Hundreds of Colorado homeowners locked in long term ‘predatory’ listing contracts

Homeowners say MV Realty took advantage of them during vulnerable times. The company's Homeowner Benefit Program is the subject of lawsuits in six states.

In the heart of the pandemic, Laura Walsh found herself in a tight spot like so many other Coloradans.

The single mom saw her business start to dry up. She was diagnosed with stage three breast cancer. She needed money. So she turned to her biggest asset for financial help and started looking for home refinancing offers.

The search led Walsh to sign a listing agreement with a Florida-based real estate company called MV Realty which, in the end, would cost her nearly $20,000 of her home’s value. She’s one of about 900 Colorado homeowners 9NEWS found that have signed up with the company now being sued for its practices in several states.

The listing contracts, known as MV Realty’s Homeowner Benefit Program, offer a small amount of cash to homeowners up front in exchange for a promise: let MV Realty be the listing agent if and when you ever sell your home. The agreement guarantees the company a portion of the commission for the real estate sale.

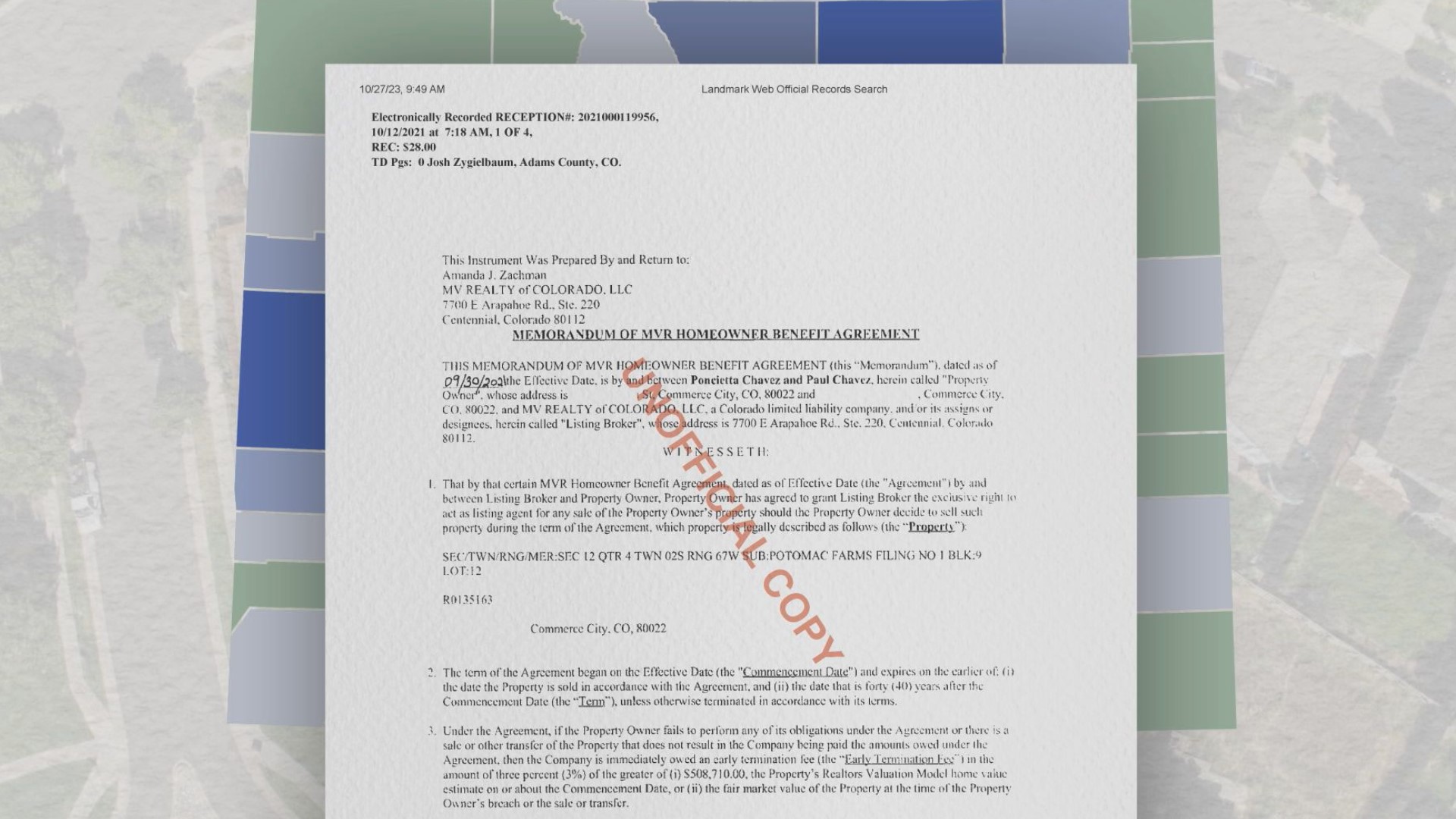

The fine print on the agreements binds the contracts to the land, meaning even if a homeowner dies, their successors still have to follow the terms. And the agreements are valid for 40 years. To ensure that the agreement is known and enforced, MV Realty files a memorandum with the local county clerk and recorder tied to the property.

The agreements got the attention of Colorado state lawmakers earlier this year. They passed a bill banning these long-term listing contracts. But the law isn’t retroactive, meaning hundreds of Colorado homeowners who already signed may still have to pay up.

MV Realty calls its program “an innovative option” for homeowners and insists the agreements fully comply with laws.

An enticing text message

Walsh said when MV Realty initially contacted her, the texter said the company was new to Denver and was working on doing market research. They offered to pay her about $1,700 if she signed an agreement that she said she was told would give MV Realty the first chance to sell her home whenever she decided to do so.

So she did some research.

“I saw that they were actually a company out of Florida,” she said. “They had really good reviews from Zillow, which didn't really make sense to me, but they had some things on there saying they were a great company to work with. And so I decided to do it.”

She said the company sent a notary to her. She looked over the contract, signed it, and got her check.

“I'm always very thorough in contracts and we read through it and it was very much just kind of a marketing slash potential realtor,” she said. “I told them I had no intention of selling my house anytime soon. And they said, no worries. It's more about us getting into the marketplace and getting more information on the real estate market in your area.”

She signed the agreement in 2021. When the pandemic dust settled in 2022, Walsh decided to sell her Thornton home. Remembering the contract, Walsh said she reached out to MV Realty.

“I couldn't find or contact any of them when it was time to sell my house,” she said.

Walsh said e-mails went unanswered. She said she called several phone numbers for Colorado brokers listed on MV Realty’s website and they were either disconnected or never returned a call.

She found an address for a Colorado office for MV Realty in Centennial and headed down there.

“I went down there and there was nobody there. It was a small, empty storefront that I think with a pile of mail inside the door.”

At that point, Walsh said she figured the company hadn’t made their Colorado operation work. So she contacted another real estate agent and put her home on the market.

“[I figured] maybe they were kind of a fly by night came in, tried to get it, tried to start up this business, and maybe it didn't work,” she said.

After listing the home, she found a buyer. And the home went under contract. A day after that good news, Walsh’s e-mail pinged with some bad news.

“The very next day I received an email with a lawsuit saying breach of contract,” she said.

Below is an example of the memorandum of agreement filed at the clerk and recorder's office.

It was MV Realty, arguing Walsh had broken the terms of her Homeowner Benefit Agreement. The lawsuit said the company was entitled to 3% of the sale price of Walsh’s home, nearly $20,000.

“According to the terms of the lawsuit, I would have to go to arbitration in order to settle it, which would take a long time and a lot of money,” she said. “And I would have ended up breaking the contract with the gentleman that bought my house. So then I would have been in two lawsuits.”

So in the end, she decided to pay MV Realty and her actual realtor.

Others still stuck

Poncietta Chavez got a similar text message offer when she was looking for refinancing deals for her Commerce City home.

Chavez worked in finance for years and said she knows the ins and outs of financial contracts. At first, the deal offering cash upfront for future real estate services sounded too good to be true. But she said after a lengthy conversation she felt more comfortable.

“It was simple, right? They didn't explain all the ins and outs and all the stuff,” she said.

Chavez said she forgot about the deal until she went to refinance her home. The deal got held up because the lender noticed the agreement with MV Realty on the property and refused to close the refinancing without Chavez taking care of the contract. Chavez said the refinancing company told her they wouldn’t work with MV Realty because the company was under investigation.

“I'm like, if I would have known this, I would have never got involved with these people because this sounds kind of underhanded and sneaky, you know,” she said.

