DENVER — The city of Denver has launched a new housing program that aims to increase homeownership in communities of color. The Metro Down Payment Assistance (metroDPA) social equity program offers homeowners $15,000 or $25,000 based on their income level and approval by the Department of Housing Stability. The assistance program targets people who lived in or are descendants of families that lived in Denver’s redlined neighborhoods from 1938-2000.

“Redlining was an assessment of risk by banks and government institutions to say where was a safe and good investment,” said Denver’s Housing Stability Executive Director Britta Fisher. “Unfortunately, those were very much categorized with race and that made an exclusionary habit of not giving people who are Black, Indigenous or People of Color (BIPOC) loans at all or only in certain neighborhoods which really segregated our communities further.”

The program is for families who make up to $150,000 a year and a credit score above 640. Applicants may receive up to 5% of the mortgage loan for the down payment with no interest. Fisher said the loan is forgivable, so an applicant doesn’t have to pay back the loan if they stay in the home for more than three years.

“There are many wrongs that have happened in the past and every day that we can do something to make it a little [righter], we want to do that,” Fisher said. “We have a stubbornly low minority home ownership rate and so our Black, Indigenous and People of Color are simply not getting that needle moved on homeownership and we want to do more every day to see that change.”

A 2018 study from the Urban Institute showed the Denver metro area has a gap of almost 32% between white and Black homeowners. Fisher said it’s one of the city’s primary goals to increase BIPOC homeownership from 41% to 45% by 2026.

“The program is not going to make up the big discrepancies and disparities that we see but we think it’s an important first step while we have more work to do,” Fisher said.

Town and Country Realty is one of the oldest Black-owned real estate companies in Colorado. Muriel Williams-Thompson, a broker there, said this program is a step in the right direction.

“There’s a lot of demand when it comes to how many people are looking for properties so if that’s the case, then those who actually have the most money and the highest credit scores are the ones who actually that are going to win the properties at the end of the day," she said.

Williams-Thompson said she’s happy programs like these exist and that their message of wanting more BIPOC homeownership in Colorado is being heard.

“That’s why we exist, we service those families,” Williams-Thompson said. “A lot of these families don’t come with generational wealth, so it pushes them out, it makes it difficult.”

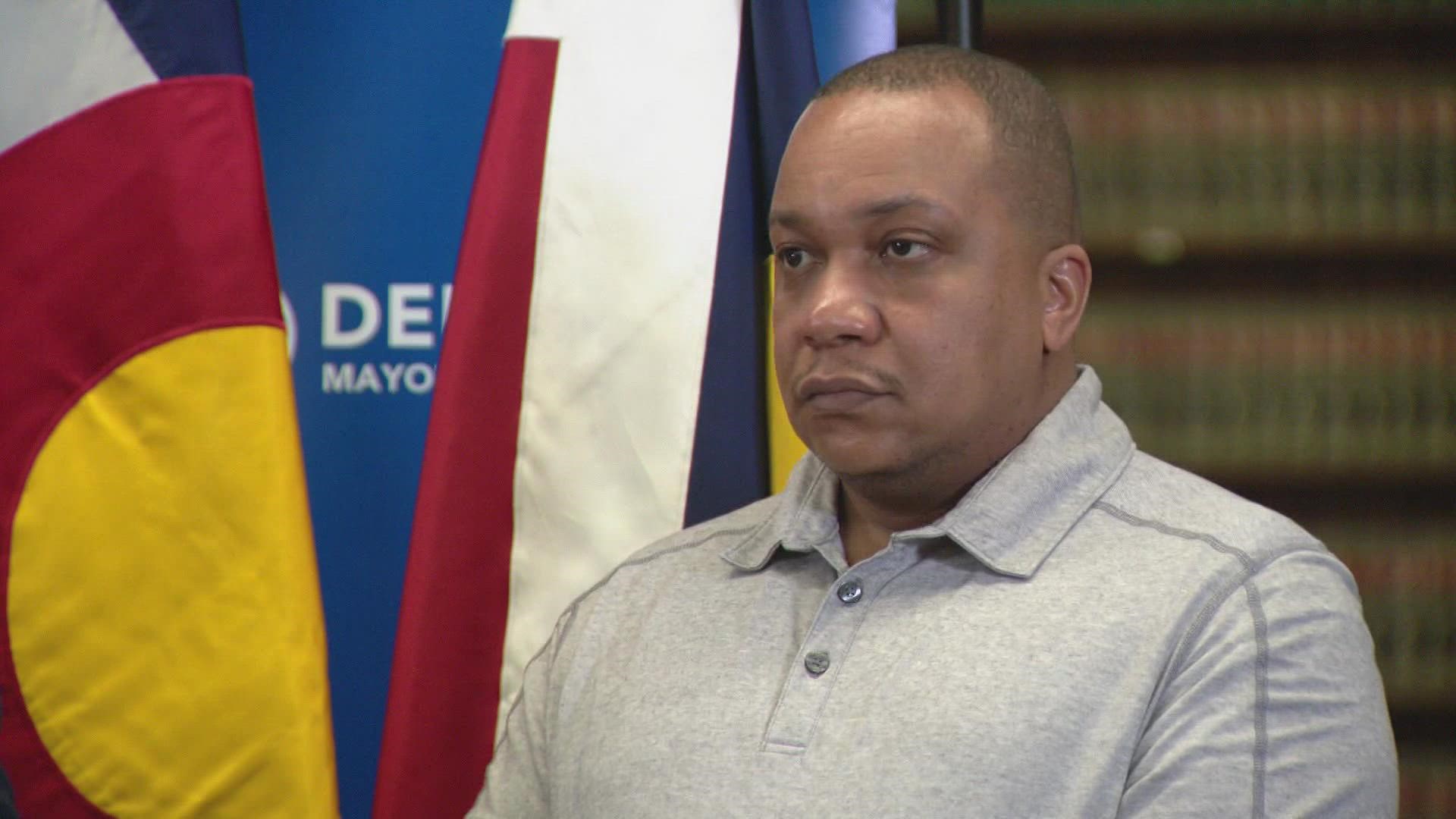

Denver resident Dontraell Starks is just one of the people this program could help.

“It’s tough, it’s very frustrating,” he said. “I’ve been looking for years but it never works honestly, it never works.”

Starks has been looking for a larger home for his family of seven for the past decade. He and his family live in a three-bedroom home in Park Hill. He said even though he has a credit score of 800, he’s had difficulties trying to secure a home loan.

“At the end of the day, it always comes down to, ‘You can’t qualify for this,’ or, ‘The money that you have wasn’t sitting in the bank long enough,'" Starks said. “It’s all these different excuses when we know what the real excuse is -- it’s because you’re Black.”

Starks was one of the first applicants granted a loan under the new program. His grandparents lived in the Whittier neighborhood at 1533 30th Avenue. He said social equity programs like these are just part of fixing the issue.

“I appreciate the help, I’ll take all the help I can get," Starks said. "But in reality, it’s just not enough. But it is a good step. It’s a good first step,”

According to the city, homeowners may use the funds for a down payment or closing costs to purchase a home anywhere in the Front Range approved through the metroDPA program. Their focus is leveling the playing field for homeownership opportunities among all communities in Denver.

“Equity is a core value to the city of Denver and we’re making decisions with our budget and with programs like this to align our values and say, ‘We no longer want race to predict housing outcomes,’” Fisher said. “So, this is a good first step with our metroDPA social equity program to advance minority home ownership.”

For more information, click here: www.denvergov.org/housing.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark