Patients who have health insurance are billed differently than people without insurance by healthcare providers, and some have discovered that their insurance doesn’t always get them the best deal.

9Wants to Know asked you to Show Us Your Bills – and some of bills revealed that the negotiated rate with insurance can be higher than the exact same bill if the patient does not have insurance.

“I just am curious about what I am paying insurance for? What am I getting out of it if the uninsured are getting a bigger discount than I am?” said Bailey McHugh of Aurora.

McHugh went to a freestanding emergency room in January to get treated for severe stomach pain. About three months later, she received a bill for $1,273. The bill stated her insurance was paying nothing.

“I thought it was a little much, but then I realized it was without insurance,” McHugh said. “So I called up my insurance and filed a claim immediately to help me pay for it and help minimize the cost.”

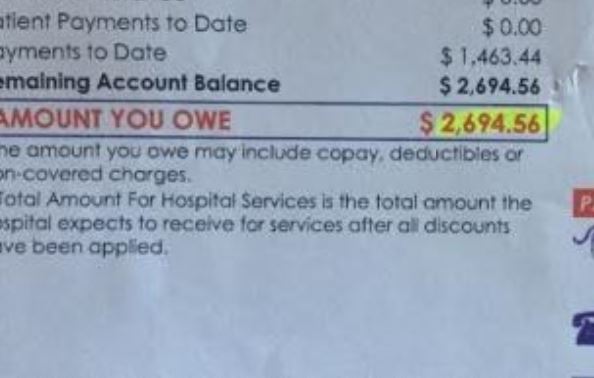

But the cost wasn’t minimized. McHugh received a second bill about a month later, and she now owed $2,694.56, even after her insurance kicked in.

“I was very confused about where these numbers came from,” McHugh said.

She’s not the only one.

In a similar case, Jane Bayer knew she needed an MRI for her knee. She called a local imaging center to ask what she would pay with her insurance. She was told she would owe $682 toward her deductible.

“After I hung up the phone I just decided to try calling back just a few minutes later and just see what the same procedure was going to be if I just paid out of pocket without insurance,” Bayer said.

She was told she would only have to pay $450 to $232 less than if she used her insurance.

“I felt like I was being taken advantage of because I’m paying hundreds of dollars in health insurance every month thinking that I am going to be getting a better rate,” Bayer said.

"What you're encountering is all of the places where it doesn't quite work right,” said Michele Lueck, president and CEO of the non-partisan Colorado Health Institute. “You’re seeing a cost shift – you’re charging some people extra money to cover or offset the costs of people who are not covering the costs of their own care.”

In healthcare, those who do not have any insurance, the “uninsured,” are generally considered less able to pay their bills. Since people without insurance tend to have less money – they are billed at a lower rate. There are laws that set limits on what hospitals and other care providers are allowed to charge the uninsured.

People with insurance are considered more able to pay, and thus are asked for more money.

This is how a spokesperson for HealthONE, Laura Stephens, described it in an email regarding Bailey McHugh’s situation:

“As is standard across the hospital industry, we work with our patients on their hospital bills, whether it’s through negotiated rates with their insurance providers (which may vary from insurance plan to insurance plan), a discount, payment plan or other means. Our assistance is provided to the uninsured too. We collect very little from uninsured patients, therefore a pricing discount offered to them is intended to recoup at least some portion of the cost of the care we provide, versus not being able to collect anything.”

Lueck said it’s still important to have insurance. Insurance pays for care over the entire year, and when bills for major health events, like surgeries and long-term care, pile up – it’s critical to have coverage.

In the short-term, Adam Fox, with the Colorado Consumer Health Initiative, said this system doesn’t make sense, and really doesn’t work for patients.

“It doesn’t make sense that the hospital is able to first offer one price and then all of a sudden switch the costs once they know that the person has insurance,” Fox said. “It makes it incredibly hard for consumers to navigate and they are often receiving bills that don’t explain any of it.”

For the most part, he said, patients are on the hook for the costs.

“Consumers end up paying these bills because they don’t fight back,” Fox said.

Bailey McHugh did fight back, and after 9Wants to Know reached out to HealthONE with regards to the increased charges, McHugh was given a discount of about $2,300. Since launching the Show Us Your Bills campaign, 9NEWS has helped consumers save more than $155,000 on medical bills.

For more tips on this, or any other story, contact 9Wants To Know producer Katie Wilcox: katie.wilcox@9news.com or 303-871-1725