COLORADO, USA — The result of a bill passed by legislators more than a year ago is showing up on Coloradans receipts in the form of an extra 27 cents on most delivery orders.

The intent of the fee is to help pay for Colorado's transportation infrastructure and the state's Department of Revenue said the fee is the first of its kind in the country.

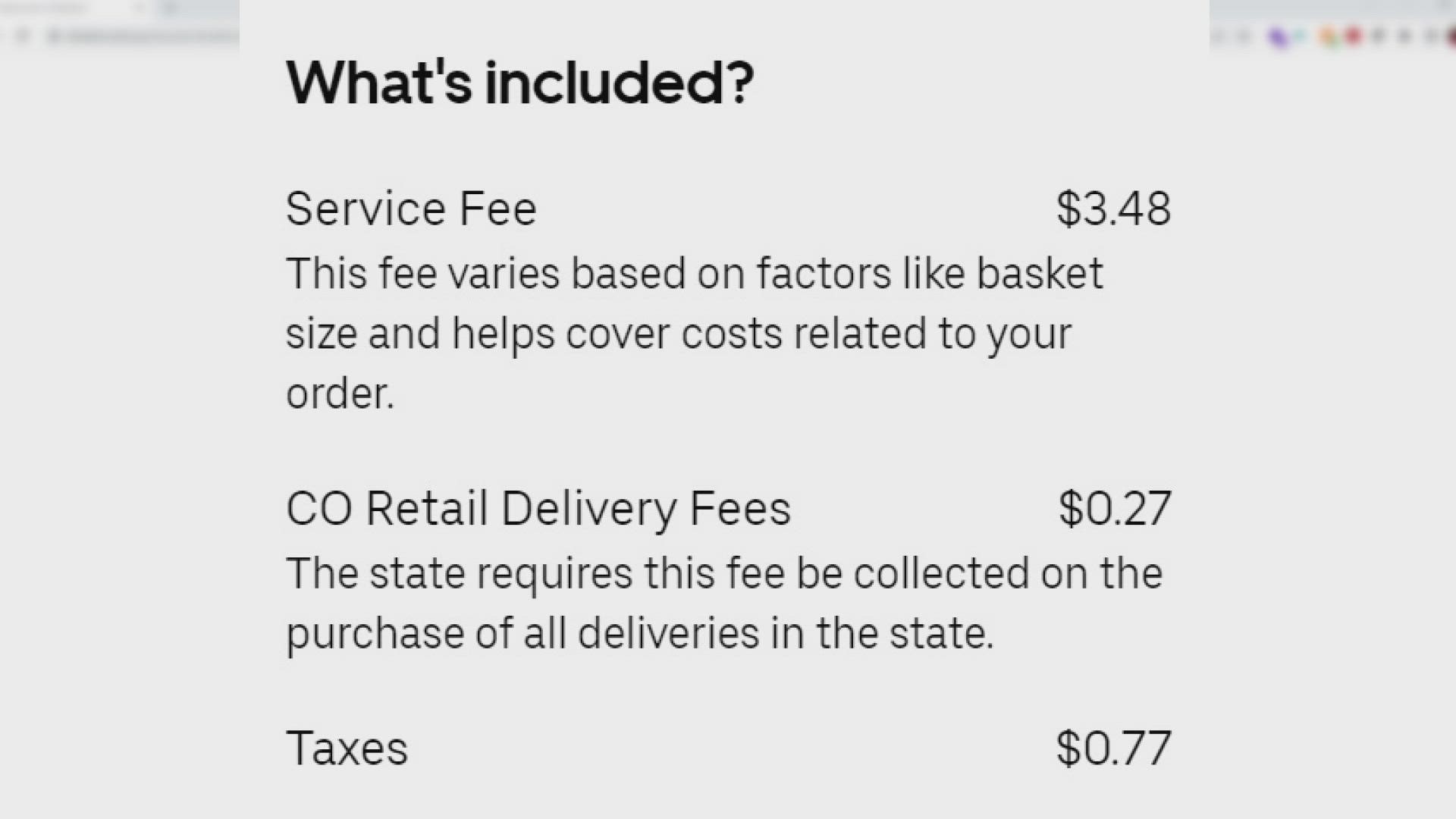

As of July 1, 27 cents is added to most delivery orders sent to a location in Colorado, and if retailers are abiding by the statute, the added fee can be seen on receipts.

In a hearing at the capitol on Wednesday, representatives from the Department of Revenue explained the statute has a "one order, one fee rule."

That means no matter how many items people buy, and how many deliveries that might take, there is still just one 27 cent fee per order.

"We need to figure out new ways to fund transportation," said John Dundon, the owner and president of Taxpayer Advocacy and Services Incorporated.

Dundon agrees with the spirit behind the fee, but not the rollout of it.

“This piece of legislation really flew under the radar because it was such a small kind of sort of amount, 27 cents per transaction, that we really didn’t understand at the time of the writing of this statute how invasive it would be, and how difficult it would be and how expensive it would be to enforce," said Dundon.

As the government relations chair on the Committee for the Colorado Society of Enrolled Agents, Dundon asked the state on Wednesday for clarification on the delivery fee.

“When should the fee apply? Specifically. And what it distills down to is the statute that created this new fee is very clear when it comes to defining what a retail delivery is, but is silent as to when a seller of goods physically brings their store to the customer," said Dundon.

Some of his clients are tool truck driving companies. The drivers have fixed routes and sell things along the way. Dundon said sometimes people ask to buy a tool the driver doesn't have in their truck, and the driver will bring that item on their next trip to the customer's house.

"Does the retail delivery fee apply in that particular situation is our question?' Dundon said.

Dundon added there is also frustration when it comes to municipalities that have their own sales tax, and will essentially be taxing this fee.

"Aurora for example will include this fee as part of the total cost of the item to be subject to the City of Aurora taxes," said Dundon. "And so you’re paying a tax on a fee, and there’s a constructive argument that can be made that that’s a little bit of government overreach at the local level."

Despite confusion and frustration, every retailer that falls under the statute needs to start filing a new tax form right away.

The Department of Revenue expects to see the first returns from the fee on August 22.

SUGGESTED VIDEOS: Latest from 9NEWS