DENVER, Colorado — The pandemic has already slowed Colorado’s economy to a crawl. But now the state’s complicated tax laws are promising to cut residential property taxes by 18% according to a new forecast presented to the Joint Budget Committee on Tuesday. That would be one of the biggest drops in state history.

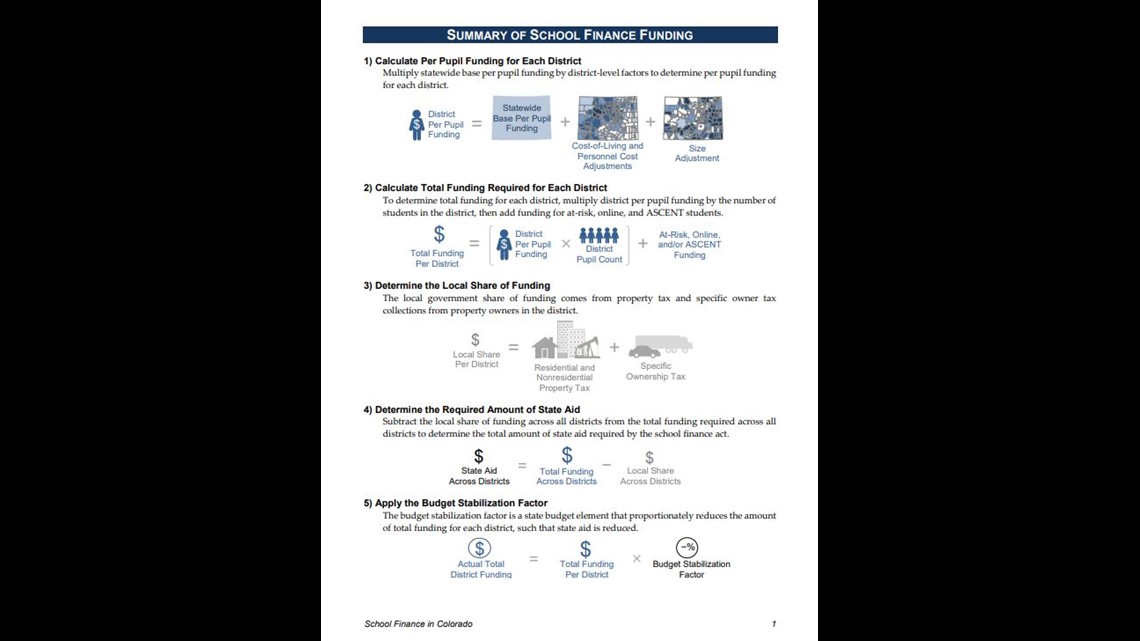

While it may be welcome news to homeowners, the projection shows the cuts could cost school districts $491 million and county governments, which fund services including libraries and fire departments with that tax revenue, more than $200 million when the new tax rates are set in 2022.

The Gallagher Amendment, passed in 1982 to limit then-skyrocketing residential-property taxes, says only 45% of the state’s property tax revenue can come from residential properties. The other 55% comes from commercial and industrial properties, including oil and gas, which are declining in value. State projections released Tuesday show oil and gas values are down 30% and commercial values are down 20%.

This will cause the residential assessment rate to fall from 7.15% to 5.88% despite home values being up 10% from the last time the legislature was forced to set this rate according to the latest projections.

“School districts are going to be hit so hard that I'm not sure they will be able to weather further hits coming in the future,” said Amie Baca-Oehlert, a high school counselor and president of the Colorado Education Association.

RELATED: Tax laws squeeze rural Colorado counties (story is from 2017)

Technically, the state is required to backfill what districts can't get via property taxes. But, given the track record the state has in underfunding schools, Baca-Oehler is skeptical of how this happens. She points to the “negative factor,” a budget-balancing tool used by the legislature that’s resulted in district budgets being slashed by hundreds of millions in recent years.

“The state, if they don't have the funding they're going to have to do things that have negative impacts or negative consequences on students, on public education, potentially other services within the state budget,” she said. “It could be a very dire picture.”

RELATED: We asked financial experts to answer some of your questions about money and COVID-19

Democratic State Senator, and Vice-Chair of the Joint Budget Committee Dominick Moreno has serious concerns about the commitment to backfill, too.

"It's the straw that breaks the camels back. I don't know that the state budget could sustain that level of commitment,” said Moreno.

He said there are a few ways to address this issue but believes the best path forward is to let voters decide whether to eliminate the Gallagher Amendment. Another option would be to get state legislators to refuse passing new tax rates which would likely bring on lawsuits.

He said the “silver lining” in addressing the issue is that rates wouldn’t have to be set until 2022, giving the legislature time to address the issue.

While the state would somehow be expected to backfill education budgets, fire departments, which often rely heavily on property taxes, would not get that relief. The estimates laid out by the state on Tuesday show counties funding these districts could lose out on hundreds of millions of dollars if property taxes drop in 2022.

RELATED: Fire chiefs: Colorado tax law will cause deaths (story is from 2018)

SUGGESTED VIDEOS: Local stories from 9NEWS