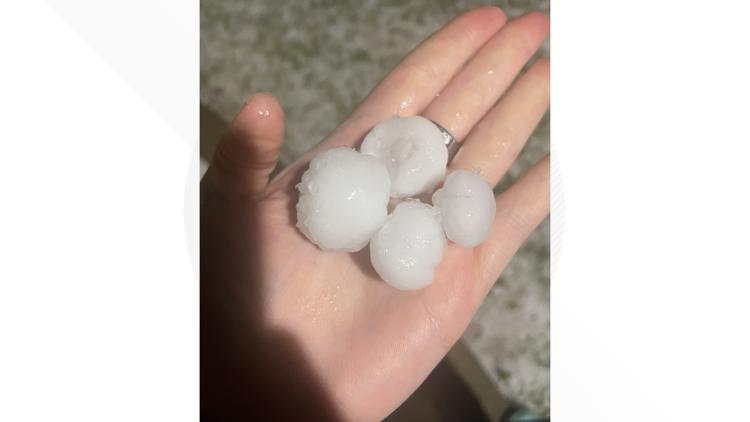

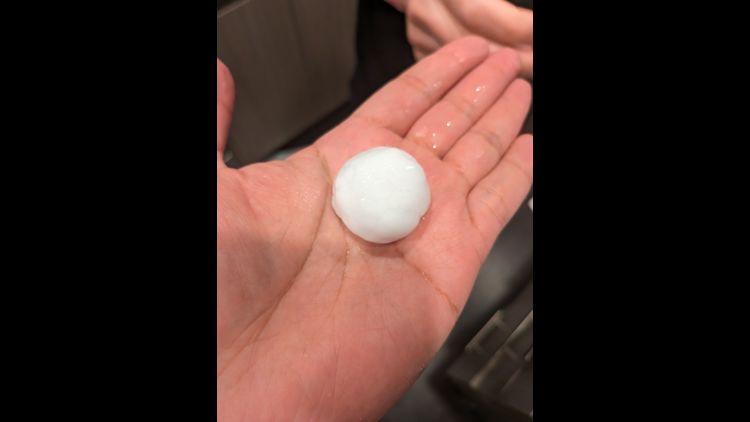

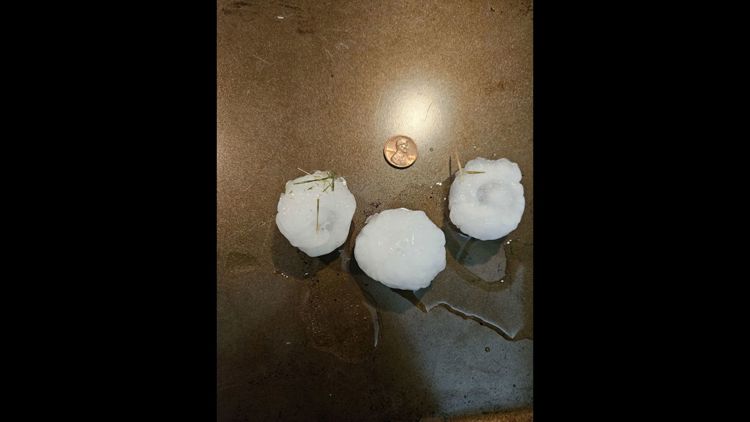

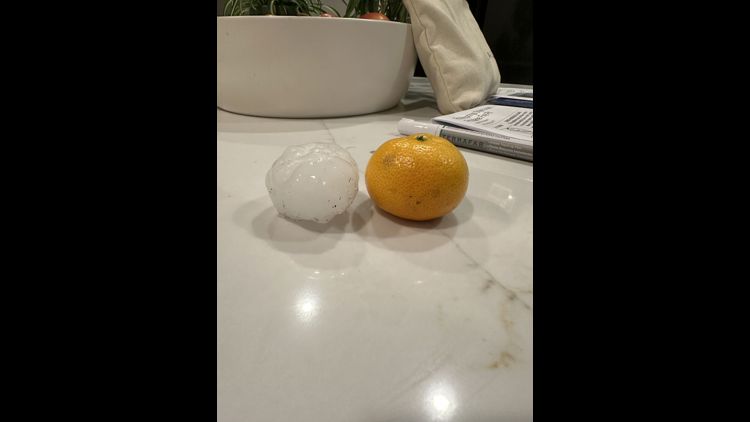

DENVER — Severe thunderstorms dropped baseball-sized hail on the Denver metro area late Thursday night.

