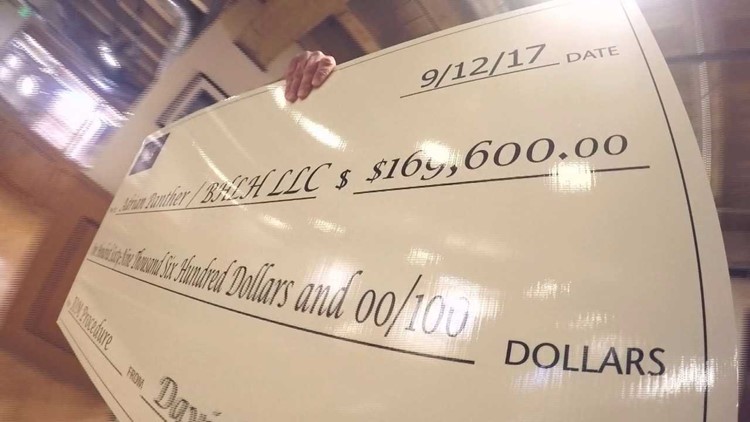

COLORADO, USA — The six-figure check that occupied a spot in their bank account had a habit of making Dave and Debra Altman a tad nervous.

The money, all $169,600 of it, wasn’t exactly theirs to keep, but it also didn’t seem right to simply forward it to a medical company run by an out-of-state whiskey distiller whose bill included a hand-written return address.

And so the money sat.

For months.

What follows is a story that might say less about the actions of one Colorado couple and much more about the state of the American health care system.

At a time when the staggering cost of health care accounts for nearly one out of every five dollars spent in the U.S., far too often the system tends to reward those who charge the most.

'Edie' wants his six-figure check

The email’s subject line was blunt.

“Outrageous bill being PAID by the insurance company.”

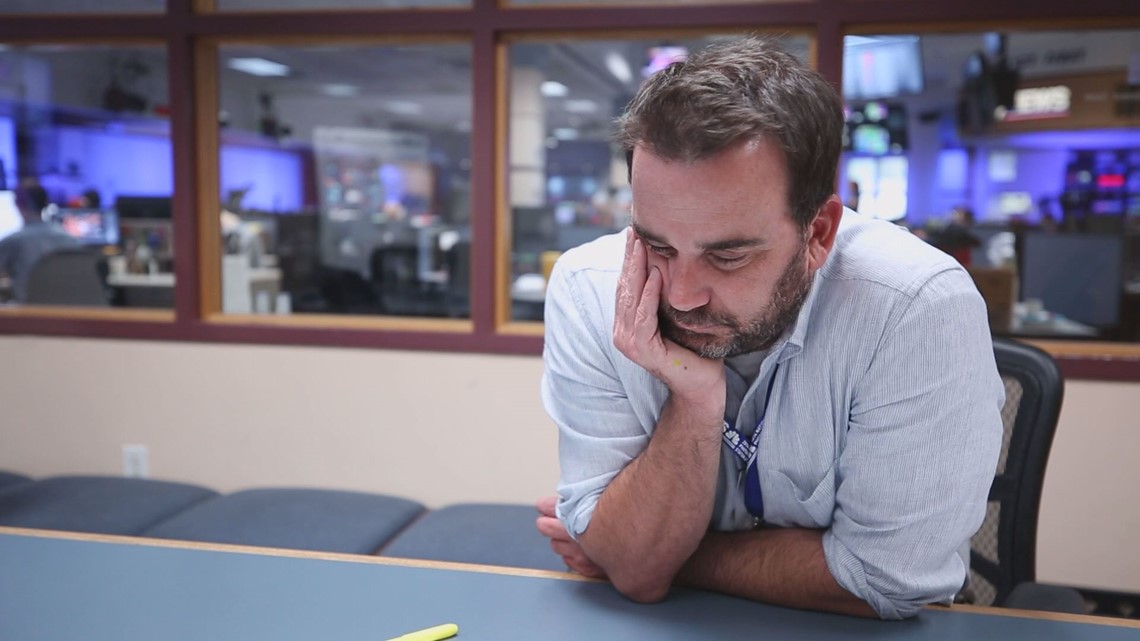

Dave Altman wrote me many months ago after seeing our “Show Us Your Bills” series on 9NEWS.

