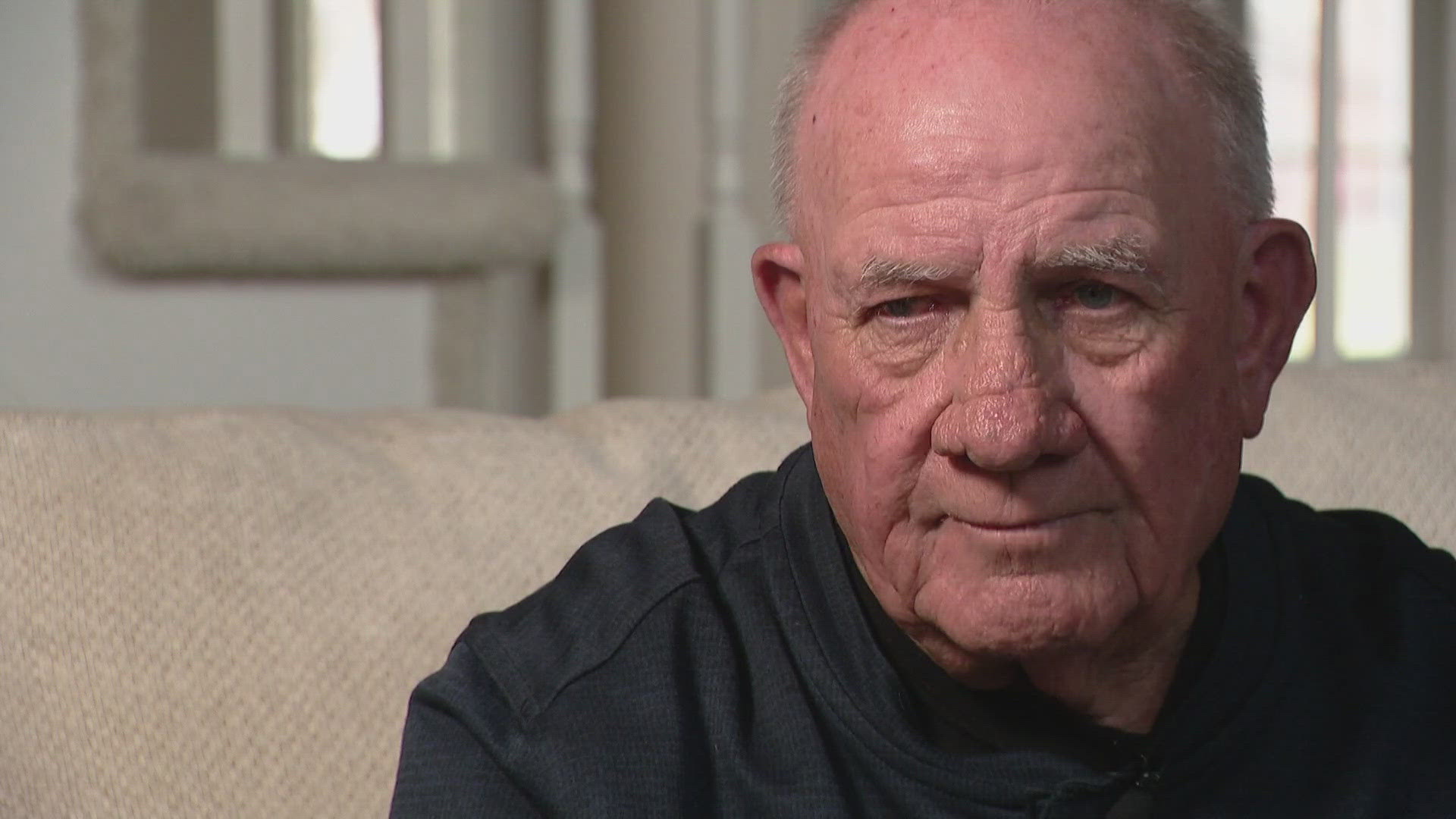

AURORA, Colo. — The letter Milt McMinn opened earlier this year brought terrible news to a father who had thought he’d become accustomed to terrible news.

“I frankly couldn’t believe it,” Milt said. “I didn’t know what to think.”

Seven years after a disgruntled customer shot his son in the face inside an Aurora car repair shop, the letter informed Milt that most of the money that had been set aside to care for his son was missing under what the letter called “unusual circumstances.”

“There are a lot of people who have a ton of questions,” Milt said.

At the center of those questions is a now bankrupt entity known as the Center for Special Needs Trust Administration. Known simply as “the Center”, the Florida-based nonprofit once held, as a pooled trust, the funds of more than 1,000 families caring for loved ones with unique needs.

Court records show more than $100 million from the trust is now missing. That’s roughly half of the amount the Center had amassed since its founding more than two decades ago.

“This trust isn’t for wealthy people. It’s not a trust for people buying yachts. It’s set up for people in situations like my son that really need the money just to survive,” Milt said.

Chase McMinn, 47, suffered critical injuries in 2017 when a man, upset that employees inside an Aurora auto repair shop had refused to work on his car, returned to the shop and shot Chase in the face.

Chase requires a constant level of care. Years ago, through a pair of settlements with insurance and workmen’s compensation, Milt secured six figures to help provide long-term care for his son.

“The defendants insisted that we use [the Center for Special Needs Trust Administration] in 2019,” Milt said. At the time, unbeknownst to Milt and his attorney, the Center had already loaned its founder, according to bankruptcy filings, more than $100 million.

In addition, according to court records, those loans had started to come due in 2017. There had been “no meaningful attempt to repay” those loans, according to a filing.

At the center of this is the Center’s founder Leo Govoni who loaned the money to himself, court records say. Attempts to reach Govoni by our sister station in Tampa, Florida, have gone unanswered.

“From the outside looking in, everything looked legitimate,” said Thomas Leeder, a Florida-based attorney.

But, from the inside looking out, the Center had massive problems.

“It’s disgusting what happened. It should not have happened, and the only reason this can happen is that we have no oversight whatsoever,” Leeder said.

Contact chris.vanderveen@9news.com if you have been impacted by the bankruptcy declaration by the Center for Special Needs Trust Administration.