DENVER — Melody Montano did everything right. She had insurance and chose an in-network hospital.

Three years, a lawsuit, a property lien, and thousands of dollars of wage garnishments later, the single mother can’t help but wonder if anyone is looking out for patients like her.

“It affected a lot,” she said, fighting back tears. “It affects your whole life. It affects your credit. It affects everything.”

A six-month 9Wants to Know investigation found she’s hardly alone. Surgeons working on-call shifts at various Denver-area hospitals are aggressively trying to collect unpaid bills by placing liens and garnishing wages of former patients.

The surgeons do it while working in hospitals that are largely unwilling or unable to curb their billing habits.

Among the findings:

- Existing Colorado law has done little to protect patients who go to hospitals in-network with their insurance from receiving surprise medical bills from out-of-network providers working in those hospitals.

- One Colorado collections company, with a history of collecting debt owed to a small group of surgeons, has placed more than 170 liens on Denver-area homes since the start of last year.

- Liens have been placed on the homes of patients who have received care in at least eight Denver-area hospitals.

- Debts owed to out-of-network surgeons frequently range from $2,000 to $10,000.

- After reviewing the results of the 9Wants to Know investigation, a Colorado company that represents numerous surgeons agreed to tell its collections company to stop pursuing liens against its patients.

Montano called her ordeal a cautionary tale for any one of the millions of Coloradans who believe their insurance plans will adequately cover them in the event of an emergency.

“You don’t ask as you’re being wheeled into the operating room, ‘Oh, are you in network with my health insurance?’” she said.

“This isn’t fair.”

SURPRISE! YOU’VE GOTTEN A BALANCE BILL!

Montano sifted through the pile of paperwork on the kitchen table of her Aurora home. Somewhere within a stack nearly a few dozen pages high, she found something of importance.

It was her Explanation of Benefits. Lots of people call it by the acronym EOB. Hers came from her insurance company, Cigna.

An EOB explains to a patient what the insurance company is willing to pay a medical provider and what the patient might expect to personally pay for the same procedure.

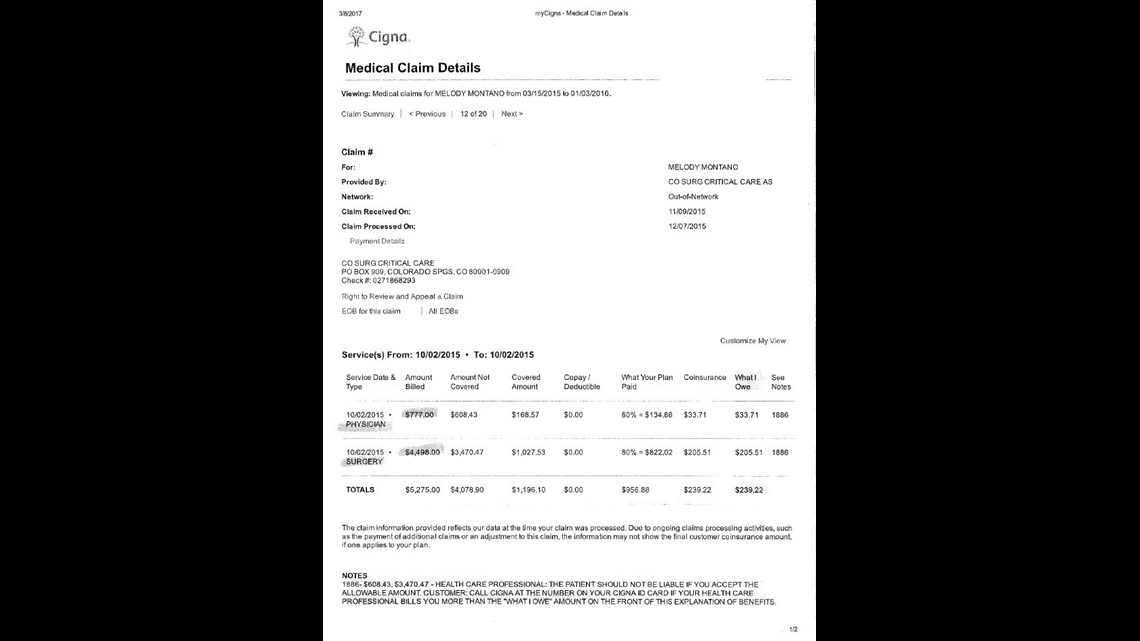

In the case, her EOB told her an on-call surgeon working for Colorado Surgical and Critical Care Associates had filed a $5,275 claim with Cigna for her 2015 gall bladder removal at Parker Adventist Hospital.

