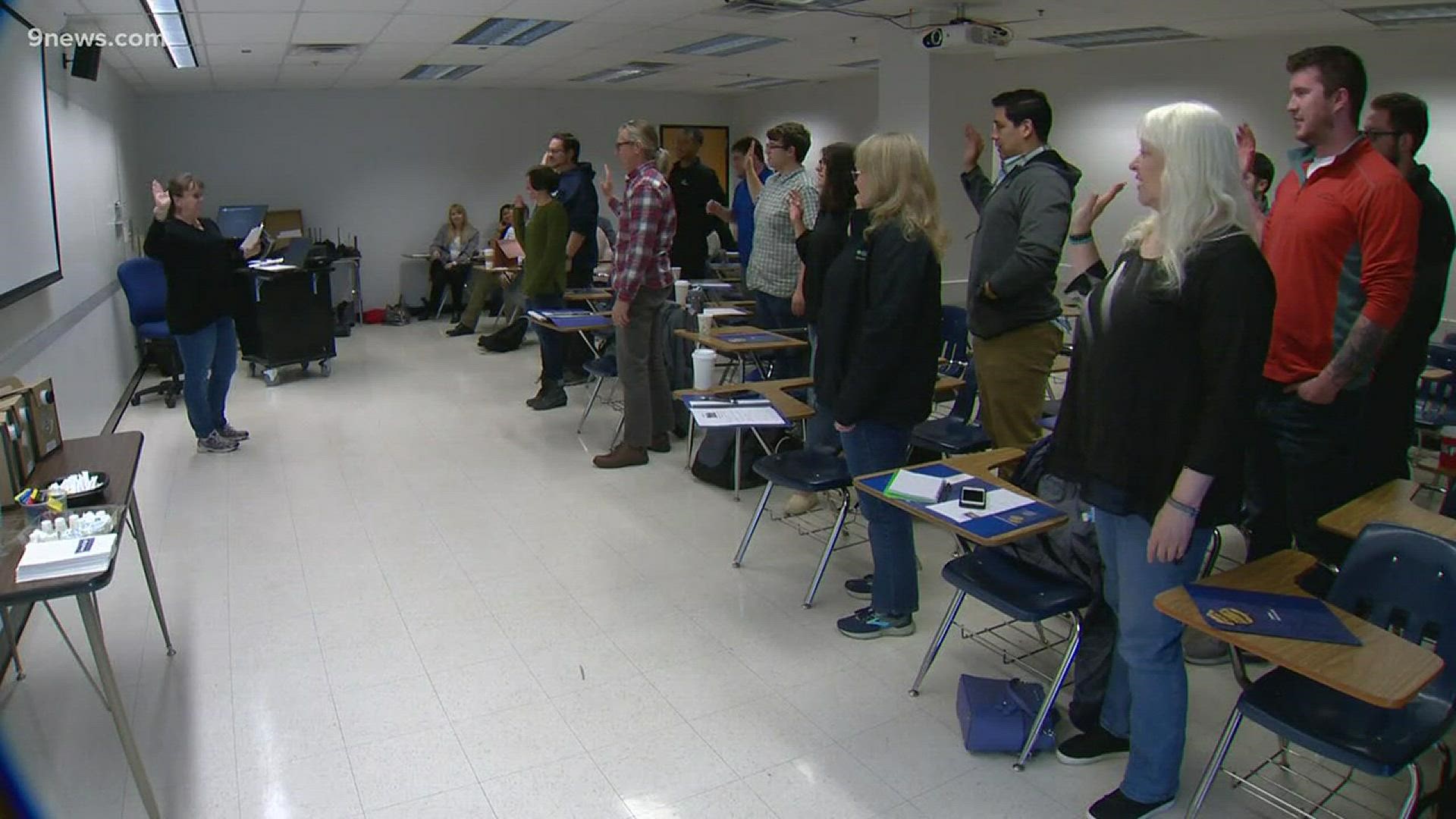

DENVER — Twenty accounting students from Metropolitan State University of Denver served as honorary “special agents” as part of a fraud simulation led by the Internal Revenue Service Criminal Investigation.

“They do different scenarios that are similar to cases that we would work,” said Special Agent Karen Gurgel, who works for the Internal Revenue Service Criminal Investigation field unit out of Denver.

