DENVER — Democrats at the Colorado legislature are attempting to find out how much a vote is worth.

Last week, Democratic Gov. Jared Polis and Democratic lawmakers unveiled a plan to try to put a dent in the massive property tax bills we all received.

Over the weekend, Democrats added a caveat, more like a carrot on a stick for low income taxpayers. They want to provide certain Coloradans more money in Taxpayer Bill of Rights (TABOR) refunds in return for a yes vote on a November ballot issue.

Senate Bill 23-303 – Reduce property tax increases (Proposition HH)

This bill – which as of Monday evening was still being debated on the last day of the legislative session – would refer to voters in November, a proposal to change the math equation that determines a property tax bill.

The proposal would make some of the home’s value tax-free and lower the assessment rate that the home’s value is multiplied by. Property tax bills will still go up, just not as much as the notice you received in the mail this month.

Local governments and special districts rely on property tax revenue to fund their budgets. Whatever amount that the property tax bills are lowered will be backfilled by the state using TABOR refund money.

That means, in return for a property tax increase that is lower than it would be without this proposal, taxpayers would be giving up a portion of their TABOR refund for every year backfill is necessary for local governments and special districts.

This would be put on the Nov. ballot as Proposition HH.

House Bill 23-1311 – Equal TABOR refunds regardless of income level

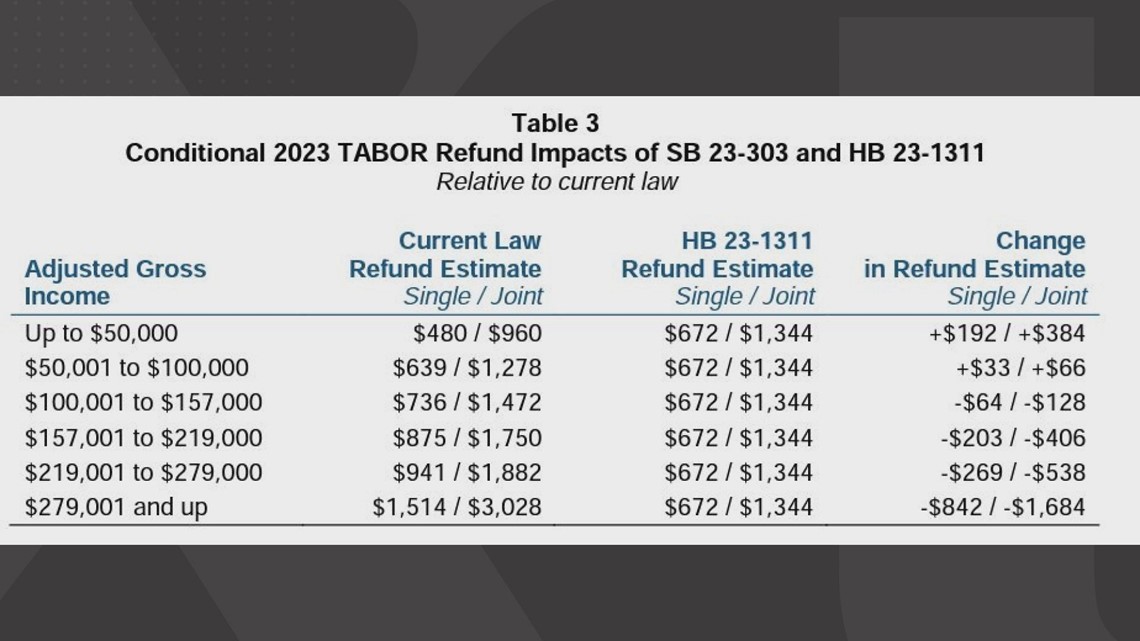

This bill, which was introduced on Saturday, passed and sent to the governor on Monday, would give equal TABOR refunds to Colorado taxpayers next year regardless of income level. Currently, TABOR refunds are tiered based on six different income brackets.

What one has to do with the other?

Equal TABOR refunds regardless of income level will only happen if voters pass Proposition HH on the Nov. ballot.

Otherwise, TABOR refunds will be issued based on the six-tier income level system.

Based on analysis by legislative council staff, which runs numbers for state lawmakers, this is the breakdown of TABOR refunds under the current six-tier system versus if equal TABOR refunds for all if Proposition HH passes:

“We knew that if we were going to be using the TABOR surplus to pay for some of the local government backfill for some of the property tax reductions, that we were going to need to grapple with this question of whose TABOR refunds are impacted most,” said State Rep. Chris deGruy Kennedy (D-Lakewood). “We believe that coupling this refund mechanisms bill with the property tax bill is what guarantees that this will do more for lower income people.”

deGruy Kennedy said that he wanted to propose a bill for equal TABOR refunds permanently at the start of the year, but waited based on the property tax situation.

“I put my bill on hold, so that we can make sure that whatever we did was integrated together,” deGruy Kennedy said. “There are some of us who believe that these flat refunds are the right policy regardless and I have every intention of bringing a bill next year to continue those flat refunds in perpetuity, but for the time being, this was the negotiation that we landed on.”

“If this is that important, and we’re talking about equality for everybody, equal for taxpayers, then let’s make it permanent,” said State Sen. Barbara Kirkmeyer (R-Brighton).

Kirkmeyer even proposed an amendment to make the equal TABOR refunds permanent, but Democrats rejected it.

“I’m like, ‘are we only going to do that one time because why aren’t we doing it, just making it permanent? Let’s just make it permanent.’ And I had an amendment and they would not agree to that,” Kirkmeyer said.

She used the word ‘duped’ because in exchange for lower-income earners receiving slightly more in TABOR refunds for one year, they would be giving up a portion of their TABOR refund over multiple years if Proposition HH passes.

“They’re going to get anywhere from $33 to $192 additional money with this, so you’re being duped,” Kirkmeyer said.

“If your income is over $150,000, sure maybe you’re not living large, but you don’t need the help as much as someone whose income is below $50,000,” deGruy Kennedy said. “We also know that renters are less likely to own a home, which means they may not be guaranteed as much of a benefit from the property tax bill. This is one way of making sure those renters benefit, as well.”

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark