DENVER — Robin Hooding has a new meaning today.

The classic story of Robin Hood involves taking from the rich and giving to the poor.

In 21st Century lingo, Robinhood is an investment app, which small-time investors used to group up on the rich by betting on companies that hedge funds were betting would fail.

"Just like anything, you get on Reddit, you, kind of, fall down some wormholes and then all of a sudden you're trading GameStop in a short squeeze, dealing with options, where five months ago, I had no idea what any of it was," said Lakewood resident Nick Korsick.

Korsick has an engineering degree but could have been mistaken for an investment pro this past week.

"I was trying, kind of, saving bits and pieces from paychecks. I really don't want to get into numbers of what I have, but I was trying to save up for a down payment on a house," said Korsick.

He wants to buy in the Sloan Lake area. Denver metro prices being what they are, he was making quick money investing in GameStop. It's part of a game that briefly stopped today.

"It's, kind of, like outsider trading is illegal now," said Korsick.

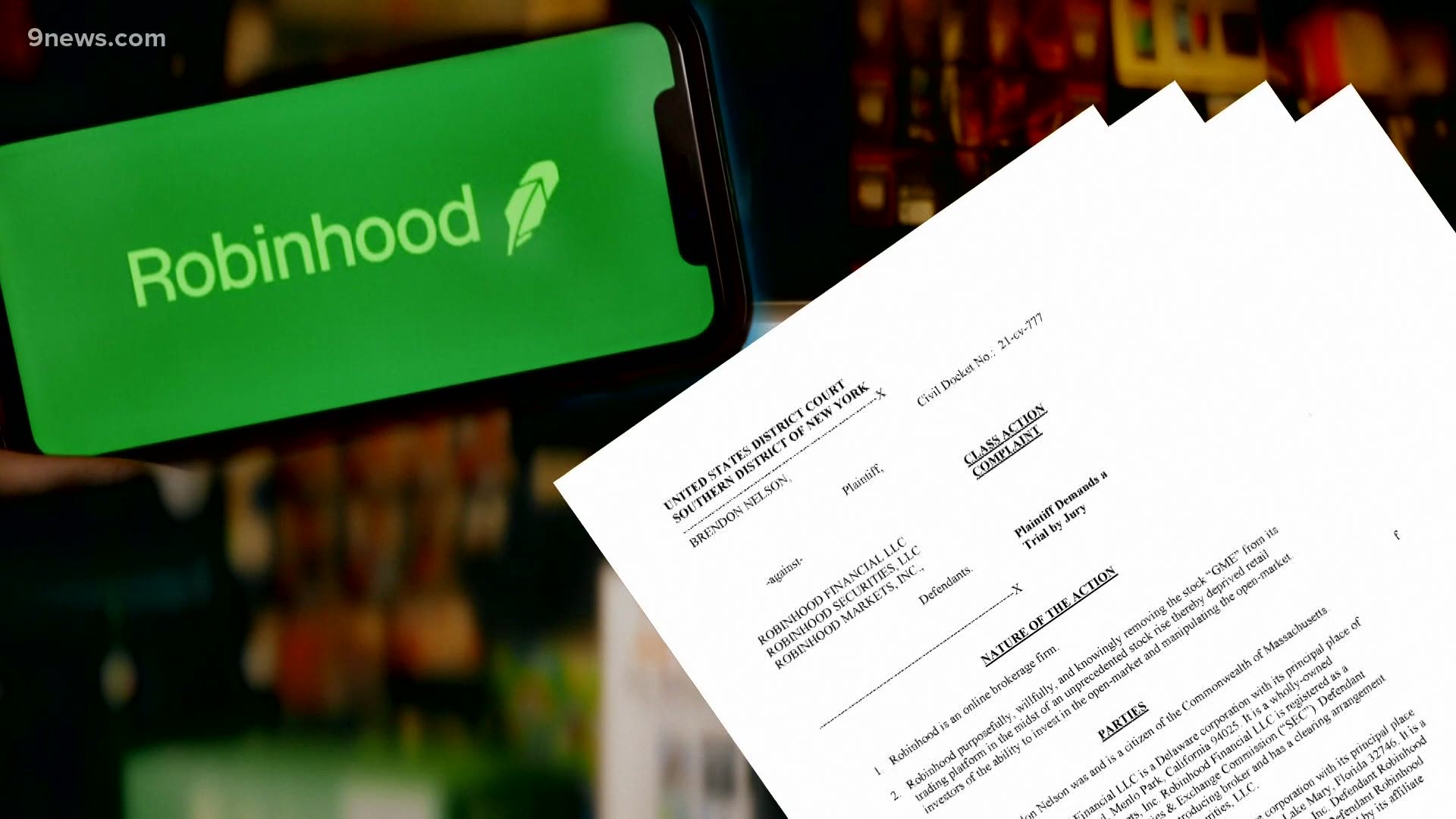

The Robinhood app, as well as TD Ameritrade, shut down buying of GameStop and a few other companies, allowing users to only sell.

That means the small-time investors were prevented from possibly making more money, while the move could have helped the hedge funds that need the stock price to fall.

Hedge funds were short sellers of GameStop stocks. That means they borrowed shares from brokers and sold them at one price, hoping to buy them back at a lower price, then return the shares to the brokers and pocket the difference. Success in that endeavor requires the stock price to fall. Stock prices can fall when people are limited from buying them. (NPR has a great explainer on this).

"I have money in, I know what my risk is and I've accepted this risk, and I want to keep going forward and making these trades, and they're using their pull, the hedge funds, to not allow me to make trades," said Korsick.

Robinhood created a blog post explaining Thursday's actions. The app explained how it has federal securities rules to follow that came into play. "To be clear, this was a risk-management decision, and was not made on the direction of the market makers we route to," Robinhood wrote.

Korsick compared his trading to gambling.

"I'm making that choice to be in that casino. Nobody's forcing me to be there, and I don't need somebody there to catch me if I start slipping," said Korsick.

"To change the rules late in the game always hurts the small investor; the little guy, the little gal," said Rep. Ed Perlmutter (D-Colorado).

Perlmutter sits on the House Finance Committee that could hold hearings on this issue.

"I don't see it as a bailout at this point. I don't know why the brokers, why Robinhood or some of the others, TD Ameritrade, limited the purchases, and that's something we've got to investigate," said Perlmutter.

"I always talk about Mrs. McGillicuddy, the lady that lives down the street, and is she being treated fairly? The gentleman who you spoke to, it's gambling to some degree, but the gambling rules changed late in the game and he was left holding the bag," said Perlmutter.

Perlmutter does not sit on the Investor Protection Subcommittee that would have direct oversight of this issue.

Colorado's newest Sen. John Hickenlooper could have some perspective on this. His Chief of Staff, Kirtan Mehta, was an attorney for Robinhood, working as senior counsel for public policy. When asked if he or Hickenlooper feel that what happened today was good public policy, his office told 9NEWS that Mehta has recused himself from this issue.

Hickenlooper does not have his committee assignments yet, but did not request the Banking Committee, which would be the jurisdiction that deals with this topic.

SUGGESTED VIDEOS: Full Episodes of Next with Kyle Clark