Poor credit impacts millions of Americans, and many people seek out services to help them repair their credit and get out of debt.

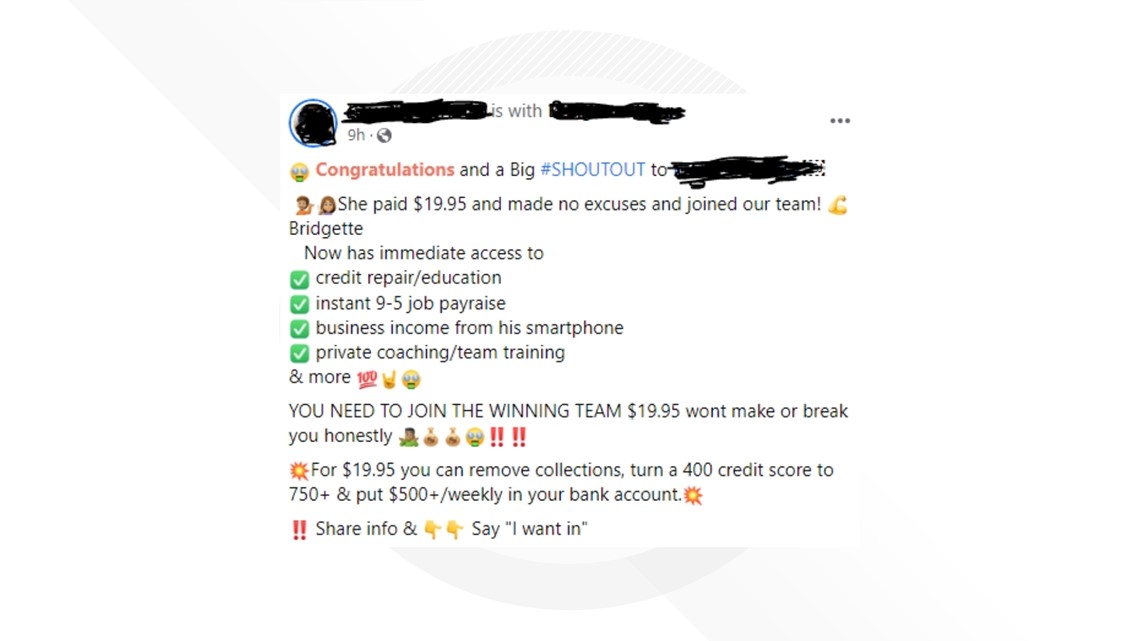

Thomas Nitzsche, a certified financial educator at Money Management International, recently sent the VERIFY team a screenshot of a Facebook post from a person claiming to offer credit repair services at a low cost. Nitzsche says social media posts, similar to the one below, are typically scams, but many people have a hard time telling the difference between them and legitimate services. Here are tips on how to spot similar fraudulent offers.

THE SOURCES

- Thomas Nitzsche, certified financial educator at Money Management International

- Better Business Bureau (BBB)

- Federal Trade Commission (FTC)

- Consumer Financial Protection Bureau (CFPB)

- Department of Justice (DOJ)

WHAT WE FOUND

Red flags to help you spot credit repair scams

Credit repair companies typically promise to clean up credit reports for a fee, but the chances that these companies can do anything account owners couldn’t do on their own is slim, according to the Better Business Bureau (BBB) and Federal Trade Commission (FTC). That’s because each person has the right to correct inaccurate information in their credit file, but nobody can remove accurate negative information, the BBB says.

The BBB and FTC share red flags that can help people identify potential credit repair scams on their websites. These include credit repair companies that:

- Charge fees before your debts are settled

- Pressure you to pay fees masquerading as “contributions”

- Try to look like a government program

- “Guarantee” to make the debt go away or improve a credit score quickly

- Tell you to stop paying debts and communicating with creditors

- Say that you can’t get additional information without providing personal financial information

- Promise to repair your credit without actually reviewing your financial situation

- Offer a debt management plan (DMP) without teaching budgeting and money management

- Promise that they can erase bad credit or remove information from your credit reports

- Don’t explain your legal rights when they tell you what they can do for you

“If there's an organization or person that's claiming that they can improve your credit 50 points in the next two weeks or some other claim like that, that's really a red flag,” Thomas Nitzsche told VERIFY.

People who are worried about credit debt are often vulnerable to fast solutions, but the BBB, FTC, and Nitzche all say only time and conscientious payments will actually repair a person’s credit.

“There are no guarantees when it comes to credit because it really is just a matter of good financial healthy habits over time that then will incrementally improve your credit,” Nitzsche said.

VERIFIED tools to help you get out of credit debt

Credit counseling is the most comprehensive solution to repairing credit because it uses a variety of resources to help solve financial issues, according to the BBB. Those resources include budgeting, educational programs, access to counselors, and sometimes, a personalized debt management plan (DMP).

A DMP is a system that allows a person to pay one monthly payment that covers all of their included debt, according to Money Management International. After your creditors agree to the plan, you make a single payment each month to the facilitator of your DMP, who then divides and disperses the payment to your creditors every month.

The BBB says individuals seeking credit counseling services are protected under the Credit Repair Organizations Act (CROA). CROA prohibits untrue or misleading representations and requires certain affirmative disclosures in the offering or sale of credit repair services, according to the FTC.

Legitimate companies adhering to CROA must provide the following:

- A written contract detailing your rights and the services to be performed

- A three-day cancellation period with no charges

- Details on how long it will take for you to get results

- An accounting of all costs and fees

- Any guarantees that they are making through their marketing

The Consumer Financial Protection Bureau (CFPB) and the FTC can guide you toward legitimate nonprofit resources to use for improving your credit online. The U.S. Department of Justice (DOJ) also shares a list of approved agencies for people looking for credit debt reduction assistance on its website.

Additionally, the National Foundation for Credit Counseling (NFCC), which is the umbrella organization for all nonprofit credit counseling organizations in the U.S., can connect you to local credit counseling agencies in your area at nfcc.org.

Nitzsche says that trusted financial organizations, like your bank or credit union, also typically offer free financial wellness tools to their customers.

Reporting credit repair scams

If you have a problem with a credit repair company or are a victim of a scam, fraud, or bad business practice, you can report it to the FTC at ReportFraud.ftc.gov, the CFPB at bureau@cfpb.gov or the BBB at complaint@bbb.org.

You can also contact your state attorney general or your local consumer affairs office to file a report.