The series highlighted some of the absurdities associated with health care billing.

In general, we spoke with a lot of patients upset over just how much they were being asked to pay.

“Chris,” Altman’s email stated, “I have kind of a reverse situation than most of what you have showcased.”

The phone call that followed helped fill in many of the gaps. Here’s the general outline:

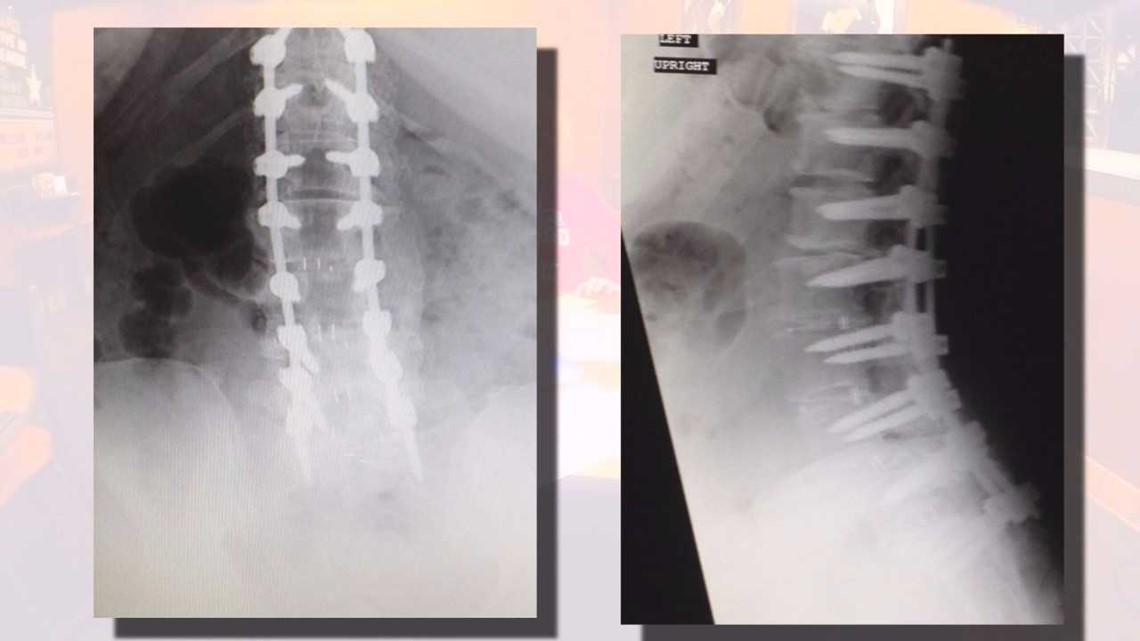

In 2015, his wife Debra underwent a six-hour back surgery at Parker Adventist. The surgery was largely unsuccessful in relieving Debra’s pain, but that wasn’t his main gripe.

