DENVER — Jeff Desserich left UCHealth’s Ear, Nose and Throat Clinic expecting to pay a few hundred dollars for the 15 minutes it took for a nurse practitioner to pry loose the remaining bits of earwax that still lingered in his ears.

Months later, he’s on the front end of a $100-a-month plan to pay off what now amounts to an $1,800 bill for the simple procedure.

What the high school teacher has learned will almost certainly fuel a day’s lesson in his financial literacy class. What 9NEWS Investigates has learned should also fuel a discussion in your household about what can happen when you seek medical care within a system that struggles to fairly bill patients.

“It’s very frustrating,” Desserich said.

If he could go back in time, he said, “I would not have done it.”

9NEWS Investigates, with Desserich’s permission, sent the details of his earwax removal to three medical billing experts. All three agreed the bill was absurd.

“It’s a ridiculous price,” said Patrick Haig, the CEO of Goodbill.com, a Washington-based organization that helps patients fight incorrect billing practices.

“It’s outrageous,” said Cynthia Fisher, founder of PatientRightsAdvocate.com, a nonprofit that advocates for healthcare price transparency.

“It’s totally obscene,” said Adam Fox with the Colorado Consumer Health Initiative.

It’s also, Haig said, not terribly unusual.

“That’s what’s pretty terrifying is that these are pretty ordinary, run-of-the-mill American hospital bill cases,” he said.

Why?

Well, for starters, let’s look at the details of Desserich’s bills from UCHealth.

The first bill he received was for $502. At first, Desserich assumed that was the only bill he would receive.

“I thought, dang, this is the worst-case scenario,” he said.

A few weeks later, his scenario got even worse. That $500 bill was merely for the professional side. Basically, it was the bill to pay the person – a nurse practitioner in this case – to remove the earwax.

That’s common in the world of medical billing.

“Typically, when you go to a hospital you’re going to get two bills. You’re going to get the physician bill – or the professional bill – and you’re going to get the hospital bill,” Haig said.

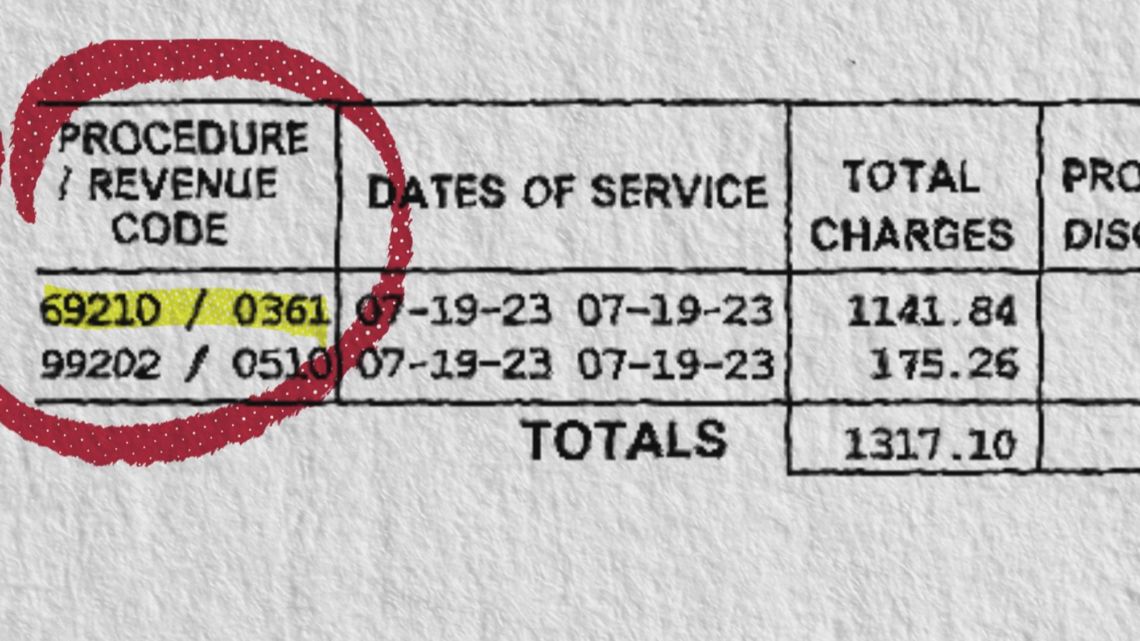

Desserich’s second bill included two lines – each coded with distinct codes – for the procedure.

The first code was 69210. That’s for “removal of impacted cerumen (earwax).” UCHealth billed Desserich $1,141.84 for that.

For comparison sake, government-run Medicare would have paid around $57 on a 69210 claim.

The second code was 99202. That’s the code for an “office or other outpatient visit for the evaluation and management of a new patient.” UCHealth billed him $175.26 for that.

That’s what brings the entire bill above $1,800.

UCHealth, correctly, told 9NEWS Investigates that the amount billed to Desserich was part of a contracted rate it has with Desserich’s insurance, Aetna.

“This is their contract,” UCHealth spokesperson Dan Weaver said. “If you have questions about the amount, please reach out to Aetna.”

We did. Aetna told us, through a spokesperson, “The services billed by the provider who treated the member were repriced at the contracted rates between the provider and the Aetna Network.”

We asked Haig, Fisher and Fox their advice for patients facing big medical bills.

Haig told us:

- Ask the medical provider for a line-by-line itemization of how they coded your procedure.

- Look at your Explanation of Benefits (EOB) from your insurance company to see how your insurance paid (or did not pay).

- Hospital bills are often incorrect. Make sure your itemized statement meshes with what was actually done.

Fox told us:

- Ask to be financially screened. You might qualify for assistance based on your income.

- Look at your EOB and see where your insurance company might have paid (or not paid). Work with the insurance company when it comes to appealing insurance decisions.

- File a complaint with the Colorado Division of Insurance (for insurance company mistakes/errors) and/or the Colorado Department of Public Health and Environment (for hospital mistakes/errors).

> SHOW US YOUR BILLS: 9NEWS Investigates has spent years looking into medical bills. If you have a bill you'd like to share, email showusyourbills@9news.com.

SUGGESTED VIDEOS: 9NEWS Investigates