As is customary in the strange world of health care billing where charges almost always far exceed what’s actually paid, Cigna ended up paying the surgeon $956.88 and then expected Montano to pay $239.22 as part of her plan’s coinsurance.

Basically, Cigna expected the surgeon to be paid a total of $1,196.10 for the surgery.

To put that into perspective, a national database of insurance claims known as Fair Health reports the average in-network payment for the surgery would be $1,233.

Medicare would have paid no more than $900.

In other words, the expected payment – while not high – was within the realm of realistic in-network reimbursement.

At the bottom of Montano’s EOB, Cigna informed Colorado Surgical and Critical Care Associates Montano “should not be liable” for any additional amount.

There was just one problem.

While Parker Adventist had a contract with Montano’s insurance, Colorado Surgical and Critical Care Associates did not. It’s common practice for surgeons and medical technicians to work in hospitals without being hospital employees. Think of them like subcontractors ... and because of that they aren’t subject to the same contractual relationships with insurance companies.

Those doctors and technicians are thus free to accept – or not accept – whatever insurance plans they choose, and as out-of-network providers. they also are free to ask for more when they believe an insurance company hasn’t paid them enough.

It’s precisely what happened to Montano.

Colorado Surgical and Critical Care Associates still sent Montano a bill for the unpaid balance of its original $5,275 charge.

It’s called a balance bill. Some call it a surprise bill. (Legislators passed a law in 2006 trying to curb the practice, but for reasons we will outline later it isn’t working very well.)

When Montano refused to pay the bill thinking that Cigna’s assurance on the bottom of the EOB was enough, Colorado Surgical and Critical Care Associates used a small collections company out of Colorado Springs to sue Montano for thousands of dollars.

Credit Systems Inc. won a judgment against Montano in Arapahoe County Court and, on June 23, 2017, it placed a lien on her home.

Think of a lien like a legal claim to a property that compels the owner to pay off a debt before selling or refinancing. It’s commonly used to try to collect unpaid taxes or child support.

Liens give unpaid creditors the first crack at proceeds from a sale.

As we found, it’s also a way to get patients to pay bills to surgeons they never chose.

In Montano’s case, she had no idea that a Colorado Surgical and Critical Care Associates surgeon would ultimately be the one responsible for removing her gall bladder. No one at the hospital bothered to explain that any of the company’s surgeons had no contract with her insurance as well.

RELATED | You have no obligation to pay these medical bills (but you can still get them in the mail)

A spokesperson for Colorado Surgical and Critical Care Associates – or CSCCA – declined a 9Wants to Know request for an on-camera interview, but he did send us a statement saying, in part, the company has now told its bill collectors to no longer pursue property liens after learning more about Montano’s case.

“From now on, we will instruct any collection agency to which any of our patients are referred to never proceed with in-court pursuit of our patient’s debts that might result in a judgment against them such as has occurred with Ms. Montano,” read the statement from CSCCA. “Such legal action against our patients is inconsistent with our mission or providing high quality, compassionate emergency surgical care for the communities we serve.”

The company has yet to respond on whether or not it will reimburse Montano for her lost wages due to garnishment.

“That’s what they’re allowed to do.”

In 2016, Emmett Malone went to Swedish Medical Center knowing something was wrong. The pain in his lower abdomen was brutal, but it wasn’t too bad to stop him from taking his UnitedHealth insurance card out of his wallet.

“I just gave them my insurance, and everything checked out,” he said.

Swedish was in-network. He assumed everything that happened from then on out would be covered.

It wasn’t. At the time, no one told him the surgeon prepping to remove his appendix had no contract with UnitedHealth.

“At least nine months later, I get this bill for like $3,300,” he said. “Apparently the doctor who performed the surgery was out-of-network.”

Malone refused to pay it.

A year later, Credit Systems Inc. placed a $3,767.95 lien on his Englewood home. Credit Systems wanted not only the balance of the surgeon’s bill, it also wanted interest.

“Apparently that’s what they’re allowed to do,” said Malone.

9Wants to Know found, since the start of last year, Credit Systems Inc. has placed more than 170 liens on Denver area homes.

