DENVER — The Federal Reserve increased the student loan interest rate for the upcoming 2022-2023 school year. According to Forbes, the rate will increase by 1.26 percentage points. That's a 34% increase in interest rate for undergraduate student loans compared to the rate last year.

Metropolitan State University Economics Professor Alex Padilla spoke to 9NEWS about the impact the increased rate will have on incoming students.

(Editor’s note: This interview has been edited for context and clarity.)

9NEWS: Why are we seeing such an increase right now?

Padilla: The main goal of the current administration is to try and tame down the inflation. We have an inflation rate that has not been that high in over 45 years. It’s over 9%, which is about four to five times more than what economists recommend in terms of new inflation rate. So therefore it means prices are being increased on an annual basis, significantly, which lowers the purchasing power of consumers.

Is this a significant hike in interest rate compared to years past?

Padilla: Yes, 34% is a significant increase, yes, but the goal is to tame down inflation, and one way to do that is to raise interest rates -- not only student loans, but every type of lending product, to ensure people consume less.

What impact will this have on students?

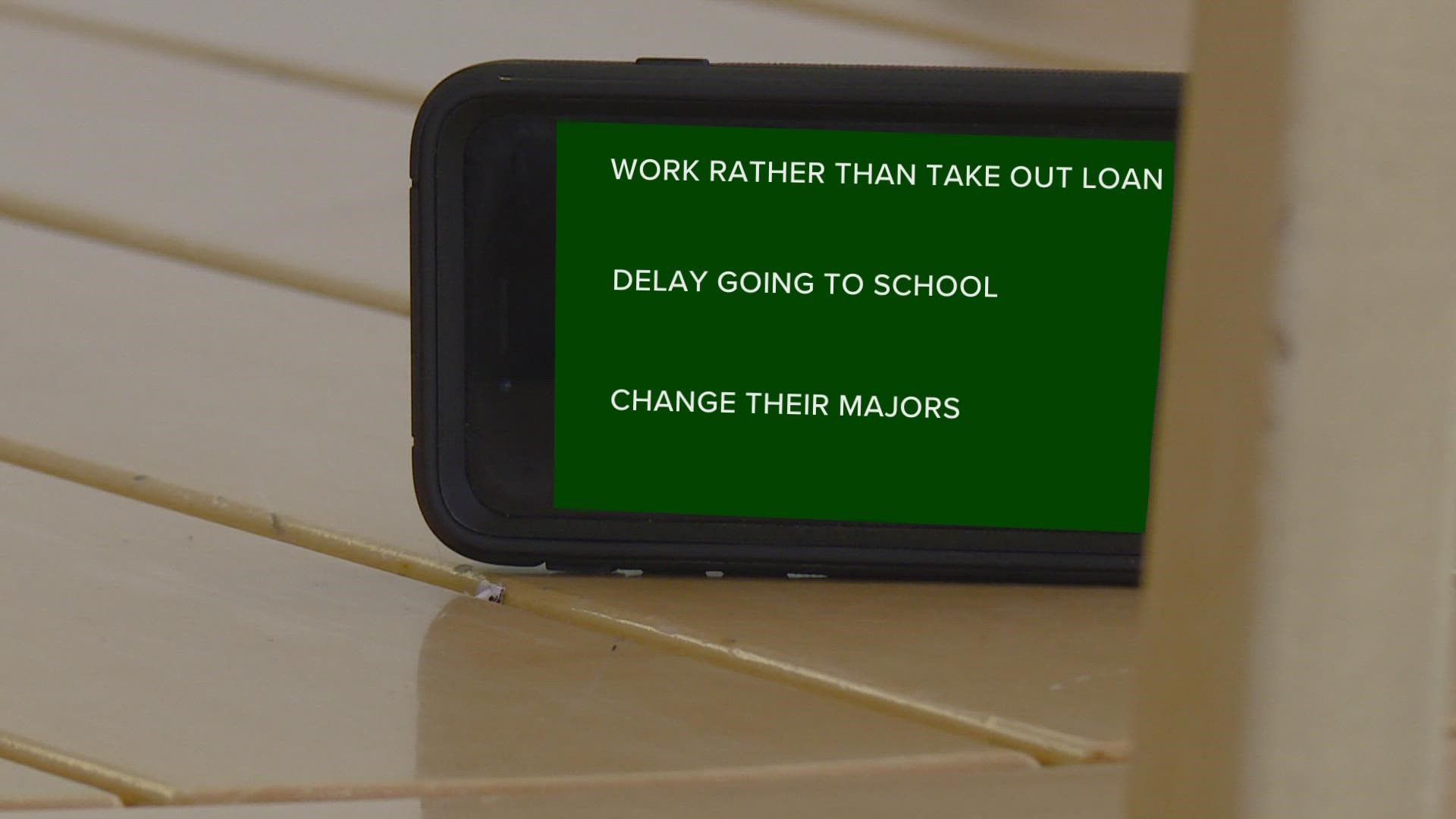

Padilla: It means students will have to reconsider the way they have to finance their education, and so instead of taking a loan, they might go to work. So we may have an increase in the portion of new students that are going to enter the labor force to be able to pay for their education.

It’s important to know that this is only for new federal student loans. Current students who have already taken a loan in the past have a fixed interest rate for 30 years, in general. They’re not being affected by this increase in interest rate. Only the new students are being affected by that increase.

For those new students, if they want to go to school or go to university to pursue a higher education, a college degree, they will have to decide whether or not they are going to take that loan or they are going to work. One of the consequences of that is that we do observe some labor shortage in the U.S., and as a result of that, we might mitigate a little bit of that shortage.

But also, as students go to work to be able to pay for their education, that will give them on-the-job training. That will give them job experience, and that might motivate them to study harder because they don’t like the job they have now to pay for their education.

We probably will observe potential students that are going to delay entering universities because currently wages are going up because we have a labor shortage.

Another thing is that students might reconsider what type of majors they are going to pursue for their education, in the sense that even though research shows that having a college degree is highly beneficial, that’s just an average. Prospective students might actually do their homework when it comes to early career wage, median wages and which degree pays more after they graduate, compared to which degree pays less.

Any advice for incoming students?

Padilla: Look at the data. What do reports say in terms of unemployment rate and median age? Look at where you’re planning to live and look at your options.

So it’s a lot of homework, but it’s an important investment and sometimes you have to consider the fact that you don’t need to have a college degree to have a successful life. You don’t need a college degree to make lots of money. It’s going to be a different type of work. It’s going to be a different type of life. It’s going to be a different type of comfort level. If you’re going to have a college degree, what are you going to do with it? And what can you do with it? What kind of sacrifice are you going to make for that college degree? Understanding that it’s not necessarily true that even if you are a successful graduate you are going to be able to make a high income. Truth can be unpleasant, but truth matters.

SUGGESTED VIDEOS: Education stories from 9NEWS