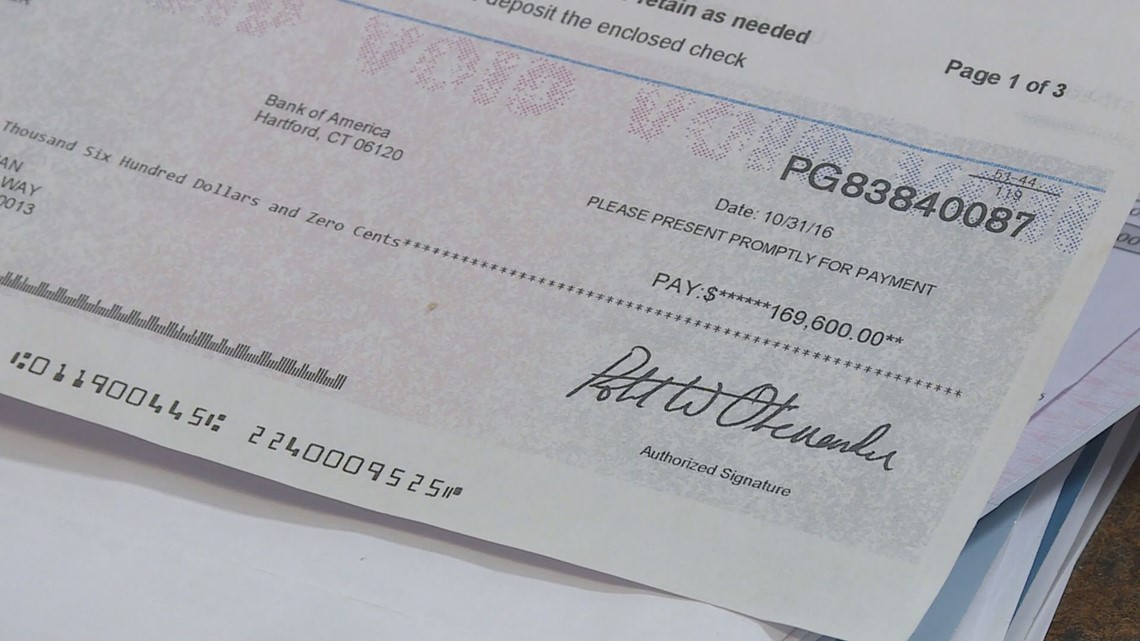

More than a year after the surgery – long after numerous claims for the expensive surgery itself had been processed – the Altmans received a check from their insurance, UnitedHealthCare, for $169,600.

“We really felt like there was a mistake,” explained Dave Altman. “It straight out didn’t make sense.”

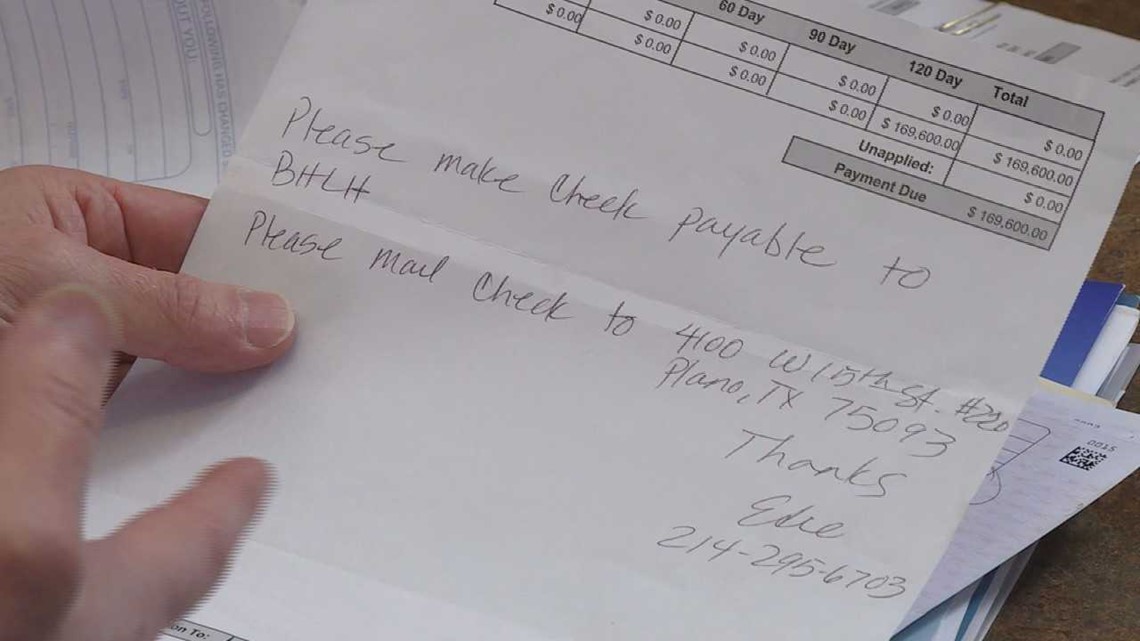

A few weeks later, however, it all started to make a bit more sense when a bill arrived in the mail. BHLH LLC. wanted $169,600.

