DENVER — Colorado Attorney General Phil Weiser announced Thursday that the office would lead a multi-state investigation into the proposed merger between Kroger, which operates King Soopers, and Albertsons, which operates Safeway.

Weiser also filed a brief backing the motion for a preliminary injunction that was filed by Washington's Attorney General.

Oral argument on the motion to temporarily block the dividend is scheduled for Friday, Dec. 9 in King County Superior Court.

“If the special dividend is allowed to be paid out to investors, it would lessen Albertsons’ ability to compete not only during the pendency of the merger review but also in the event that the merger is blocked and Albertsons has to continue on its own,” Weiser said in a press release. “The special dividend also risks devaluing any stores that would be part of a potential divestiture by limiting Albertsons’ ability to make capital improvements to those stores, provide routine maintenance, or even ensure proper inventory. That, in turn, could poison the well for any potential divestiture remedy.”

It's the latest in a seemingly nationwide watch of the merger between the two companies, which operate many stores in Colorado.

A team in Weiser's office is now set to take information from the public, conduct economic analyses of the merger and look at what the legal requirements are when it comes to the merger.

"The reality of this merger is it will affect multiple states. We want to cooperate as we analyze the effects of this merger, not just in Colorado, but across the nation, to make the best case we can to protect consumers," Weiser said.

Weiser also announced that in the new year, he will hold public community forums across the state to listen to Coloradans’ feedback and concerns about the merger.

Meanwhile, nonprofits that host food pantries have been keeping watch on the potential merger, for how it could impact their operations.

Advocates worry that prices could rise or stores could consolidate or close in areas where they're most needed, impacting food deserts.

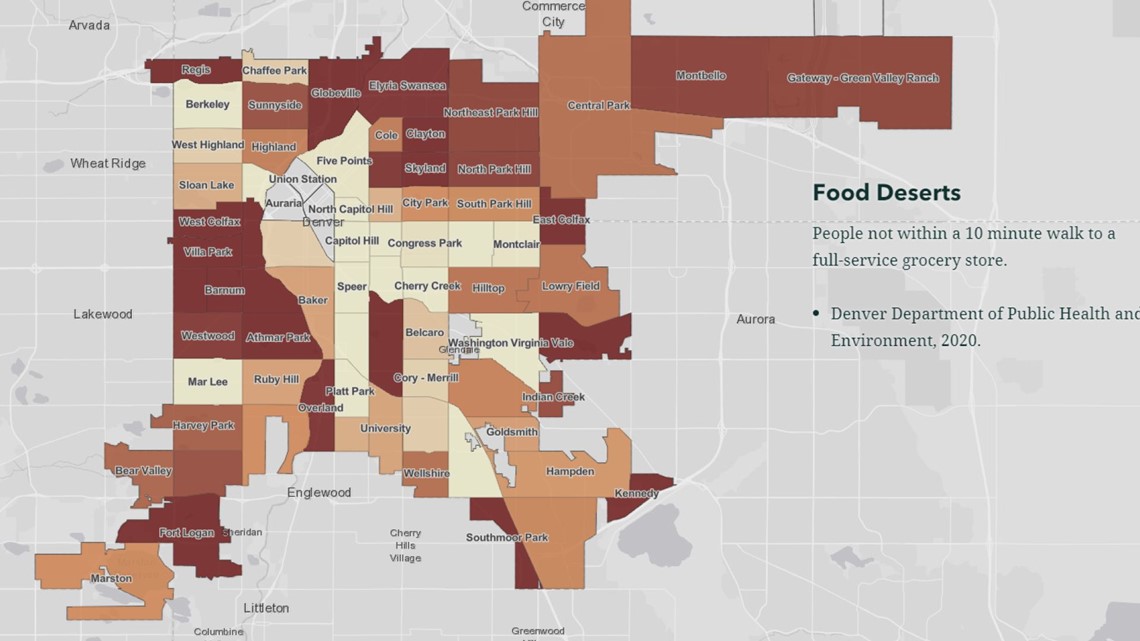

A map on the makeup of food deserts in Denver, published by the Denver Human Services Index, displays which areas see the densest amount of people that live far from a grocery store.

For example, according to the map, which cites data from the Denver Department of Public Health and Environment, 89% of those that live in Elyria-Swansea do not live within a 10-minute walk to a full-service grocery store.

"In the end, you know, if there's consolidation, there's fewer locations. There's more demand for the food at those locations," said Todd McPherson, the development director of Integrated Family Community Services.

Demand for their Englewood-based food pantry has grown ten-fold, he said.

On average they serve between 5,000-6,000 people each month or 1,200-1,500 people a week.

Right now, he believes the makeup of the merger is out of their control, but are ready to adapt as needed if any impacts make it to their operations.

"We want to truly enrich and nurse their lives. And whenever there's uncertainty in different areas and wondering how we're going to brace against those changes. It makes us a little anxious sometimes, too," he said. "And when we're restricted by how much we can give, it kind of makes you feel a little awkward that you would want to do more. But your hands are tied. And you just have to wait until the other shoe drops to kind of see how you brace for the next challenge."

It's been all about adapting to the changing landscape with inflation, supply chain issues and more, he said.

"Well, it's really about doling out the resources that we have. So when things are good and the resources are available, we can give people a whole lot more. They might be coming for four weeks' worth of groceries, whereas if our resources dry up or we need to make pricing changes in our purchasing, then we just have fewer things to give to people," he explained. "We've continued to step out to serve the community and wait for backfill from partners and the community to support us."

Overall, he believes his team will be able to adapt to whatever new environment may come their way if the merger is approved.

"We will be here because we rely on the community to support us," he said.

Weiser referred back to what's considered a failed divesture that was part of Albertsons' merger with Safeway in 2015 when arguing against a $4 billion payout.

"Back then, the Federal Trade Commission required Albertsons to sell off 168 of its stores as part of that merger approval. Haggen, a regional grocer, purchased 146 of the stores. Several months later Haggen went bankrupt after it was stripped of cash due to the payment of a $20 million dividend to its private equity shareholder and accelerating a $25 million loan repayment to that same shareholder. In the end, Albertsons reacquired many of the divested stores at a discount and bought the Haggen brand name, while other stores closed permanently," a press release from Weiser's office explained.

Weiser also said his office can enforce federal antitrust laws on their own outside of the action of federal regulators, referring back to several mergers where he said his office intervened.

It is still unclear if any stores are planned to close or consolidate if the merger goes through.

Kroger and Albertsons both argue that the merger could help customers with things like a broader selection and improved customer experience.

In a press release, it's explained that the merger would lead to an expanded network of stores and distribution centers, as well as a broader supplier base.

SUGGESTED VIDEOS: Latest from 9NEWS