DENVER — Today, the state regulators who oversees Xcel Energy held a meeting about the expensive bills. We've been telling you what those charges are, and now we're looking at the why.

We've said it before: The price of natural gas is higher than last year, and your usage is likely up because it's been colder.

We took more of your questions to Colorado's Public Utilities Commission (PUC), which regulates companies like Xcel.

Erin O'Neill, Chief Economist for the PUC, gave us some answers.

Why is my bill so high? Is it just because gas is expensive?

"Gas prices are about 40% higher than they were last year," O'Neill said.

Natural gas is purchased by Xcel and that cost is passed down to us dollar-for-dollar.

At what point can the PUC say that was a bad business decision, you have to eat the cost for that?

"If the Commission staff found a problem and felt like there was something that utilities were doing that was not prudent, they bring that to the commission and say, we need a prudent review, we want to look at these costs. That is very rare," O'Neill said.

She said that utility companies like Xcel provide the PUC a gas purchase plan explaining how much gas they plan to buy long term, how much they plan to buy daily and how much they plan to store.

Then that gets compared after the fact with a gas purchase report to see how that all went.

"We do review those in pretty close detail. And I've never seen like a disconnect between what public service purchases at in the market price or something like that," she said.

When the PUC approves rates, is profit built into what you're approving? Like when I pay something, I'm paying Excel back plus profit?

In short, yes.

"It depends on exactly which piece of your bill that you're referring to. There are pieces that we refer to as base rates. It's the pieces of your bill that include the cost of infrastructure and recovery, operations and maintenance, those sorts of costs, as well as the rate of return, or the profit that's built in, for the utility who's making those investments on behalf of ratepayers," O'Neill said.

Xcel gets a return on capital investments, but they don't get a return on things like operation and maintenance.

Profit isn't a set percentage every time. It depends on things like the market, and the cost of debt (how much it costs the company to go get the capital and to finance the investments that they're making).

"The cost of debt is generally something that is set by the by the market and sort of demonstrated by the cost that the other entities are getting. The return on equity is something that the Commission determines based on similar industries, what is needed for the company to be able to raise the capital, they need to make investments, but also relating to the level of risk associated with the entity," O'Neill said. Those economic conditions are what the PUC takes into account when determining returns.

I hear investment and recover. That sounds like code words for business expense that customers pay back. Why does Xcel get paid back for every business expense?

"As a regulated monopoly, they [Xcel] have the right to operate in the system, they have an obligation to provide safe and reliable service to their customers. So they're getting paid back for the investments that they make on behalf of a customer just like when you're buying any other product," O'Neill said.

So, you’re paying for building and maintaining the system that provides power to you. If Xcel needs a new power plant, that cost is "recovered from," or charged to, the ratepayers.

What about Xcel's record $555 million in profits in 2022? Say they make $545 million, couldn’t they use $10 million of their own to build a power plant and save us $10 million?