The bill, sent from a P.O. Box in Osakis, included a hand-written entry that asked the Altmans to forward the UnitedHealth check to a business address in Plano, Texas.

“Please make check payable to BHLH,” wrote a woman named “Edie.”

“Who is Edie?” I asked the Altmans.

“We don’t know,” replied Dave.

“Who are any of these people?” I asked.

“We don’t know,” replied Dave.

What is IONM? 9NEWS Chris Vanderveen explains.

What they did know was that the money was meant to pay for something known as intraoperative neuromonitoring. We’ll talk about what that is in a moment.

But first let’s get into a bit of a side note here, if only for clarity sake.

It’s not unusual for insurance companies to forward money to patients in order to pay out-of-network claims. In this case, BHLH was not in network with United, and thus it had no contract to help facilitate a payment.

Instead, United forwarded its payment to the Altmans with the assumption that the Altmans would simply forward the funds to the biller.

So let’s get back to the bill itself.

What exactly is intraoperative neuromonitoring (or IONM, for short)?

While it sounds complicated and relies on some fairly fancy equipment, IONM is relatively simple in its intent.

Using IONM, a typically off-site neurologist can monitor readings taken inside an operating room and help alert the surgeon if he or she is coming close to doing any long-term damage to the patient’s nervous system.

In other words, it can be very important during some surgeries.

In 2014, a national study found IONM can, on average, add $3,000 to $4,000 to the cost of a surgery. So why did Debra’s IONM cost so much more?

And who was in charge of BHLH LLC. and its IONM company South Downing LLC.?

While finding an answer to that first question has proven tricky, the answer to the second one can readily be found in Colorado Secretary of State records.

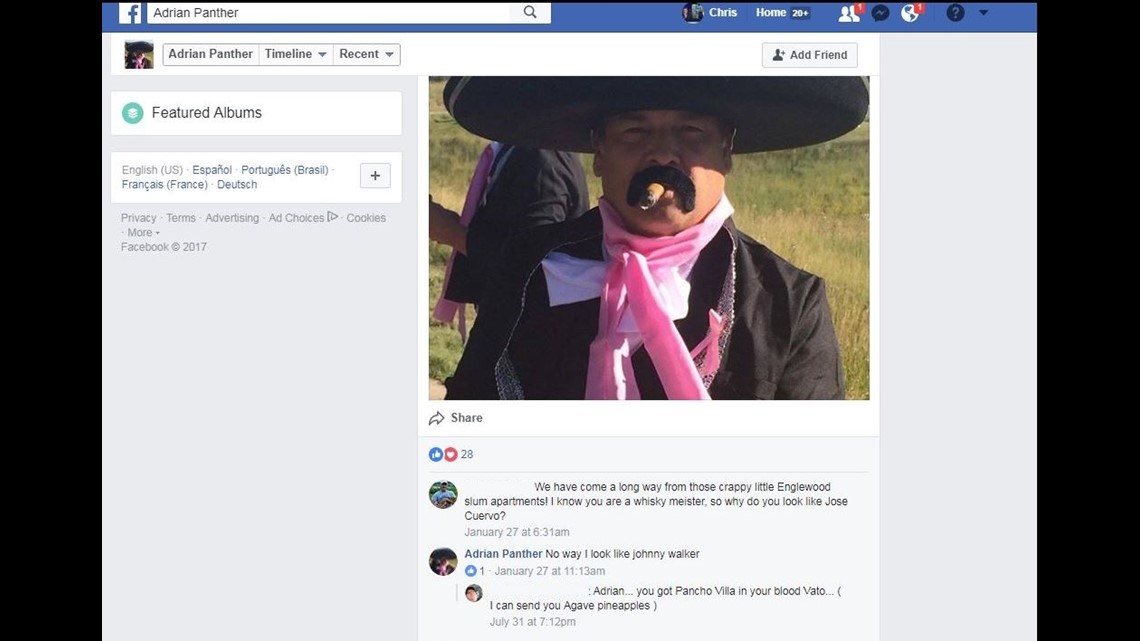

In Colorado, both BHLH and South Downing are registered to a man named Adrian Panther. Panther, a part-time resident of Colorado, devotes a good portion of his time these days running Panther Distillery in Osakis, Minnesota.

