DENVER — By now, you know what TABOR means.

The Taxpayer Bill of Rights limits how much the state can collect and spend.

Anything over that limit gets refunded back to you.

It is that pot of money that Gov. Jared Polis (D) and Democratic lawmakers want to use to give you property tax payment relief.

That means money that is owed to you because of TABOR would instead be used to fund the local districts impacted by lowering property tax increases.

Democrats at the State Capitol introduced a bill to reduce property taxes (SB23-303) on Monday, one week before the last day of the legislative session. The bill, if passed by lawmakers, would be put on the ballot in November, asking voters to approve changing how property taxes are determined for the next 10 years.

The language that would show up on the Nov. ballot would read as:

"SHALL THE STATE REDUCE PROPERTY TAXES FOR HOMES AND BUSINESSES, INCLUDING EXPANDING PROPERTY TAX RELIEF FOR SENIORS, AND BACKFILL COUNTIES, SCHOOL DISTRICTS, WATER DISTRICTS, FIRE DISTRICTS, AMBULANCE AND HOSPITAL DISTRICTS, AND OTHER LOCAL GOVERNMENTS AND FUND SCHOOL DISTRICTS BY USING A PORTION OF THE STATE SURPLUS UP TO THE PROPOSITION HH CAP AS DEFINED IN THIS MEASURE?"

“State surplus” is a way of avoiding saying “TABOR refund money.”

Local districts and local government are funded through property tax money.

Districts include:

- Cities

- Counties

- School districts

- Fire protection districts

- Parks and recreation districts

- Water districts

- Sanitation districts

- Library districts

Any increase in property tax bills means an increase for those entities. Any decrease to that amount would mean fewer dollars for those entities. If lawmakers pass this proposal and voters say yes to it, the districts would be backfilled with TABOR refund money, as long as there is TABOR refund money to be had.

“There was a group of 42 of us that have been meeting since last January,” said Ann Terry, Executive Director of the Special District Association of Colorado. “We have been meeting as a property tax group with the counties and the cities and the schools and the realtors and the assessors and treasurers, it’s kind of a long list.”

Despite that long list of groups meeting since the start of the year, Terry said her organization found out about this proposal just before it was announced at a news conference with the governor on Monday.

“This feels like it was done in a vacuum and that vacuum left us out. And when I say ‘us,’ I mean all of us in the local government world,” Terry said. “This is my 27th legislative session, and I think it’s important that something this big has a lot more discussion.”