"They’ll start from an informant or [with] information from one of the IRS Service Centers, and they’ll work it all the way through a search warrant and potentially an arrest warrant," she added.

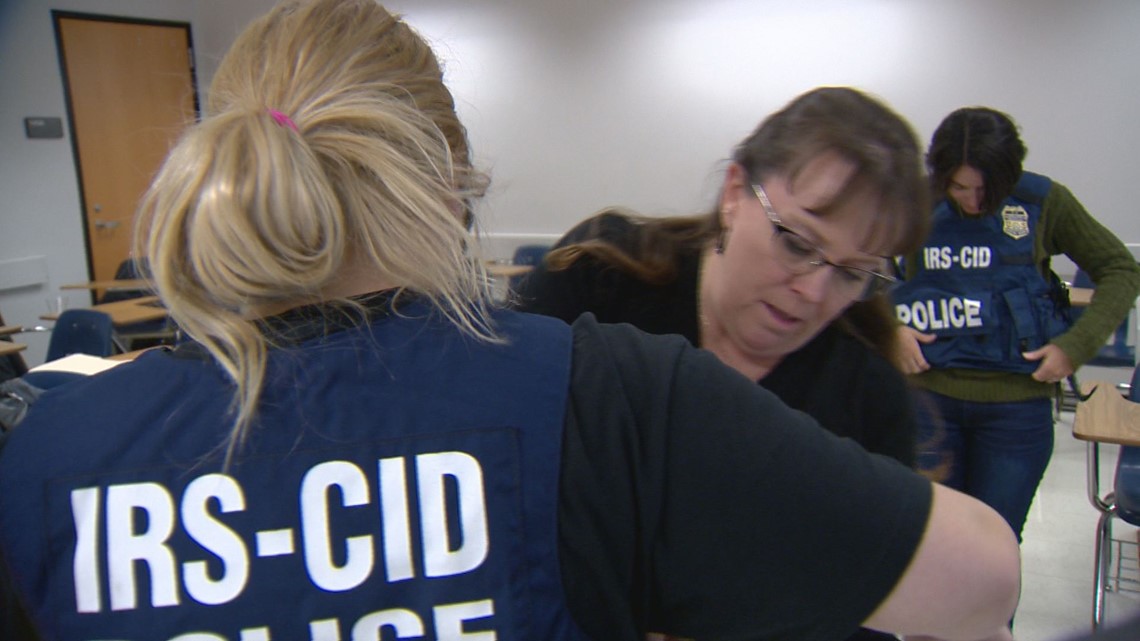

Gurgel said the simulation is part of an accounting requirement that's part of the hiring process.

"That’s why it’s typically more of a business student that we see," she said.

Gurgel said the students worked directly with IRS special agents to investigate simulated white-collar criminal case scenarios that they see every day.

"They’re going to do some surveillance at some point, so they’ll be following around the bad guy,” Gurgel said. "They’ll also be doing undercover operations, so they are going to have people who are going to go in and talk to people who are doing things less than above board.”

The students participated in a workshop called the Adrian Project.

The project was founded more than two decades ago through a collaborative partnership between the IRS and Adrian College, located in Michigan. MSU Denver has been the workshop host in Colorado for the past nine years.

“With IRS criminal investigation we focus on financial fraud particularly tax fraud,” said Special Agent in Charge Steven Osborne. “What we find is finance students or accounting students tend to gravitate and are more interested in our line of work.”

Osborne graduated from MSU Denver with a degree in accounting in 1996 and then launched his career working for the IRS.

“I want them to walk away with a better understanding of criminal investigation, who we are and what we do — and there may be one of two of them who will want to follow in our footsteps and become a special agent,” Osborne said.

Undergraduate and masters accounting students who attended the workshop solved cases like identity theft, money laundering and embezzlement. The student “special agents” conducted interviews, reviewed financial documents, performed surveillance, carried out undercover operations and executed search warrants.

“We just try to get them out there and let them know that there’s other opportunities besides the traditional number crunching,” Gurgel said.

“This is a ton of fun and a great way to spend a Friday afternoon,” said Senior Abby Fitzsimons. “I want to hopefully go into the FBI to be a Forensic Accountant there and be someone who can find bad guys through money.”

SUGGESTED VIDEOS | Feature stories from 9NEWS