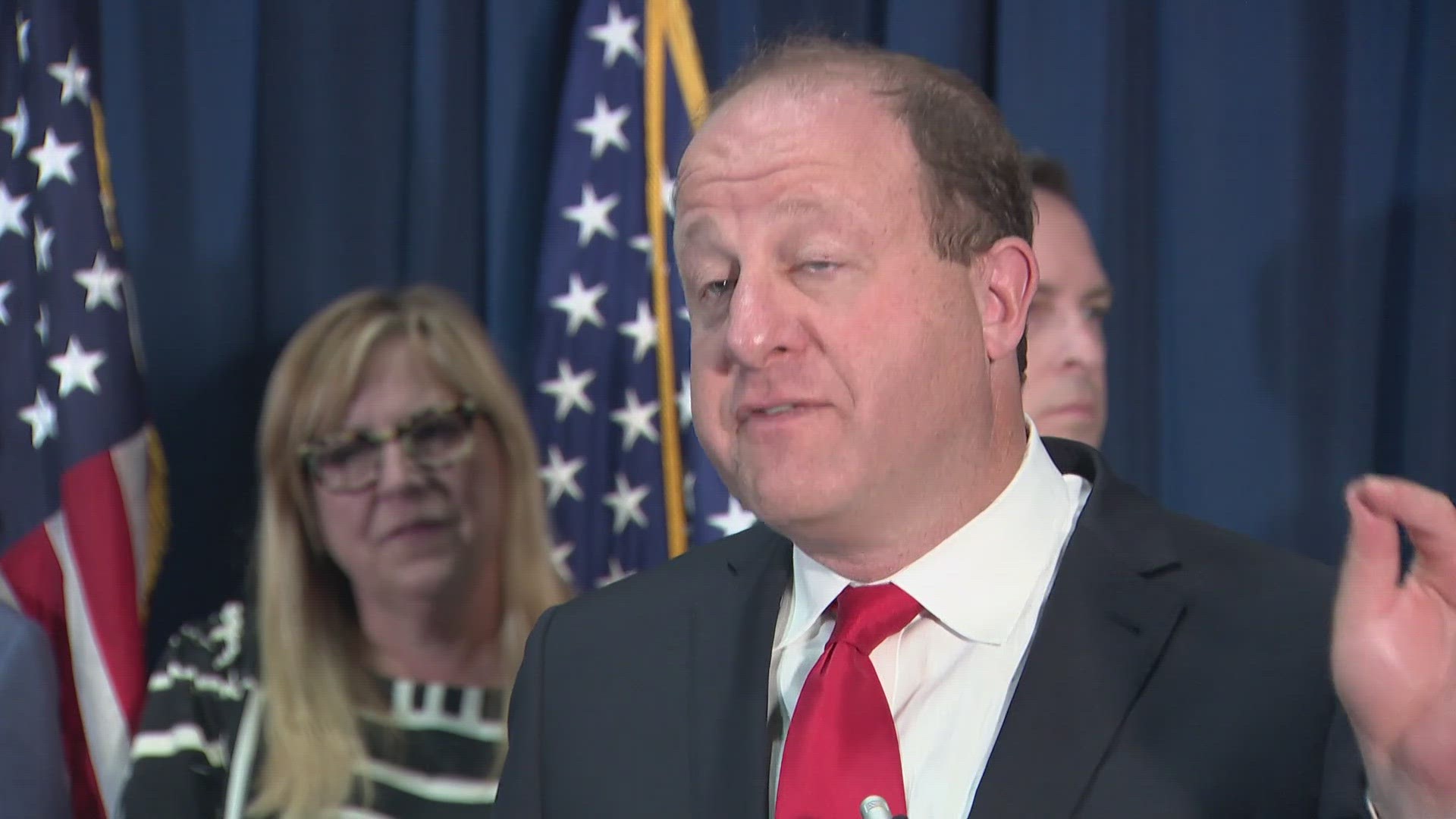

DENVER — Colorado Gov. Jared Polis and state legislators announced plans Monday that they said would help ease property tax increases.

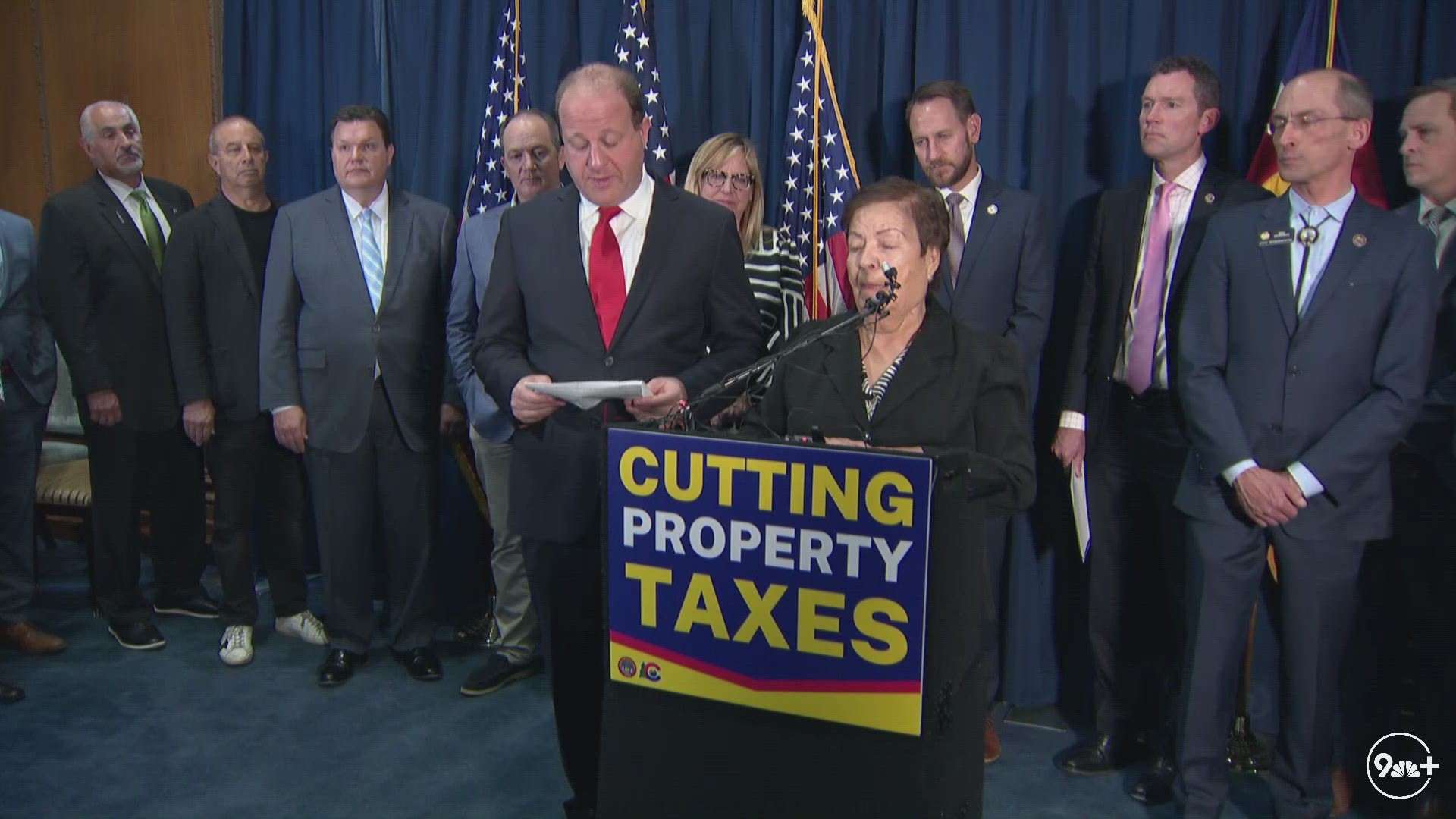

It's an effort that would help homeowners and businesses in Colorado, the governor said. The plan, which Polis said will be on the November ballot as Proposition HH, would reduce the residential assessment rate from 7.15% to 6.7%, and reduce the taxable value of homes by $40,000 in 2023 and 2024. If passed, the taxable value reduction would continue for primary residences in future years, the governor's office said.

The governor said during a news conference Monday that, if approved, the average homeowner in Colorado would see their property tax increases be cut by 50%.

This news comes after nine metro Denver area county property assessors announced last week that property valuations saw a double-digit increase in their biannual assessment.

"Coloradans are about to get hit with painful property tax spikes, which is why we're taking action now to meet the moment and provide real relief for Colorado families," said Colorado Senate President Steve Fenberg, D-Boulder.

Legislators said the proposal would protect funding for schools and use TABOR surpluses to backfill revenues for fire and water districts, and for ambulance and hospital districts that are not growing as fast.

“We recognize that property tax reductions cannot be considered without also accounting for the impacts these cuts will have on local governments,” said Rep. Chris deGruy Kennedy, D-Lakewood. “This bill makes responsible reductions, unlike those proposed in recent ballot measures, and includes provisions to ensure we’re protecting school districts, fire districts, and county child welfare offices while we pass this important measure to help Colorado families keep up with the cost of living."

Douglas County is seeing the largest median residential increase at 47%, and the lowest is 33% in Denver. The metro area also includes Adams (38% increase), Arapahoe (42%), Boulder (35%), Broomfield (41%), Elbert (35%), Jefferson (36.5%) and Larimer (40%).

> Video below: Watch the full news conference:

Polis' proposal also calls for capping growth in district property tax collections, excluding school districts, at inflation and allowing local governments to override the cap after giving notice to property owners. Seniors who currently receive Homestead Exemptions would be able to keep those exemptions, no matter if they move, according to state legislators.

Property assessments, which are done every two years, are one piece of a three-part equation used to determine state property taxes.

The other two core components are the assessment rate determined by the state legislature, and the tax rate (or mill levy) set by various local authorities. Residents will not know the amount due for 2024 property taxes until the end of 2023, when the tax and assessment rates are set.

Assessors observed transactions and market conditions from Jan. 1, 2021, through June 30, 2022. Assessments were mailed to property owners by May 1.

> Video below: Watch the news conference with county assessors in the Denver metro area announcing property valuations:

SUGGESTED VIDEOS: Latest from 9NEWS