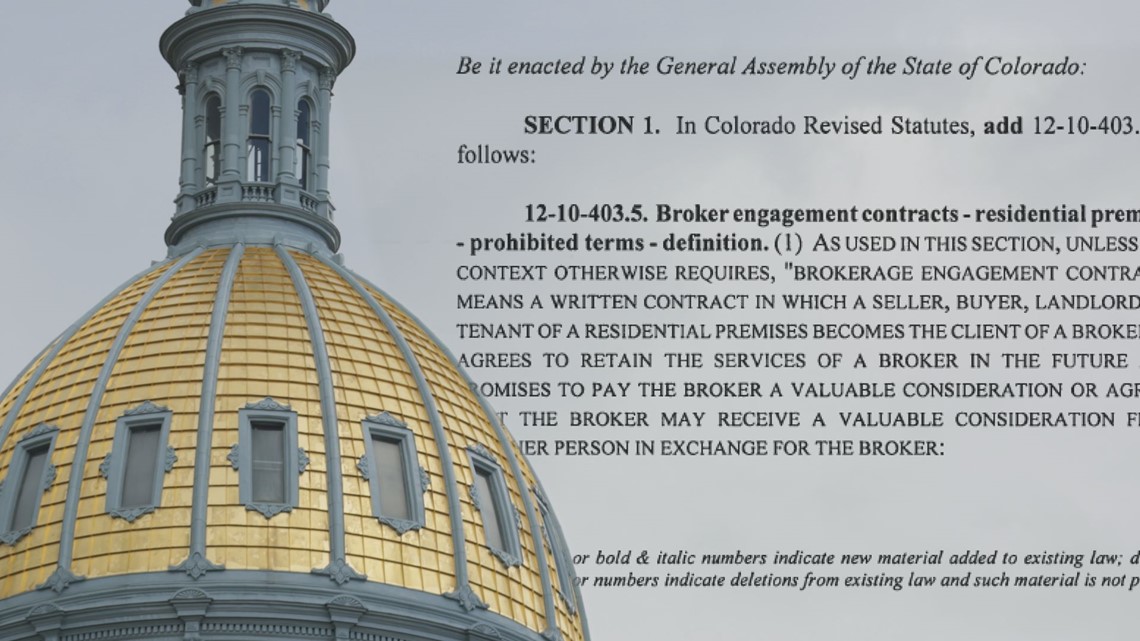

Lawmakers take notice

MV Realty’s Homeowner Benefit Program is the subject of lawsuits in six states. Attorneys General are suing MV Realty in their home state of Florida, Pennsylvania, Massachusetts, New Jersey, North Carolina, and Ohio, alleging the program targets older adults, people of color, and people with disabilities. The lawsuits label the agreements as predatory.

“While I think it was clear to everybody that they were violating the intent and the spirit of Colorado real estate law, they weren't violating the letter,” said Colorado State Sen. Nick Hinrichsen, D-Pueblo.

Last session, Colorado state lawmakers passed a bill pushed by the Colorado Association of Realtors banning listing agreements that run as a covenant on land and listing agreements that purport to create “a recordable lien, encumbrance or other real property security in interest.”

“The trap here is that it's not a problem until you go to sell your home,” Hinrichsen said. “You're just going along with the home sale process and, you know, you'd worry about typical things. You worry about FHA inspection or a VA inspection and you worry about, you know, comps and negotiations throughout that process. What you don't typically worry about is, here's this lien and it's going to be $10,000. And if you don't pay it, it's going to be months. You're going to lose a sale. There is no way. You're trapped.”

MV Realty disputes that its agreements are liens, but said the company put a temporary pause on new agreements in the U.S. amid scrutiny. On its website, the company claims to have entered into 35,000 of these agreements with people all over the country.

Since the Colorado bill was signed by Gov. Jared Polis in April and became effective in August, MV Realty appears to have stopped entering into new listing agreements with Colorado homeowners, according to a search of Clerk and Recorder databases by 9NEWS. But the law doesn’t impact people who already signed.

Chavez told 9NEWS she was able to somehow contact the company to have the memorandum of her agreement temporarily removed while she went through the process of refinancing. As soon as the deal was done, the agreement reappeared on the county clerk and recorder’s website.

Chavez said she had no idea the agreement lasted for 40 years. She now plans on dying in her current home so she doesn’t have to pay the commission to MV Realty.

“Unfortunately, it's just something that we have to live with now, unless we could find a way to dump them,” she said. “You know, without paying them $15,000 because I don't think that they deserve it.”

9NEWS spoke with some homeowners who chose to take their homes off the market after threats from MV Realty. Others, like Laura Walsh, decided to pay and move on.

State Investigation

Both Chavez and Walsh said they submitted formal complaints about MV Realty to the Colorado Attorney General’s Office.

A spokesman for Colorado Attorney General Phil Weiser said he couldn’t speak about whether MV Realty’s practices were under investigation by his office.

But in August of last year, the Colorado Real Estate Commission voted unanimously to revoke MV Realty’s license in Colorado. In their ruling, Commissioners noted MV Realty had “engaged in dishonest dealings by misleading homeowners into signing legal documents which affect their title,” among other complaints.

However, the revocation has yet to be enforced because the case is being appealed in an administrative court. The next hearing in the case isn’t set until September 2024.

Walsh and Chavez said they both want to be there - hoping their stories will help others fight their own agreements.

“My hope is that this doesn't happen to anybody else,” Walsh said. “My hope is that MV Realty and this scheme that they have going is stopped.”

“We worked too hard to make the money we do to pay for the homes that we have And, you know, it's the American dream. And to me, it was the American nightmare.”

Do you have one of these agreements? Or have you been the victim of something you want Steve On Your Side to investigate? E-mail SteveOnYourSide@9news.com.

SUGGESTED VIDEOS: 9NEWS Originals