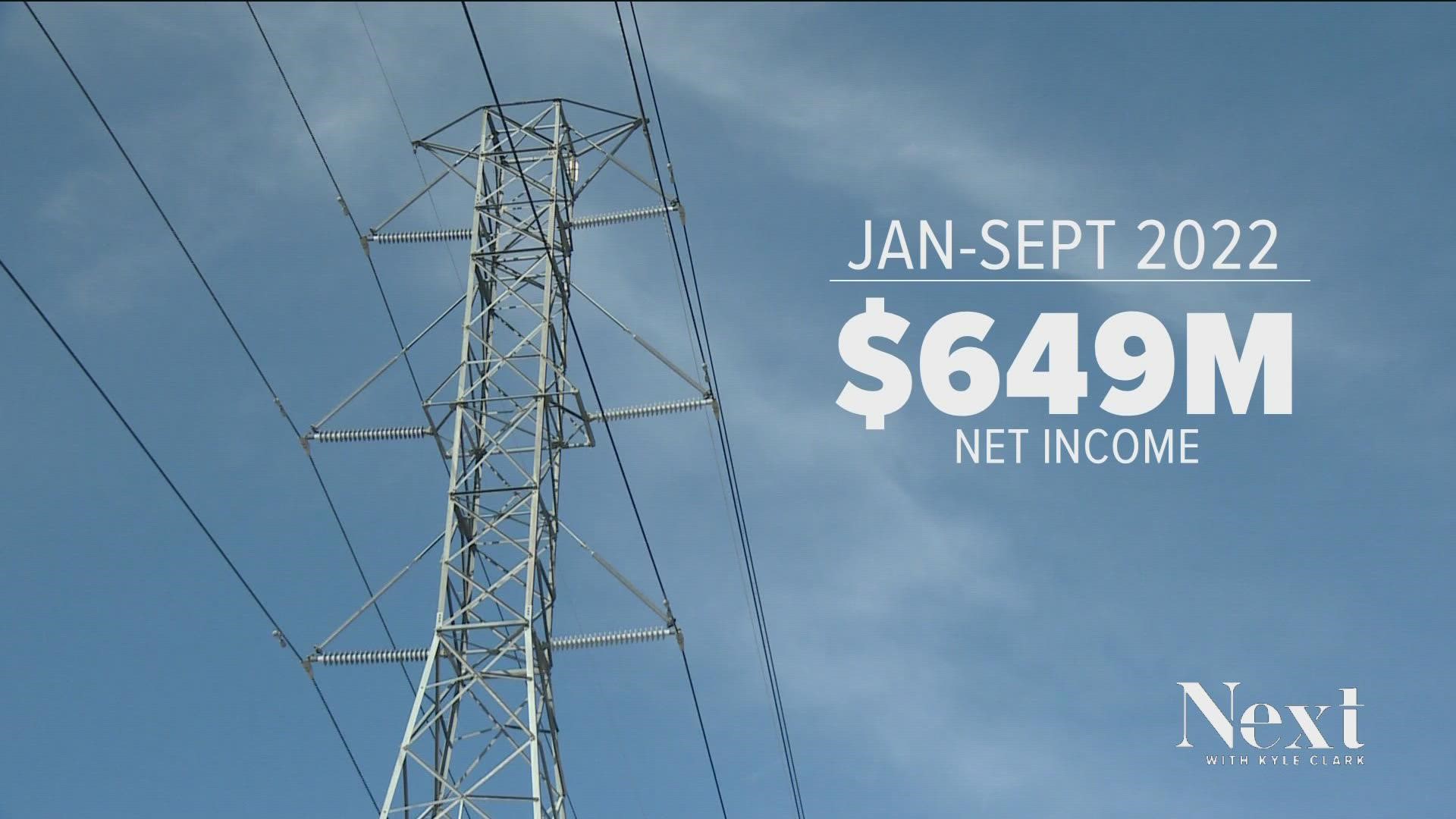

Through three quarters of 2022, Xcel had ongoing earnings of almost $650 million dollars.

When Commissioners approve the rates we pay Xcel, it turns out that includes paying Xcel back for what it calls investments, things like transmission lines or a new power plant, and extra for profit.

"That's the balance that the commissioners decide in a rate case," O'Neill said.

A rate case is a proceeding where all of those factors are examined, like what is the level of investment that the utility needs in order to be able to raise the capital from the market, since they don't get paid back immediately.

"So, all of those factors go into what the commissioners are trying to decide of how much is enough profit to keep them as a healthy corporation that can go to the market and access financing at a reasonable rate," she said.

Not every cost Xcel requests from the Commission is approved.

"There are things that the Commission says no, that's not a cost that you're going to recover from Colorado ratepayers, or that's a cost that will be shared between ratepayers and shareholders, things like equity compensation for executives, is something that we often discuss and tried to determine what's just in reasonable utility was to be able to attract talent to their business to be able to run it well."

Does Xcel ask for more than they know they’ll get, so the PUC will approve higher rates of return than they would otherwise?

The PUC says it’s hard to know.

"I think it is generally the case that they come in and ask for more than then think they'll receive. I think the other reverse also happens, that often stakeholders will say you get less than us," O'Neill said.

If Xcel files more frequent rate cases, they’re not getting as much as they were hoping for. Everything is a negotiation. The PUC also bases their cost of service of the companies like Xcel on a historical test share, where they're looking at actual costs incurred for a previous period of time.

How many times has the PUC said no to a rate increase?

It's not common for the Commission to say no to a whole rate case. O'Neill said she remembers one time for Xcel that happened in the last five years. More often, Commission says no to pieces of things, not to the whole.

There are things that the Commission says no, that's not a cost that you're going to recover from Colorado ratepayers, or that's a cost that will be shared between ratepayers and shareholders, things like equity compensation for executives.

Do we, the ratepayers, pay for Xcel's executive staff?

Yes, we do. We may not pay for all of it, but the O'Neill said the PUC decides how much Xcel can "recover," or charge, ratepayers for money that goes to their executive staff.

Once Xcel spends money, regardless of if we conserve or not, they're getting paid that money one way or the other?

Yes again. We pay for Xcel's infrastructure costs: New power plants, bigger pipes, those kinds of things.

"If customers are consuming more, more infrastructure is going to be needed to meet that higher demand. So, to the extent that customers consume less, there is feedback there that that ultimately, there will be less infrastructure required," O'Neill said. But until Xcel stops building, we pay the infrastructure costs.

One last thing. The service and facility charge: When I buy a cellphone, at some point, I pay that cell phone off. And if it becomes obsolete, then I make a new decision. Why is this an infinite charge that I'm always paying for the meter on my home?

"You buy a meter, and that meter is assumed that it's going to live for a certain amount of time, 15 years, 20 years, and that cost gets spread out and sort of amortized over that period," O'Neill said. "And then the assumption is after 15 years, you're going to buy a new meter, and your main meter may not be replaced this year, but your neighbors is, and the next year's will be, and you're not going to be charged the full price of your meter in any one year, it gets spread out over 15."

So, it's a cycle where you never actually pay off your meter, and when you do, it's time for another one and the cycle continues. It's not just the meter either, it's pipes and wires and other service and facility charges that operate on similar cycles.

SUGGESTED VIDEOS: Next with Kyle Clark