We tried to contact as many property owners as possible to better understand why the lien was there in the first place.

At least two people had no idea the liens were even in place.

The liens ranged in amounts from a few hundred dollars to more than $10,000. Among the patients who agreed to speak with us, we found liens associated with unplanned surgeries done by out-of-network surgeons inside Swedish Medical Center, Medical Center of Aurora, North Suburban Medical Center, Parker Adventist, Sky Ridge Medical Center, Castle Rock Adventist, and Porter Adventist.

Our dozens and dozens of calls led us to people like Lorren Fay.

“So, we went to Sky Ridge (Medical Center),” Fay said from his home in Highlands Ranch.

9Wants to Know asked him what he thought when we contacted him.

“I couldn’t believe it. I about fell over,” he replied.

His story mirrored Malone’s.

“I was having a really, really intense abdominal pain,” he said. When he arrived at Sky Ridge, he said, he still had the wherewithal to say something to the hospital’s staff.

“I want everyone in network,” he said. “I said it to almost everyone who came in the room.”

A few months later, he found out the bad news.

“The surgeon was billing out-of-network,” he said.

In September of last year, Credit Systems placed a $6,49.87 lien on his Highlands Ranch home.

Nicole Briggs went to Swedish Medical Center for an appendectomy in 2016.

A bill from Dr. Emmett McGuire, the surgeon who removed her appendix, resulted in a $5,802.08 lien on her Morrison home in April of this year.

Dr. McGuire declined our request for comment and referred us to a spokesperson at the hospital.

The spokesperson also declined to comment on Dr. McGuire’s billing practices because he is not a hospital employee.

Numerous calls to Credit Systems Inc. have gone unreturned.

“The whole system is crazy”

Colorado legislators passed a law in 2006 designed to protect patients from balance billing practices. W

hile complicated, the law generally agrees to hold patients “harmless” when it comes to paying out-of-network providers who work emergency cases inside otherwise in-network facilities.

In theory, patients should not be held responsible for out-of-network balance bills when they visit a hospital ER that’s in-network with their insurance.

It was designed to protect patients just like the patients contacted by 9Wants to Know.

It’s falling far short of that goal.

Take Malone’s case as an example.

Credit Systems sued him last year for the balance of the surgeon’s bill left unpaid by his insurance company.

A Douglas County judge ruled against Malone in August last year, and the collections agency placed a lien on his home.

When 9Wants to Know contacted him over the summer, Malone was exasperated.

“This whole system is crazy,” he said. “You have insurance. You have an emergency. It should be taken care of.”

It wasn’t. 9Wants to Know found it should have been because of his insurance plan.

One of the 2006 law’s main shortcomings is that it only applies to Coloradans who have insurance plans regulated by the state of Colorado.

Most plans offered by employers here are federally regulated and thus not subject to state regulation.

The easiest way to tell if your plan is covered by the 2006 law is to look at your insurance card. If it’s a state regulated plan, it will have a “C-DOI” or “DOI” printed on it. C-DOI stands for the Colorado Division of Insurance.

Malone never noticed the DOI on his card until 9Wants to Know asked him to look for it.

Once he found it, 9Wants to Know told him he could file a complaint with the Colorado Division of Insurance.

He did just that, and a few months later a representative with the Colorado Division of Insurance notified him that his insurance company would pay the rest of the surgeon’s bill.

Let’s recap.

Malone went to an in-network hospital, received an out-of-network bill, was sued by a collections company, lost in court, and received a lien on his home.

And only after all of that did the Colorado Division of Insurance notify him that he should have never been responsible for the debt.

The problem, at least in part, lies in the fact that the 2006 Colorado law does not forbid providers from sending balance bills to patients.

Lacking any legal requirement not to send balance bills, doctors – and the collections companies they utilize – are then free to sue patients, place liens, and garnish the wages of people who are potentially unaware of the minimal protection afforded them under the 2006 law.

“I have said that – as an attorney – if I sent bills like that to people I know who didn’t owe them, I would be disciplined by my profession,” said attorney and Colorado State Senator Bob Gardner (R-Colorado Springs).

“Consumers are the ones who are really hurt by this,” he said. “It’s unjust.”

He’s contemplating sponsoring a new round of balance billing legislation early next year.

If this has happened to you, email 9Wants to Know at showusyourbills@9news.com