His website proudly proclaims, “In 2011, Adrian Panther set out with a simple idea: bring great spirits to Minnesota. Adrian has always been an entrepreneur and a whiskey aficionado.”

His Facebook profile highlights a picture of him with a cigar in his mouth. A friend suggested he looked like Jose Cuervo.

“No way. I look like Johnny [sic] Walker,” replied Panther.

'We have no intention of keeping the money'

$169,600 is the kind of money that could change a life.

From the moment we met him, Dave Altman insisted he never intended on spending a dime of it.

“It’s just sitting in our bank account - just segregated. Waiting,” he told me during our first meeting in April. “We have no intention of keeping the money.”

What he did want was a better explanation of what led to the charge in the first place.

We wanted the same.

So we turned to a local IONM company based for the last 11 years in Colorado Springs. With the permission of the Altmans, we sent Debra’s surgical and IONM records to IntraNerve IONM. After having the company’s billing manager review the case extensively, IntraNerve’s Vice President of Clinical Operations Ryan Rosenhahn gave us a figure.

$7,858.

“Now this doesn’t mean we would collect on the billed charges,” he said. Due to the nature of insurance reimbursement, Rosenhahn would have expected to collect around $2,750.

Medicare would have paid no more than $2,000 for the same IONM procedure.

“Are you surprised that an insurance company would pay more than $169,000 for this?” I asked Rosenhahn.

“We were blown away,” he replied. “In our opinion, there’s never a procedure for intraoperative neuromonitoring for that big of a bill.”

So we asked United why it decided to pay 100 percent of the billed charges.

“Chris, I can tell you the charge was not fraudulent,” replied United spokesperson Will Shanley. “The member has received the funds necessary to reimburse the health care professional for the requested amount.”

Shanley would not elaborate as to why United paid so much other than to add that United, like all insurance companies, encourages all providers to enter into contracts in order to prevent unexpected, out-of-network charges.

This is where we reintroduce Adrian Panther, the Minnesota whiskey distiller and head of BHLH.

9NEWS repeatedly tried to get ahold of Panther for many months. We called his distillery. We called “Edie” in Texas.

We went by a number of addresses once tied to him in Colorado.

Finally, in August, we got a response.

Not from Panther, per se, but from his Denver-based attorney.

On August 15, Kate Bailey, an Associate at Messner Reeves LLP, sent me an email that stated, “We are aware of a former patient who is improperly withholding funds in the amount of $169,000 and we are handling that matter through the proper forums.”

That same day, Bailey sent David Altman a letter demanding “IMMEDIATE RETURN OF CHECK.”

Her letter suggested Dave was illegally holding onto money that was not his.

“Such acts bear on extortion,” wrote Bailey.

Six days later, Bailey wrote the following to me:

“We do appreciate your interest in Mr. Panther’s business, and would like you to receive unbiased information. We are however concerned with the likelihood that a camera interview may turn into an ambush or allow the opportunity for information to be taken out of context. To alleviate this concern, we are requesting that you submit, in writing, the questions that you intend to ask and we will provide written responses. If you would still like a camera interview after that, Mr. Panther’s lead counsel, Mr. (Bruce) Montoya, would be happy to participate in an interview.”

While it is the policy of 9NEWS to never submit specific questions in advance of an interview, I did tell Bailey that I wanted to discuss the general range of charges for IONM procedures and under what circumstances an IONM procedure could lead to a six-figure charge.

A week later, Bailey said there would be no on-camera interview.

“We will not put our client or ourselves in a position to be steamrolled or vilified; nor do we think that it is helpful for anyone to have Mr. Panther speak for an industry in which he is barely a participant,” wrote Bailey.