The destructive storms left a path of hail from Broomfield to Aurora before leaving the metro area just before midnight.

The largest hail report was a 2.75-inch hail stone in southeast Commerce City. There were also several reports of egg-sized hail, or 2 inches, in Aurora, Broomfield and Henderson.

The hail caused significant damage in Thornton and Green Valley Ranch.

For those that experienced hail and storm damage, the Colorado Division of Insurance (DOI) shared tips about how to start the claims process and what to know about storm insurance.

Start the claim process

- It is important to contact your insurance company or agent as soon as you can to begin the claim process.

- Contact the DOI if you need the contact information for your company or agent.

Protect yourself from roofing fraud

Roofing contractors and other construction contractors start door-to-door sales or phone solicitations immediately after hail and wind storms.

- Be careful working with anyone who has contacted you in this way.

- Check references and work with Colorado-based contractors when possible.

- Get everything in writing and read contracts carefully.

- Find more information at the Better Business Bureau’s site.

Document / mitigate the damage

If the damage to your home or car is extensive, when it is safe to do so, start taking photos and documenting the damage.

- Know that many companies allow you to submit photos when you file a claim.

- You should mitigate further damage by placing tarps on roofs, boarding up windows or placing plastic sheeting over windows, windshields or your car.

Be aware of your deductibles for both home and auto

Remember that you are responsible for paying the deductible amount.

- Review your policy declarations to find out the deductibles.

- With homeowners’ insurance, many policies will have wind or hail deductibles that are a percentage of your coverage (for example, 1%, 2% or 5%).

- Damage to your automobiles is covered under your comprehensive coverage and is also subject to your deductible.

- If damage estimates are below your deductible, understand that the insurance company will not issue a payment.

Ask questions

After you file your claim, your insurance company will assign a claims adjuster to work with you to assess the damage.

Once the adjuster has completed their assessment, they will provide documentation of the loss to your insurance company to determine your claims settlement.

- Be sure to ask the claims adjuster for an itemized explanation of the claim settlement offer.

- If there is a disagreement about the claim settlement, ask the company for the specific language in the policy that is in question.

- If this disagreement results in a claim denial, make sure you obtain a written letter explaining the reason for the denial and the specific policy language under which the claim is being denied.

Don't rush into a settlement

If the first offer made by an insurance company does not meet your expectations, be prepared to negotiate to get a fair settlement.

If you have any questions regarding the value of your claim, seek professional advice or obtain quotes from several contractors.

Public Adjusters

After a severe storm such as this, you may be contacted by public adjusters.

Public adjusters are licensed by the DOI and work on behalf of a consumer and often charge a percentage of the claim amount. The fee is agreed upon in the contract between the public adjuster and the consumer.

You are not required to hire a public adjuster, but if you do, make sure they are licensed, check references and if possible, hire a Colorado-based adjuster. And always take the time to carefully read any contracts.

Estimates for repair costs can change

Remember, the first estimate for repairs is not always the final estimate. Contractors or body repair shops may often find additional damage once repairs begin.

In these cases, it is important to provide additional information about this damage to your insurer before allowing repair work to continue. The insurer will review and issue a supplement if approved. Improvements or repair work for damage that was not part of the storm will not be covered.

Contact the DOI

While your claims need to be filed with your insurance company, the DOI can assist consumers with questions about insurance and the claims process.

Ways to ontact the DOI consumer services team:

- 303-894-7490

- DORA_Insurance@state.co.us

- doi.colorado.gov (click on “File a Complaint”)

Hail hits Denver area

Download the 9NEWS app

iTunes: on9news.tv/itunes

Google Play: on9news.tv/1lWnC5n

SUGGESTED VIDEOS: Colorado Weather

MORE WAYS TO GET 9NEWS

Subscribe to our daily 9NEWSLETTER

Download the 9NEWS APP

iTunes: http://on9news.tv/itunes

Google Play: http://on9news.tv/1lWnC5n

ADD THE 9NEWS+ APP TO YOUR STREAMING DEVICE

ROKU: add the channel from the ROKU store or by searching for KUSA.

For both Apple TV and Fire TV, search for "9news" to find the free app to add to your account. Another option for Fire TV is to have the app delivered directly to your Fire TV through Amazon.