DENVER — State ballot issues that deal with money get explained in simple terms in the Colorado Blue Book.

Proposition HH is so complicated, it took 12 pages to explain in the 2023 Blue Book.

Prop. HH would change the math that determines your property tax. If it passes, you will still see an increase in next year’s property tax bill, just not as high of an increase if it fails.

In return, voters will be giving the state permission to raise the limit on how much it can keep and spend each year, which would reduce future Taxpayer Bill of Rights (TABOR) refunds.

Also, state lawmakers decided that only if Prop HH passes, will the state send out TABOR refunds equally to taxpayers, regardless of income.

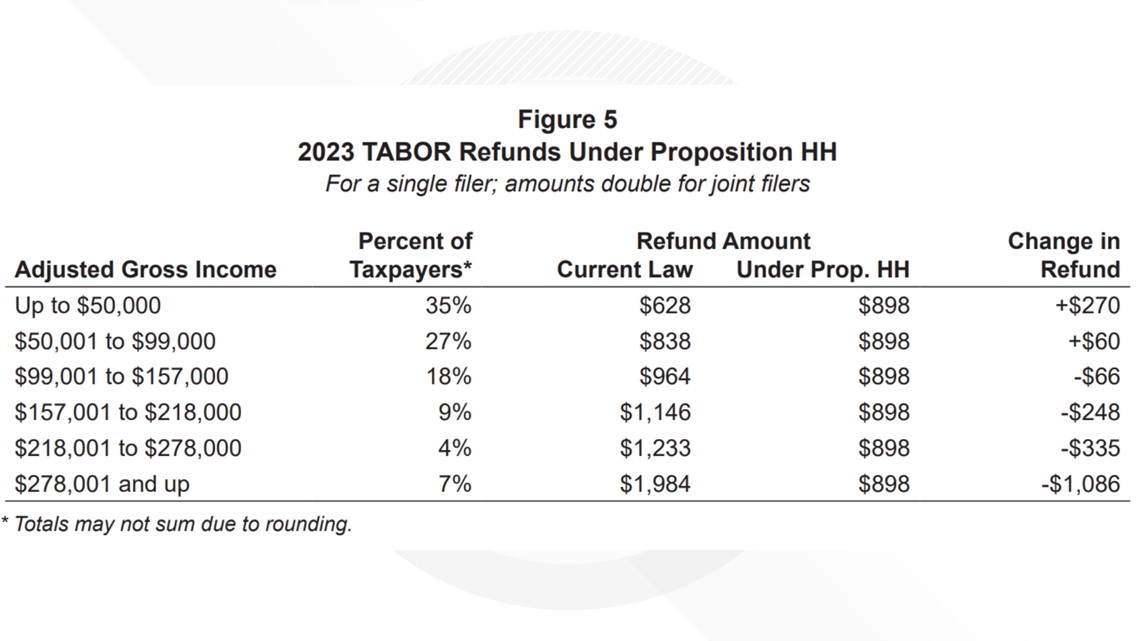

If Prop. HH passes, taxpayers will receive $898 in their TABOR refund next year (double the amount for joint tax filers).

If Prop. HH fails, taxpayers will receive TABOR refunds on a sliding scale based on their income. There will be fewer dollars for people who have lower incomes and higher amounts for those with higher incomes.

The state has provided a calculator to estimate the impact Prop. HH would have on any taxpayer in Colorado, based on their income, home value, county, school district and city.

The calculator estimates two years’ worth of Prop. HH impact on your TABOR refund and property tax bill. Beyond two years is hard to estimate because TABOR refunds will be based on how much the state collects, if the TABOR refund exists at all.

For renters, the calculator will show the TABOR refund impact based on their annual income. The less you make, the more you will benefit in the first two years of Prop. HH. While the more you make, the less you’ll receive in TABOR refunds compared to if Prop. HH fails.

The Blue Book makes estimates into the future based on current law that determines future property tax assessment rates.

If Prop. HH fails, the estimates have the assessment rates climbing back up from the current temporary reduction. If Prop. HH fails, lawmakers would have the ability to pass a bill that reduces the assessment rate. Yes, the projections that property taxes will increase at a much higher rate in the future if Prop. HH fails is accurate based on current state law, but it is possible that lawmakers will address assessment rates in future legislative sessions to reduce property tax increases.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark