COSTILLA COUNTY, Colo. — Property owners in Colorado sent in a record number of property value appeals this year. The hope was to convince their county assessors to reduce the value of their home and shrink the increase they received on their property tax bill.

There's one little problem, though. Appealing your property tax value could also put you at risk of getting an even higher bill.

"This carpet is 23 years old," said Thomas Larson sitting inside his home in Fort Garland, in Costilla County. "No, no, I haven’t touched it. One thing, I’m too old. The other, I can’t afford it."

Larson built the home himself. He says he hasn't added any square footage to the home or done any major renovations since he moved in to the house in 2000.

And yet, his property valuation went up higher than he could have ever imagined this year.

"$640,017," Larson said looking at his property valuation document. "That blew me away."

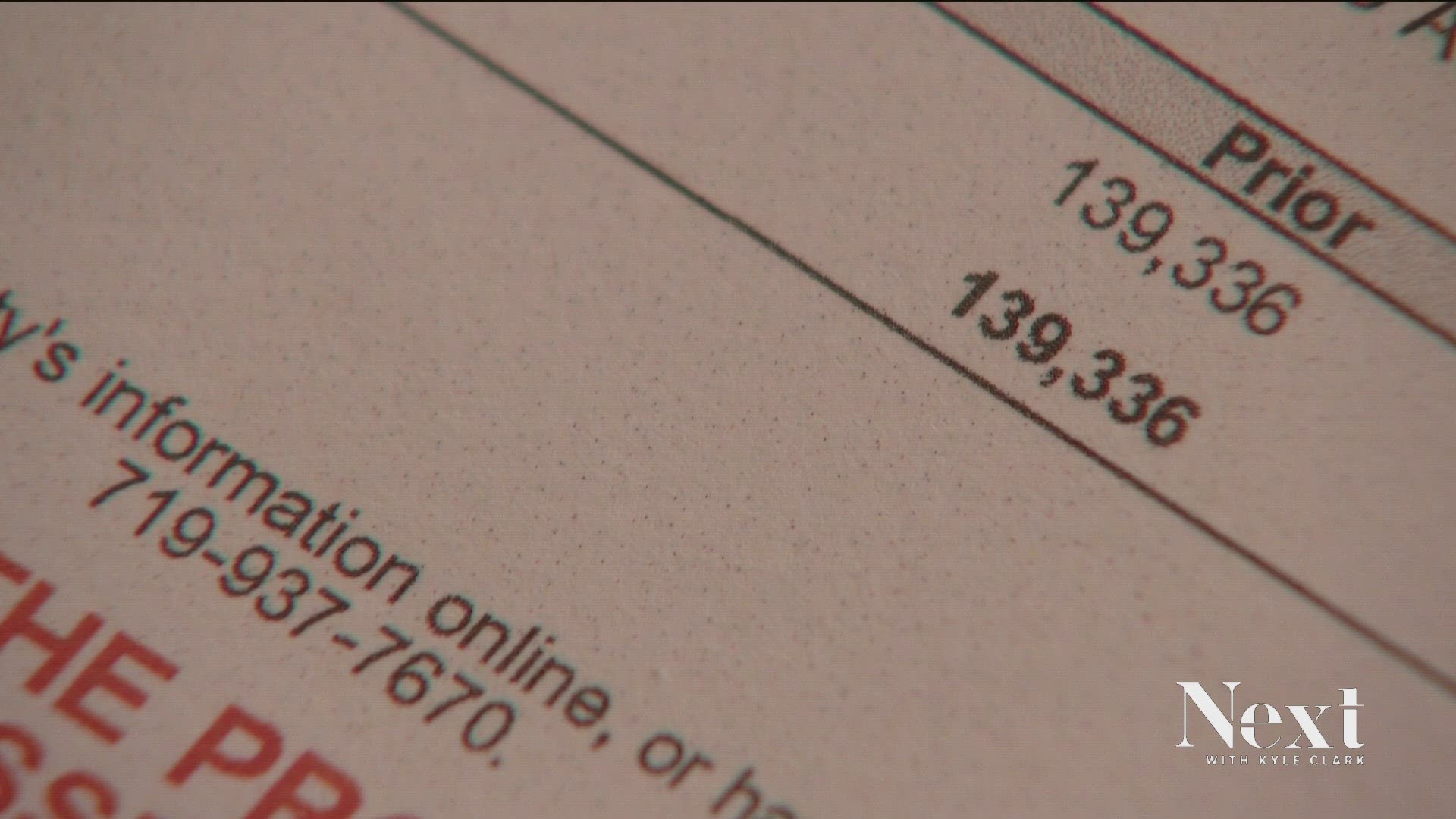

That's a lot, considering just last year the assessed value was under $140,000. Then, Larson got a card in the mail a couple of months ago telling him it went up to more than $300,000. He appealed to try and get it lowered.

The county assessor has the power to increase values after someone appeals. Higher property values mean higher taxes. When Larson got back his appeal, the assessor said his home was worth more than $640,000.

"They doubled it. So, I feel like I might have been better not to say anything," said Larson. "Appealing was probably a really stupid decision."

If you're considering taking your appeal to the next level, we should warn you that your property valuation could keep increasing with each appeal.

You didn't know that? Yeah, we didn't either.

Turns out the state doesn't require assessors to warn you before you decide to appeal.

"It makes me feel like I am being victimized by the county government. That’s exactly how I feel," said Tom Phillips, Larson's neighbor who lives down the street.

His value also skyrocketed. Now they’re fighting back.

"We’re starting to band together," said Phillips. "We actually had some meetings down at the community hall and that’s where we found out that we’re not alone."