We also reached out to the surgeon who ordered the IONM procedure from BHLH, Dr. Scott K. Stanley, as well as Dr. Bruce Katuna, the neurologist who performed the IONM.

Neither returned repeated calls asking for comment.

To this date, I still do not know why Panther’s BHLH charged so much for the IONM.

Of course, we are still willing to listen to any and all explanations, and so I encourage him or anyone else with knowledge about this to email me at chris@9news.com.

'It's just easier to write the check'

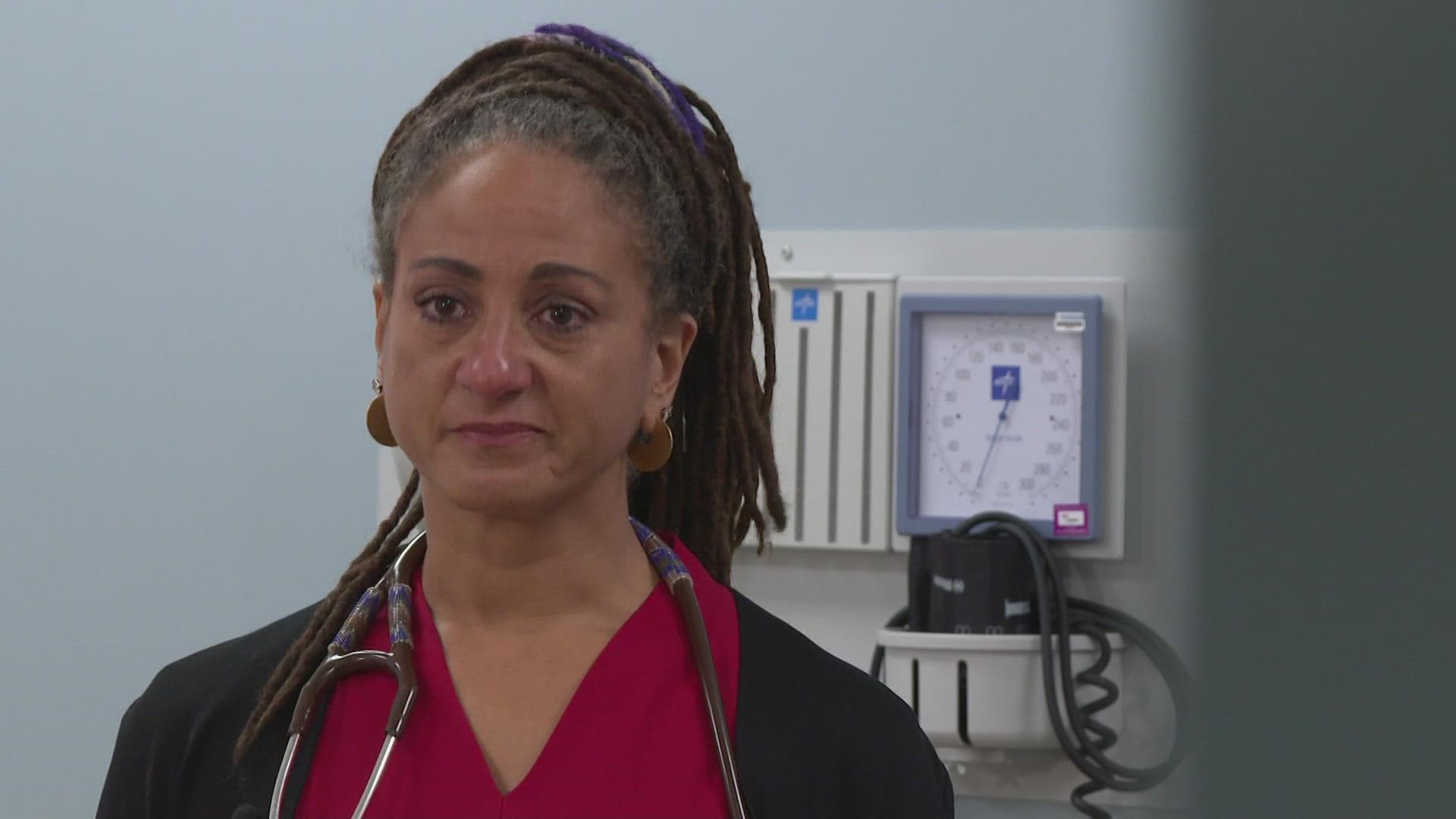

Elisabeth Rosenthal has spent the better part of the last decade documenting medical billing practices for the New York Times. Recently, she authored “An American Sickness” and became Editor-in-Chief of Kaiser Health News.

She said the story of the $169,600 check is a story of the American health care system as a whole.

“(Out-of-network providers) can try to charge whatever they like - the problem is every once in a while they’re going to get away with it, and that incentivizes them to try and try again,” she said.

