COLORADO, USA — This story is part of a series of statewide ballot issue reviews for Next with Kyle Clark we're calling "We Don't Have To Agree, But Let's Just Vote." We'll continue to look at statewide ballot initiatives on Colorado's ballot and how they would impact you.

PROPOSITION 119

History tells us Colorado voters hate raising taxes on everyone. History also tells us Colorado voters don't mind increasing what are known as sin taxes: taxes on cigarettes, gambling and marijuana.

Every voter in Colorado gets to vote on Proposition 119, asking to raise state pot taxes for out-of-school education funding.

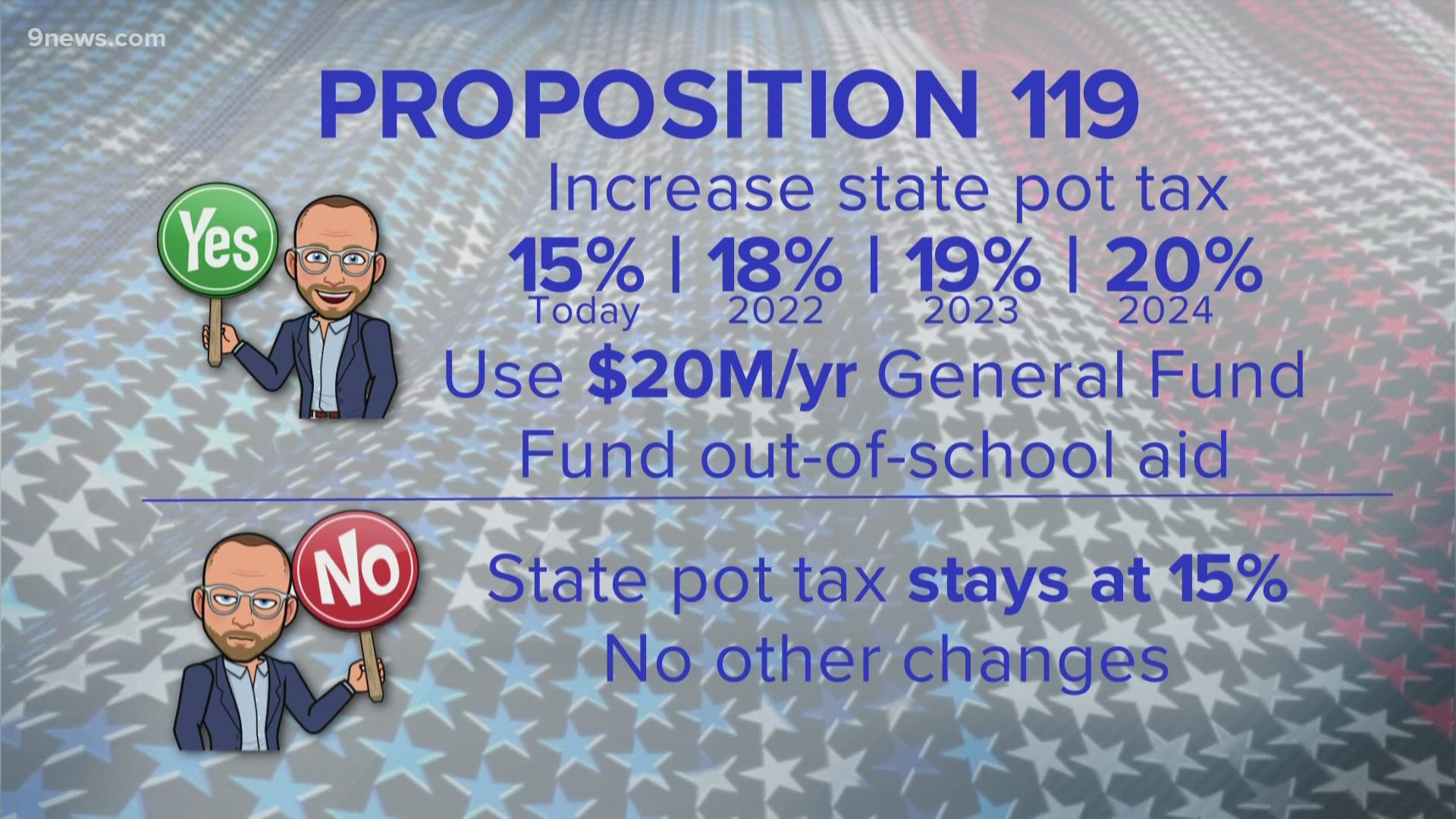

A YES vote means you want to increase the state pot tax from 15% today, gradually to 20% in 2024 (with stops at 18% in 2022 and 19% in 2023). Voting yes also transfers $20 million a year from the state's general fund -- money lawmakers decide what to do with -- to a new out-of-school-funding program. It also diverts $20 million a year from the State Land Trust to help fund this program. The State Land Trust helps fund school repairs and some school district funding. This funding would create a new out-of-school learning and enrichment program.