Together, they appeal yet again.

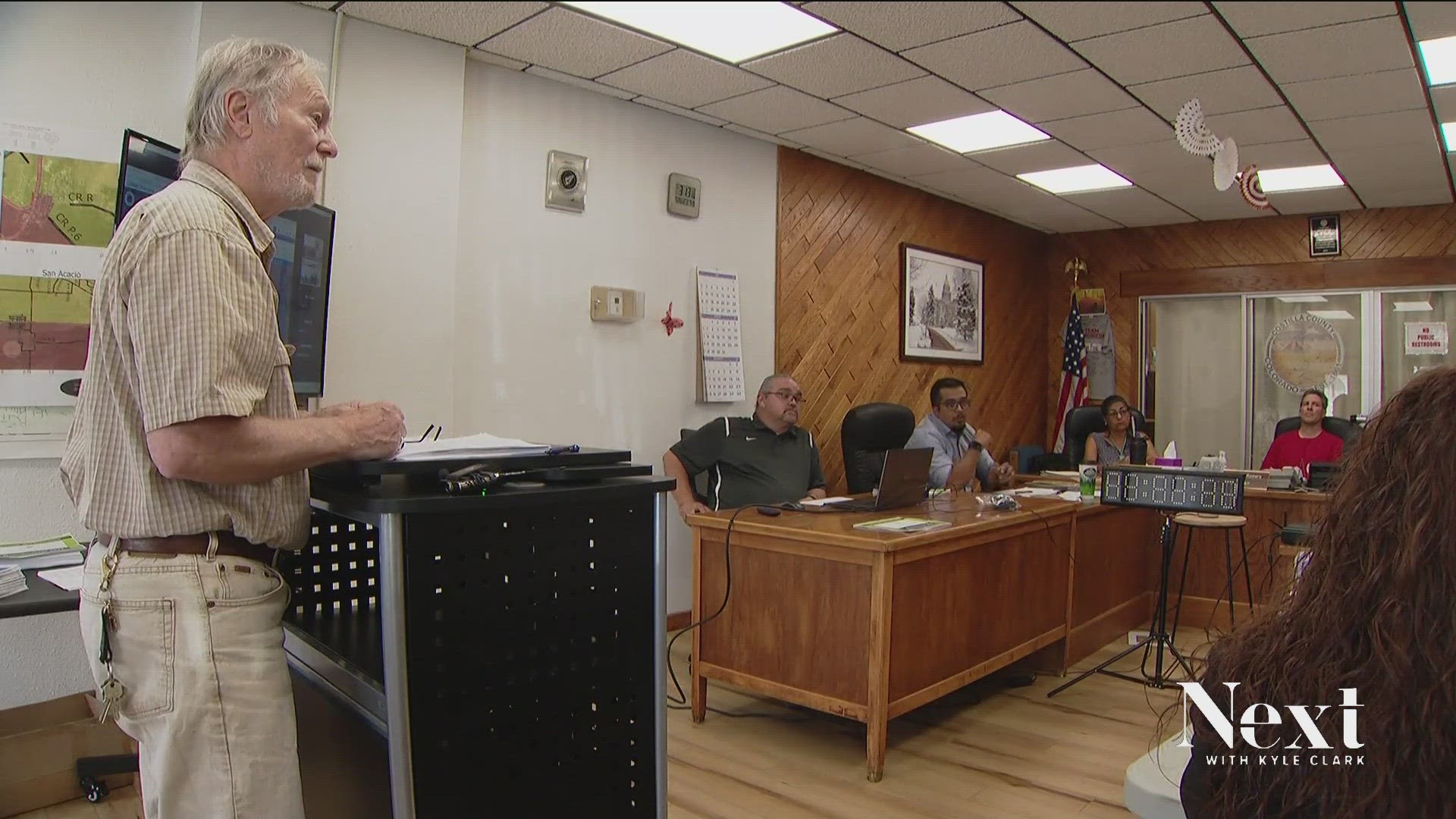

In front of county commissioners and the deputy county assessor at the Board of Equalization meeting, Larson pleaded his case on Wednesday. Hundreds more are signed up to do the same over the coming days in Costilla County.

"Why would you do that?" Larson asked the assessor who increased his home value. "I have not even done any improvements on it. It’s the same that it was when I built it."

In less than 15 minutes, the deputy county assessor, Ronda Lobato, decides she’s reducing the assessed property value of Larson's home from $640,000 to $350,000. She gave no explanation on why, how she came to that conclusion, or why it was ever valued so high.

9NEWS has been trying to talk to anyone in the county assessors office in Costilla County for the last couple of days. We sent them multiple emails. We finally had a conversation in person with Lobato on Wednesday in San Luis.

She told us she saw our emails, but didn’t have time to talk to us or respond to our questions.

Despite these cases, there are some success stories in Colorado.

We told you about Breck Larson in May. He's an Arapahoe County homeowner who appealed after his property value increased 81%.

He went above and beyond to show off the worst aspects of his home, submitting 49 pages worth of documents and photos of his 1970s fixtures, a retro turquoise bathroom and asbestos. His appeal convinced the assessor to come down about 10% on his valuation, but not the 30% decrease he wanted.

"I'm kind of looking at this as the 10% off my property value isn't really helpful, because it only knocks $1,100 off my taxes and my taxes are pretty hefty considering how high they valued my property," Breck Larson said. "Ten percent off feels like a restaurant coupon."

Like the homeowners in southern Colorado, he said he's also considering taking his appeal to the county board of equalization for a second opinion.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark