DENVER, Colorado — Seventy million Americans — as of last count — had a debt in collection within the last year, according to the Consumer Financial Protection Bureau.

That's a lot of debt.

And it's a lot of calls and notifications from debt collection companies.

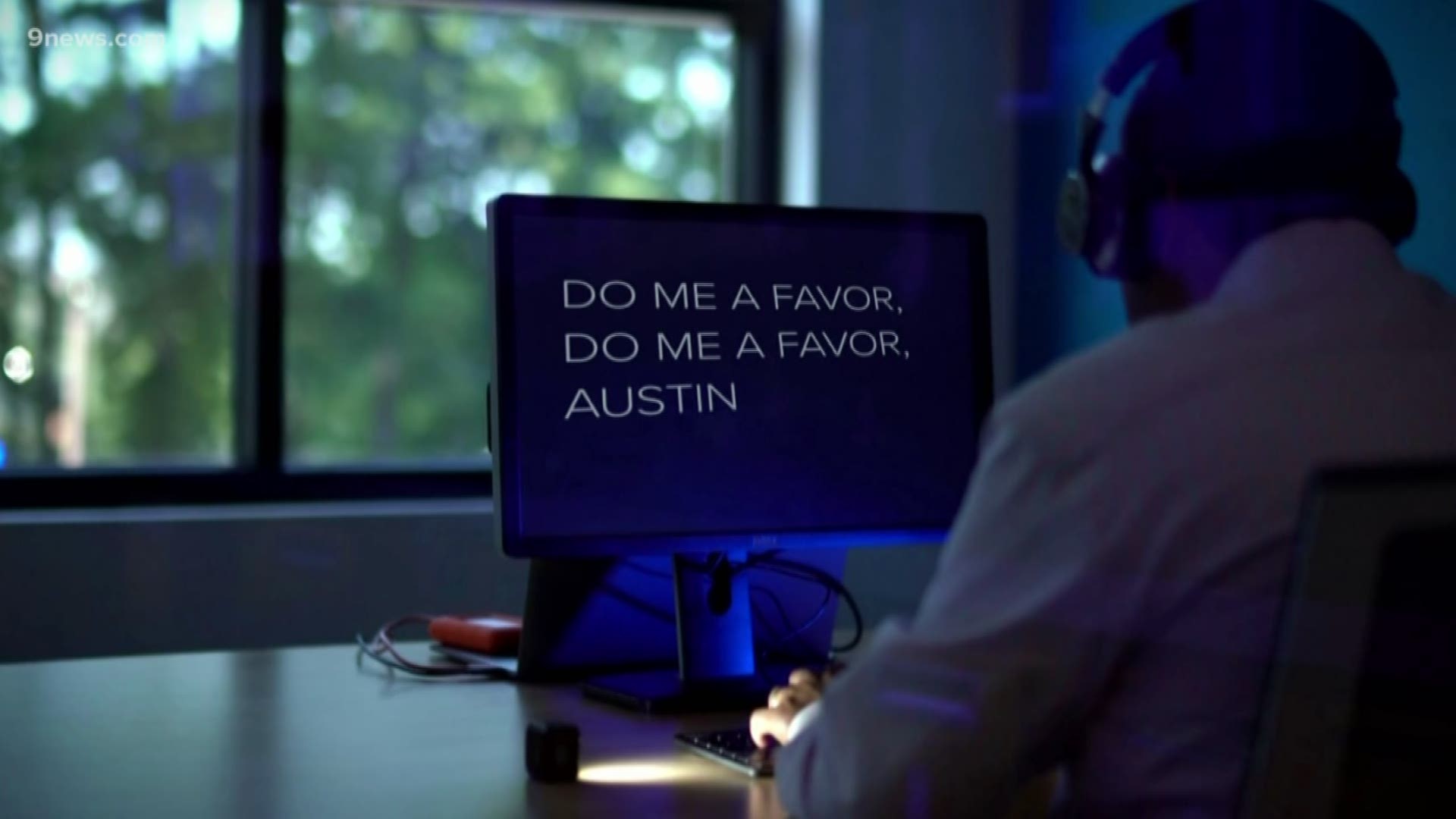

While working on a potentially problematic phone call from a debt collections company in Georgia, 9Wants to Know reached out to an expert in the subject.

Denver attorney and former acting deputy director with the CFPB Sarah Auchterlonie feels strongly about letting people know their rights when it comes to debt collections.

She offered the following five thoughts:

- Ask to validate the debt IN WRITING, RIGHT AWAY. Federal law requires collection agencies to provide you the names of the original creditor, and copies of statements or contracts underlying the debt.

- About half of all debt collected is medical debt. If you get a notice, call your insurance company to make sure you got the coverage that you were entitled to. Then, check with the hospital or care center to see if they have any programs to help you negotiate down or forgive the debt. Sometimes dealing with the original creditor can make a big difference.

- Don’t avoid calls and letters. Most collection agencies have a lot of leeway to negotiate lesser amounts or payment plans. You are more likely to be sued for the debt if you don’t participate in deciding how to handle it.

- Collection agents can have bad days, too. If you are treated rudely, not given information you request, or feel like someone is untrained or exaggerating the truth or an amount owed, ask to speak to a manager. If you don’t get a good response, file a complaint with the BBB or at CFPB.gov.

- Remember that it’s not personal, collection agents are just doing their jobs. Most situations can be handled in a way that is satisfactory to everyone.

SUGGESTED VIDEOS | Investigations from 9Wants to Know