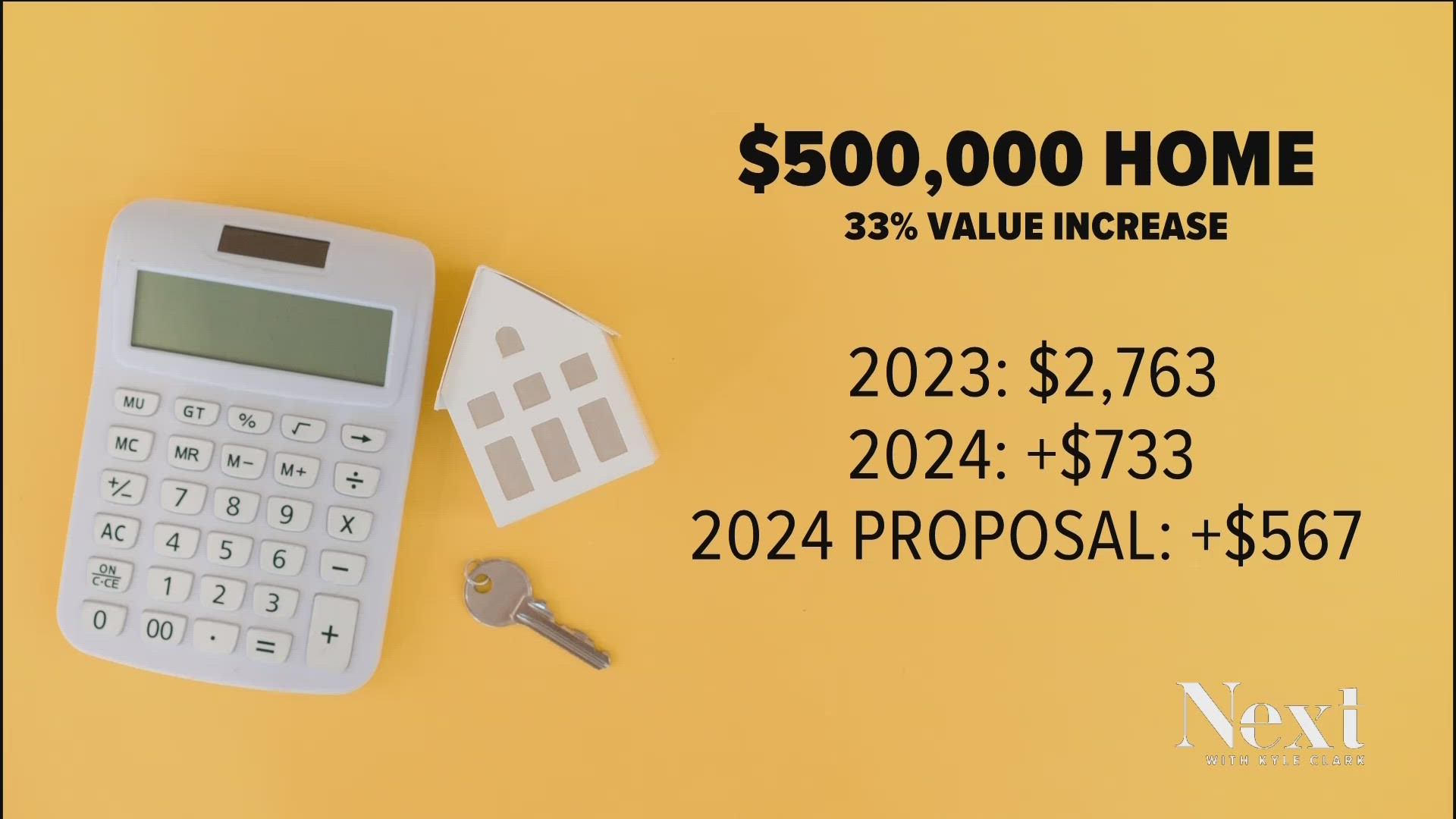

In Denver, home values increased an average of 33%.

For a home valued at $500,000 for the tax bill paid in 2023, that homeowner paid $2,763 in property taxes.

If that value went up 33%, it would now be valued at $665,000.

Under current law, the property tax for that home would go up $733 next year.

Under this proposal that would show up in front of voters in November, if passed, that homeowner’s property tax bill would, instead, go up $567.

Some of the difference between $567 and $733 would be covered by using TABOR refund money.

“It gives the governor and legislators some headlines to say they’re trying to ease property tax relief, but it’s coming from money that would otherwise come to us anyway,” said Michael Fields, the head of the conservative-leaning Advance Colorado Institute.

Fields is attempting a ballot proposal that would ask voters to cap property tax increases at 3% each year. Using the same $500,000 home example that paid $2,763 in property taxes in 2023, his ballot issue would increase that person’s property tax bill $83.

“It would be annual. So 3% each year. And we do [two-year] cycles [right now], and so, the 47% increase that I’m dealing with in Douglas County is over a two-year period, and so this would be 6% over that two-year that it could go up,” Fields said.

His proposal is being challenged in court right now, and would need to collect 124,238 signatures statewide, including 2% in each of the 35 State Senate districts to qualify for the ballot.

“We definitely haven’t taken it off the table,” Fields said. “I think it has to be a cap because the cap is what is the biggest deal because it’s the only thing that ensures it doesn’t keep happening and keep happening.”

His ballot issue would be a Constitutional Amendment, while the governor’s proposal would change state statute.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark