NEWARK, N.J. — Two men from Colorado — along with a third California man — were arrested Tuesday in connection with a cryptocurrency mining scheme that defrauded investors of $722 million, according to U.S. Attorney Craig Carpenito.

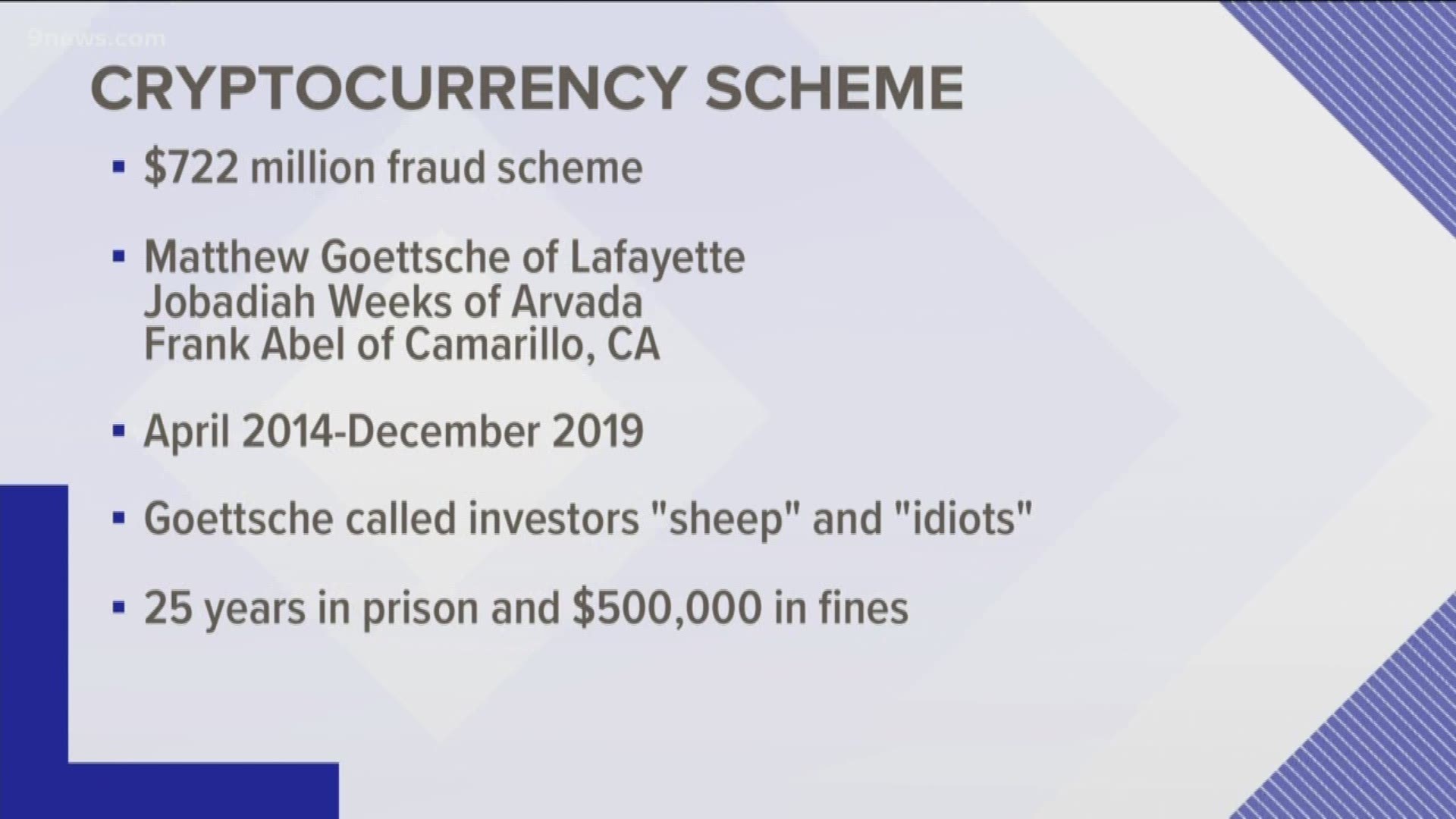

Matthew Brent Goettsche, 37, of Lafayette, and Jobadiah Sinclair Weeks, 38, of Arvada, were charged with conspiracy to commit wire fraud, the U.S. Attorney's Office said.

The two men were also charged with conspiracy to offer and sell unregistered securities along with Joseph Frank Abel, 49, of Camarillo, California.

Goettsche was arrested in Colorado, Weeks in Florida, and Abel in California, the Attorney's Office said. All three are scheduled to have their initial appearances in the districts of their arrests.

Two other defendants remain at large and their identities have not been released.

“The indictment describes the defendants’ use of the complex world of cryptocurrency to take advantage of unsuspecting investors,” U.S. Attorney Carpenito said in a news release. “What they allegedly did amounts to little more than a modern, high-tech Ponzi scheme that defrauded victims of hundreds of millions of dollars. Working with our law enforcement partners here and across the country, we will ensure that these scammers are held to account for their crimes.”

According to documents filed in this case and statements made in court, from April 2014 through December 2019, the defendants operated BitClub Network, a fraudulent scheme that solicited money from investors in exchange for shares of purported cryptocurrency mining pools and rewarded investors for recruiting new investors, the Attorney's Office said.

Goettsche, Weeks and others conspired to solicit investments in BitClub Network by providing false and misleading figures that BitClub investors were told were “bitcoin mining earnings,” purportedly generated by BitClub Network’s bitcoin mining pool. Goettsche discussed with his conspirators that their target audience would be “dumb” investors, referred to them as “sheep,” and said he was “building this whole model on the backs of idiots.” Goettsche directed others to manipulate the figures displayed as “mining earnings” during the course of the conspiracy, the Attorney's Office said.

The wire fraud conspiracy charge carries a maximum potential penalty of 20 years in prison, and a fine of up to $250,000. The conspiracy to sell unregistered securities charge carries a maximum penalty of five years in prison and a fine up to $250,000, the Attorney's Office said.

Anyone who believes they may be a victim may visit justice.gov/usao-nj/bitclub or the Department of Justice’s large case website justice.gov/largecases. There, victims can find more information about the case, including a questionnaire for victims to fill out and submit.

SUGGESTED VIDEOS | Local stories from 9NEWS