DENVER — This story is part of a series of statewide ballot issue reviews for Next: We Don't Have To Agree, But Let's Just Vote.

Proposition 116 might be the easiest to understand issue on a long and somewhat complicated election ballot.

A YES vote means you want the state income tax rate to drop to 4.55%.

A NO vote means you're OK if the state income tax rate remains 4.63%.

Voting yes means you'll be keeping more money and giving the state less money through income taxes.

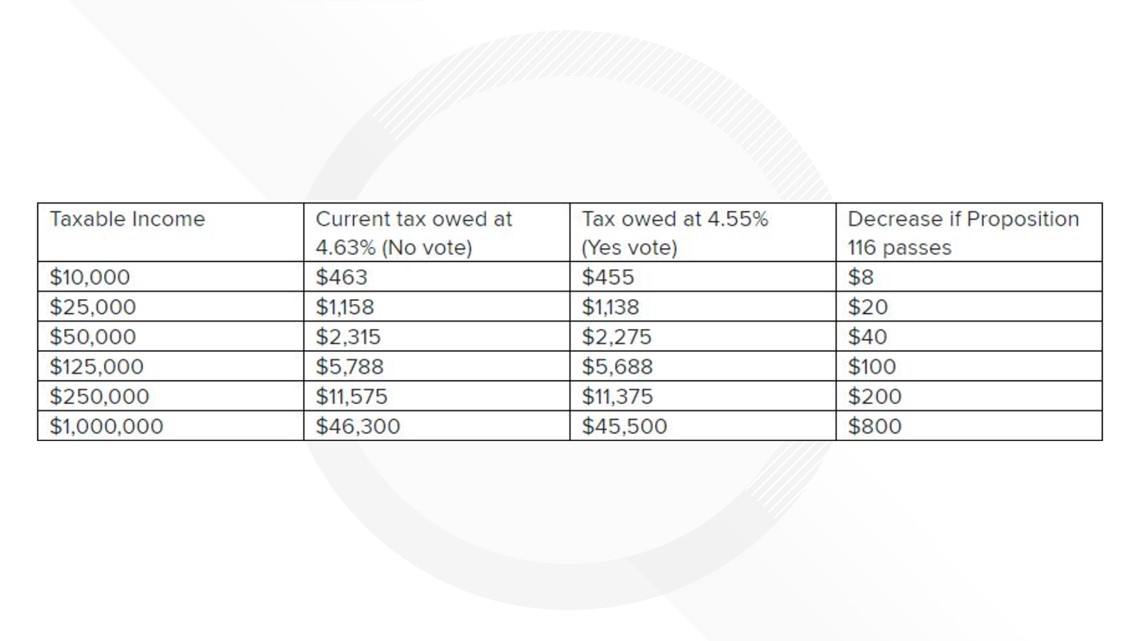

How much you keep depends on your taxable income. The bottom line? The more you make, the more you keep.

This chart explains:

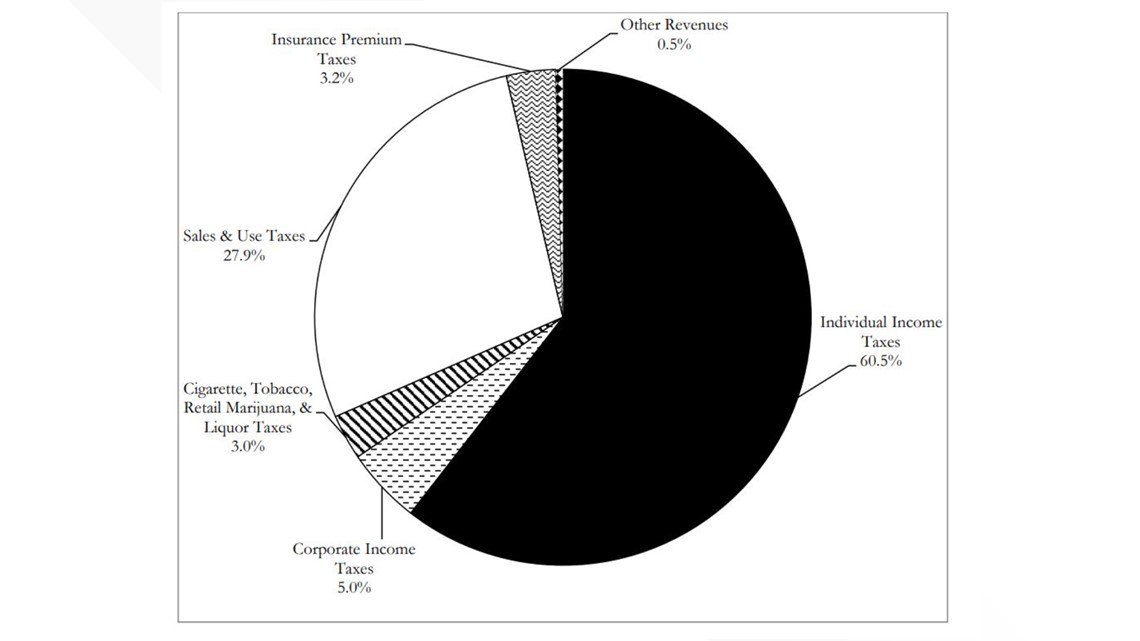

Where does your income tax go?

In 2020-21, the state's income taxes covered 60.5% of Colorado's general fund. The general fund is the part of the budget that the state legislature controls.

The general fund is the money that goes to the operation of nearly two dozen state departments:

- Agriculture

- Corrections

- Education

- Governor

- Health Care

- Higher Education

- Human Services

- Judicial

- Labor & Employment

- Law

- Legislative Department

- Local Affairs

- Military & Veterans Affairs

- Natural Resources

- Personnel

- Public Health & Environment

- Public Safety

- Regulatory Agencies

- Revenue

- State

- Transportation

- Treasury

A yes vote is estimated to mean $154 million fewer dollars for the state next year. That would mean less money to be split between the departments listed above.

Earlier this year, state lawmakers had to cut $3 billion from the 2020-21 budget as a result of COVID-19.

Last month, the governor's budget director estimated that $1.6 billion would need to be cut in 2022-23 and $2.2 billion in 2023-24.

Those seeking a yes vote argue that allowing residents to keep more money in their pockets will encourage spending, business investment and employment. They also argue the state should live within the money it has.

Those seeking a no vote argue that this is not the time to reduce state funding, as it could have an impact on the departments that are funded by state income taxes. They also argue the tax break benefits high earners more so than the general population.

SUGGESTED VIDEOS: Breaking down Colorado's 2020 ballot