I asked her why United appeared so willing to pay the cash in the first place.

“As long as it happens every once in a while, it’s easier to just write the check,” she said. “Sometimes it’s just too much trouble to investigate.”

In 2016, UnitedHealthCare reported more than $184 billion in revenues.

When dealing with that kind of money, $169,600 represents less than a drop in a bucket as big as a swimming pool.

Odd thing is, a few months ago, Altman decided the legal threats had grown too intense for him to keep fighting the fight.

So he sent the check back to UnitedHealth. He was done with it.

And that’s when United did something Dave Altman didn’t quite expect.

United sent every one of the $169,600 back to him.

“I propose that we just return the check to you, which will allow your client to pay the provider,” wrote an attorney for United.

The die had been cast.

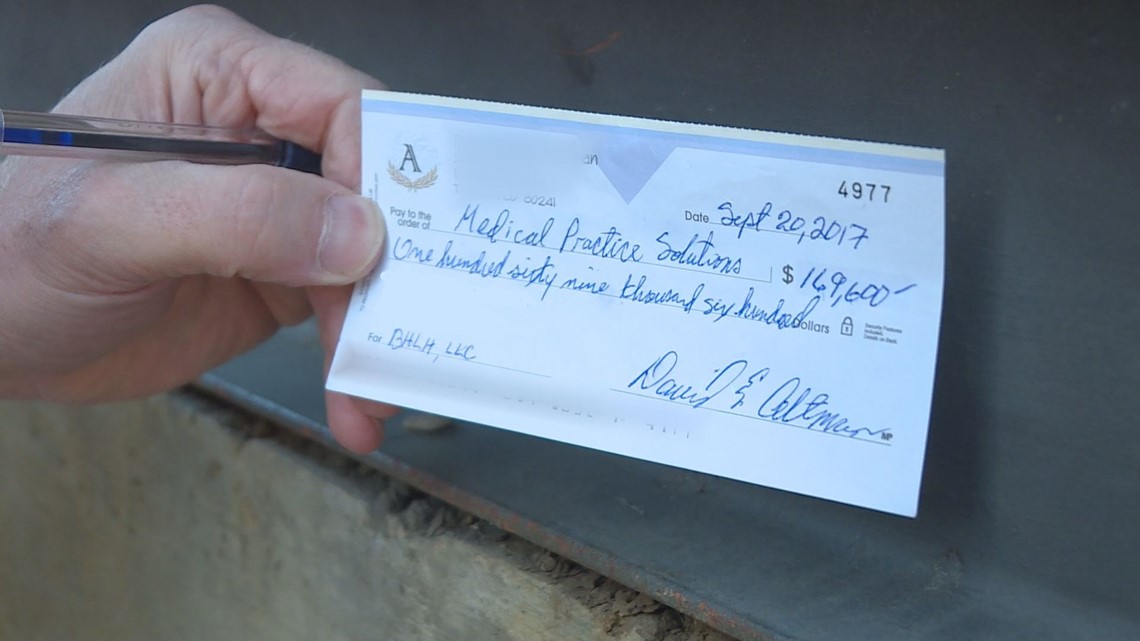

Dave Altman had only one final move to make.

