DENVER — The latest data from the IRS shows a lot of Coloradans are leaving money on the table when it comes to their tax refund.

The data is a little old, but during the tax year of 2020, only 72% of eligible Coloradans filed for the Earned Income Tax Credit (EITC), a Steve On Your Side analysis of IRS data found. Colorado was among the six lowest states for its EITC rate.

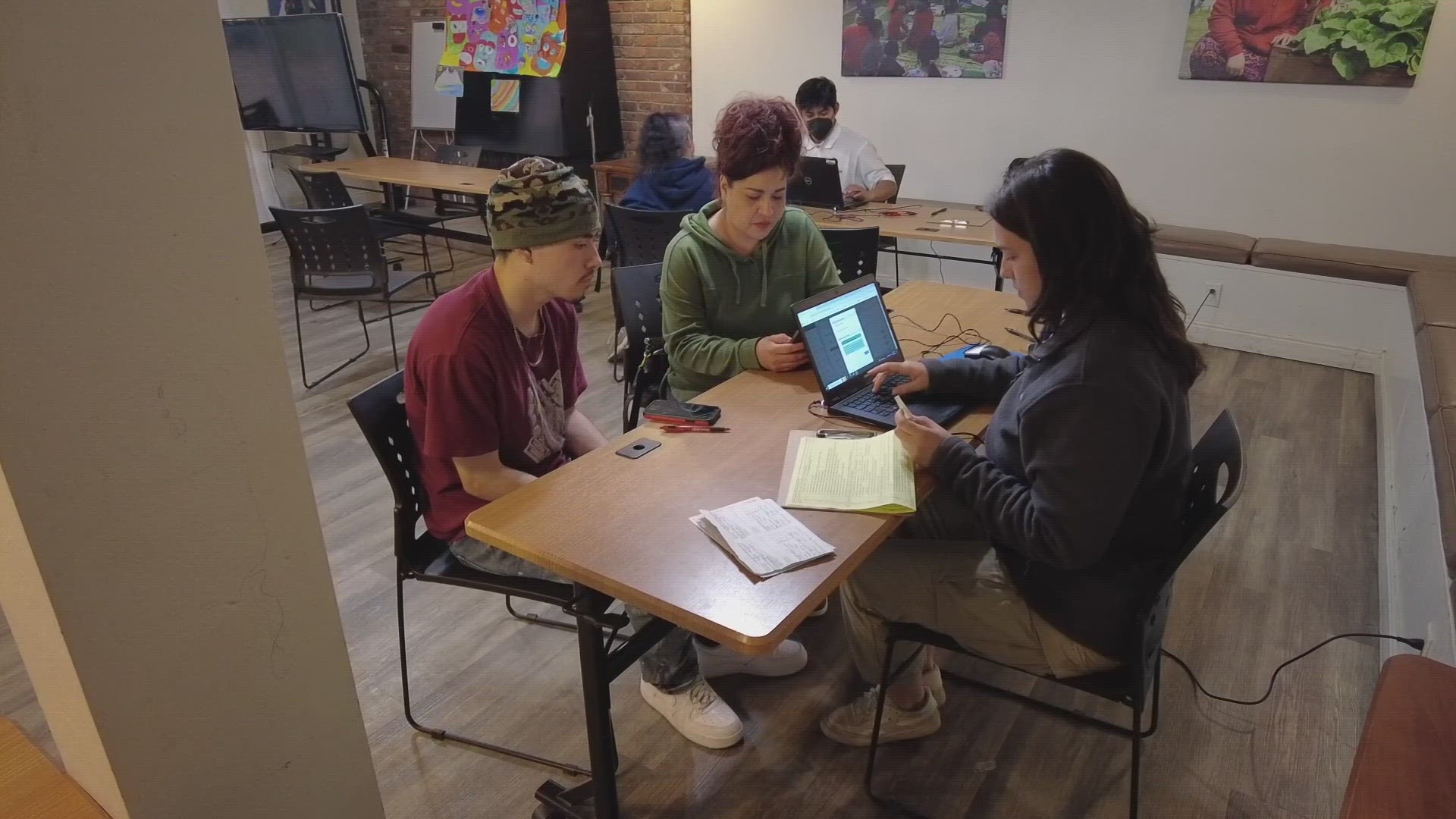

“The credit is designed to promote work and to make sure that people are rewarded for engaging in the economy,” said Kristin Hubbard, program director for Tax Help Colorado, a volunteer service of Mile High United Way, helping middle and low-income Coloradans connect to volunteers who can help file those taxes for free.

“Families who are working and are engaging in our economy can truly benefit by filing a tax return and gaining access to those credits,” she said.

The EITC is designed to help moderate to low-income workers and their families reduce the amount of taxes they owe. For the tax year of 2023, a married couple with three or more children with an annual gross household income of 68,398 or less could qualify for a $7,430 credit on their 2023 taxes.

This year, Hubbard’s team of volunteer tax professionals at Tax Help Colorado has filed more than 5,200 returns bringing in $13 million in refunds. The group hosts a number of free clinics across the state to help people file their taxes.

“If you meet our program requirements, the $64,000 or less of income, limited English proficiency or disability, I highly encourage you to come to tax help,” she said. “It's truly a program that is meeting the needs of the community in a very kind of intimate way of learning all of your tax information and a really practical way like, let us help get your family the money it's owed by filing your tax return.”

To find a Tax Help Colorado clinic near you, click here.

Along with encouraging Coloradans eligible to file for the EITC, Tax Help is also focused this year on getting lower income Coloradans to file a state return which includes a flat TABOR refund of $800 for all income earners.

“We've heard a lot of stories from elderly neighbors who are saying this is going to help me buy groceries. This means I can pay Xcel back. Just meeting those basic needs through filing their tax return and gaining access to that refund.”

Have a consumer tip for Steve On Your Side? Click here to fill out a form to send it to Consumer Investigator Steve Staeger.

SUGGESTED VIDEOS: Steve on Your Side