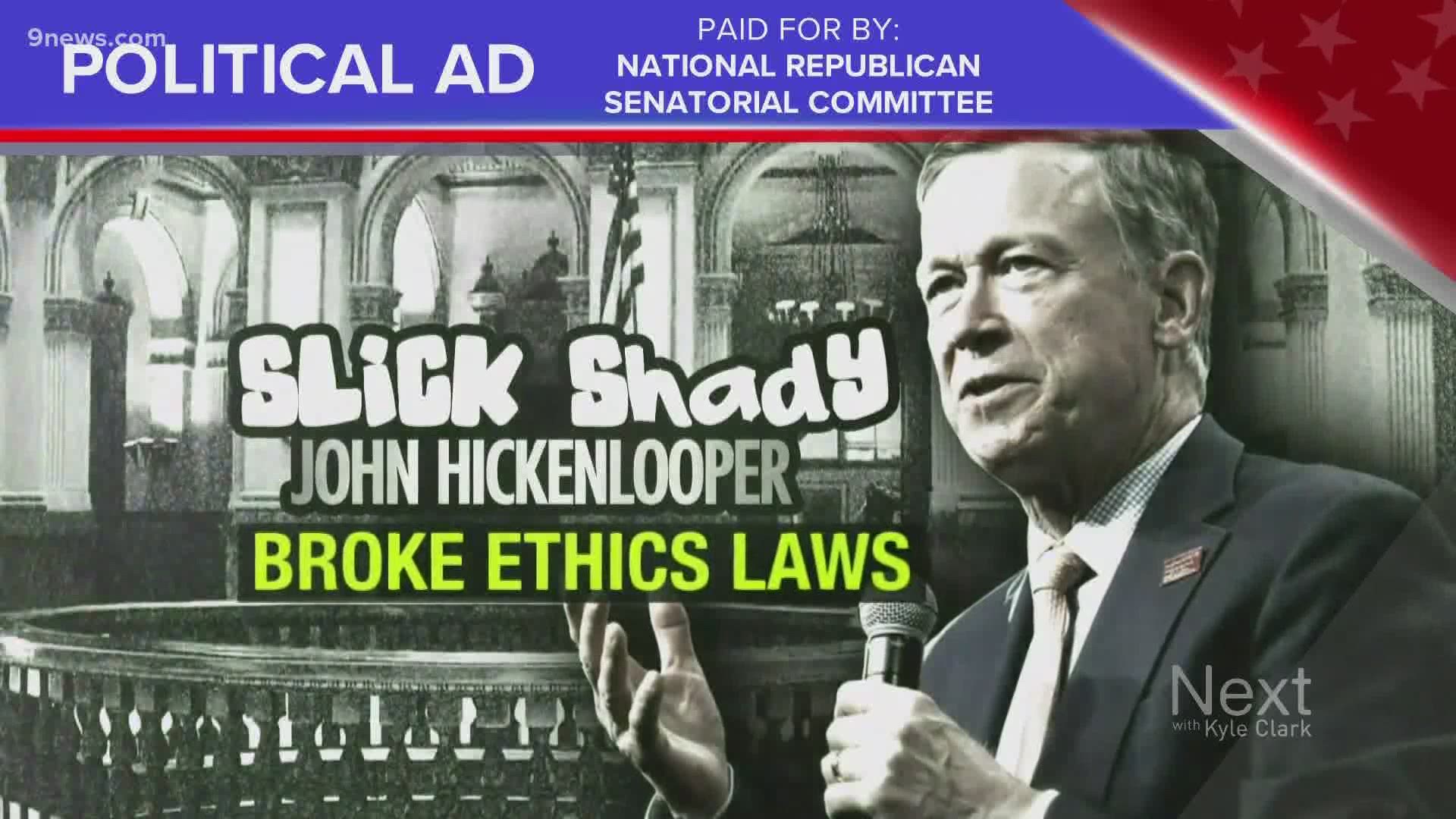

Next with Kyle Clark has its own Marshall. And this is his Truth Test of the National Republican Senatorial Committee political ad "Slick Shady."

AD/CLAIM: "We know slick, shady John Hickenlooper broke ethics laws and took millions in secretive donations…"

VERDICT: Yes and no.

We've covered both of these issues in general news coverage and previous Truth Tests

Yes, Hickenlooper violated the state's ethics ban on two trips he took as governor.

In a previous ad, the National Republican Senatorial Committee claimed Hickenlooper received $330,000 in a secret donation from an oil and gas company.

The donations weren't secret. They were searchable on the state's transparency website.

How transparent that website really is is up for debate.

AD/CLAIM: "But Colorado's shadiest politician is a tax cheat too."

VERDICT: "Tax cheat" is an explosive term, and the claim is muddy. Here's how it continues.

AD/CLAIM: "The IRS caught Hickenlooper red-handed in a complex scheme to dodge taxes. Shady John had to pay over $50,000 in back taxes."

VERDICT: There is no proof Hickenlooper tried to dodge taxes, but he did pay more than $50,000 when presented with a settlement amount by the IRS.

This claim is based on a Channel 7 investigative report from 2010, when Hickenlooper was running for governor.

Here's an oversimplified breakdown:

- In 2000, Hickenlooper and a business partner swapped land with the U.S. Forest Service, and the land they received was appraised at a certain value.

- Two years later, Hickenlooper took some of that land and agreed to donate it as part of a conservation easement, which would prevent the land from being developed. The land was appraised at a much higher value than when Hickenlooper bought it.

- As part of the conservation easement deal, Hickenlooper received federal tax write-offs and state tax credits on the higher appraisal value.

- The Colorado Department of Revenue and the Internal Revenue Service started auditing taxpayers after a concern about inflated appraisals.

- 300 tax returns were audited

- Based on the Channel 7 investigation, Hickenlooper received a letter from the IRS that stated: "to resolve the issue(s) related to the conservation easement contribution claimed on your federal income taxes" for multiple years.

- The IRS offered Hickenlooper a settlement of $52,486, and he paid it without challenging.

AD/CLAIM: "Political flim flam artist, ethics law breaker, tax dodger extraordinaire."

VERDICT: Make your own decision on what you think "flim flam artist" means. Yes, he violated the ethics law. No, he is not a tax dodger. The term "tax dodger" implies intent to avoid paying taxes. The NRSC could not provide proof of Hickenlooper's intent.

SUGGESTED VIDEO: Full Episodes of Next with Kyle Clark