The big check

“It’s not a great feeling,” said Altman as we approached the law offices of Messner Reeves LLP in downtown Denver.

Slowly, he began to write a series of numbers and letters into his checkbook.

“I don’t even know if I can fit in on the line,” he said with a dry smile.

One-hundred-sixty-nine thousand, six hundred and no dollars.

More than nine months after he received the massive check from UnitedHealth, Altman had come to the conclusion this was no longer a battle he was willing to fight.

“It just infuriates me,” he told me. “Nobody wants to say, ‘Stop! This shouldn’t happen.’”

Minutes later, we took the elevator and walked into a large, well-furnished law firm. This is probably the time to tell you that in addition to Dave Altman’s real check, we also arrived with a large, oversized novelty check in hand as well.

You know, the kind of check you might see when someone wins a lottery or something like that.

“Is Kate Bailey here?” I asked.

“Is this for real?” asked a woman at the front desk.

“This is for real,” I replied.

Unfortunately, that day Kate Bailey was apparently not in.

Bruce Montoya, a partner at Messner Reeves was, however.

Initially, he approached us with a big smile on his face.

“That’s too funny, that’s too funny,” he said.

I then asked him a question.

“Can somebody tell me why it’s $169,000?” I asked.

“No idea,” replied Montoya.

“No Idea whatsoever?” I asked.

“Attorney-client privilege,” he said.

“Any idea what an IOM procedure might cost?” I asked.

“Attorney-client privilege,” he said as he walked away.

Hours later, Kate Bailey emailed me.

Here is her email in its entirety:

“Dear Mr. Vanderveen,

I was out of the office today when individuals presumably from your office appeared to present a Publishers Clearing House style-check for Medical Practice Solutions. Those individuals were greeted by Mr. Montoya under the false representation that you were clients of mine, which, to my knowledge, violates any journalist code of ethics to which I presume you adhere.

Be aware that the check was delivered only after several back and forth discussions with Mr. Altman in which he attempted to negotiate retaining a piece of the check. A check that he was not entitled to for services that he did not perform. That attempt was both extortionist and his withholding of those funds constituted civil theft. Perhaps that is where you should focus your inquiry.”

Here is my response, again, in its entirety:

“I can assure you at no time did we misrepresent ourselves as clients of yours. I believe your front office staff may have misinterpreted the nature of our visit. We merely came to accompany Mr. Altman as he hand-delivered payment to your office.

That being said, we are continuing our efforts to better understand the billing practices of your client.

To date, we have yet to receive a statement from you or Mr. Panther that might explain why, in this instance, BHLH decided to charge a patient (and thus her insurance company) $169,600 for an IOM procedure.

During the course of our reporting for this broadcast, we have interviewed industry insiders and national experts in an effort to better understand IOM billing practices. What we have found so far tells us that a $169,600 charge falls well outside the established norms within the industry itself. In fact, one Colorado IOM company, after reviewing Mrs. Altman’s bill, told us they would have charged her less than $8,000 for the exact same procedure. A national expert in medical billing literally laughed out loud when I told her what BHLH was asking for in this case.

Here’s where I hope you or Mr. Panther can assist us with an explanation of why this procedure was so costly.

This is your chance to help me understand this before we go to air. As it stands now, neither you or [sic] Mr. Panther has given me an explanation. Minus any additional comment from you, I will [have] little choice but to report on the information as I now have it – information that suggests this particular charge falls well outside established norms.

Our story will be naming not only Mr. Panther, BHLH and South Downing, but it will also be naming you and your law firm. Should you or Mr. Panther choose not to respond to this email with a detailed explanation (our preference would be an on camera explanation), we will be obliged to report that both you and Mr. Panther refused comment.

As always, I can be reached directly on my cell or via this email address. I look forward to hearing from you.”

That email was sent more than six weeks ago.

We have yet to receive a response.

For more tips on this or any other story, contact Chris Vanderveen: chris@9news.com, Katie Wilcox, katie.wilcox@9news.com or, for those in Minnesota, Steve Eckert, seckert@kare11.com