A NO vote keeps the state pot tax at 15% and no other changes are made.

Voting in favor of Proposition 119 would not pay for K-12 in-school education or teacher needs. School districts get their funding through your property taxes. When your property taxes are not enough, state lawmakers have to backfill with state money.

A yes vote would create LEAP: Learning Enrichment and Academic Progress program. Students could apply for financial aid to cover out-of-school learning and enrichment, such as: tutoring, targeted assistance for those with special needs, second language training, social emotional and mental health services.

The money could not be used for school tuition or for materials that are part of school curriculum.

Students from low-income families, and those not proficient in their grade level, would be prioritized for financial aid. They could be eligible for at least $1,500 a year for those outside-of-school learning and enrichment options.

Providers of the out-of-school help will need to be certified by a new Colorado Learning Authority. Parents will not be allowed to be providers for their kids. That is not spelled out in the ballot question. It is, however, in the legal language that would be put in law if the ballot question is approved.

"Immediate family members are not eligible to be qualified providers in the provision of services to their child or youth," the measure reads.

What would a yes vote mean for people who buy retail marijuana products?

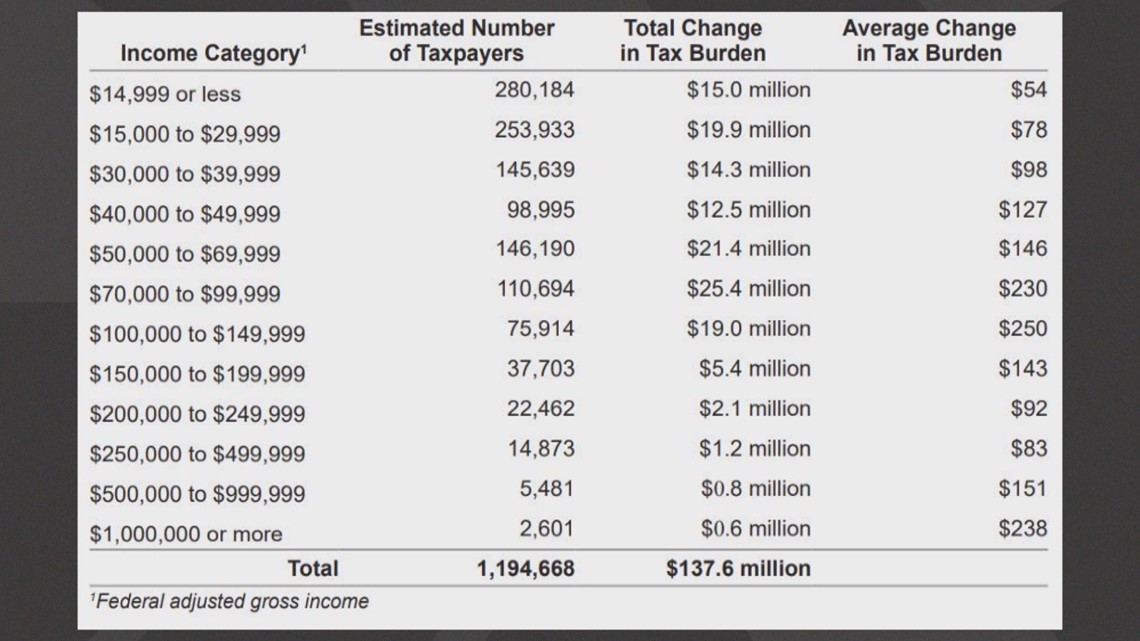

The Blue Book spells out the estimated cost to pot purchasers. The data are fascinating.

The chart (page 18 in the above link) shows the estimated impact on retail marijuana consumers broken down by income level.

State law requires Legislative Council Staff, the creators of the Blue Book, to provide this estimate, but there is no personal data collected when someone buys retail marijuana. Legislative Council Staff relied on U.S. Bureau of Labor Statistics and Centers for Disease Control and Prevention information on the usage of and spending on tobacco products by income group to create the estimate.

The bottom line is that the state estimates nearly 1.2 million people buy retail marijuana, and if the state tax were to be 20%, it would bring in an additional $137 million.

The chart shows a higher number of people in the lowest income levels buy retail marijuana. The state estimates that people who buy pot and make less than $14,999 will pay an additional $54 in tax if the state pot tax became 20%.

The chart shows people making $100,000-$149,999 and people who make more than $1 million would pay about $250 more in taxes, suggesting they buy a higher quantity of marijuana or more expensive marijuana than the lower income buyers.

If you plan to return your ballot by mail, it is recommended that you mail it back by Monday, Oct. 25, so that it has time to be received by Election Day on Tuesday, Nov. 2.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark