HIGHLANDS RANCH, Colo. — When Arthur Scott Jr.’s wife passed away suddenly in late 2023, he wanted to be sure he managed taxes right. So he went to a tax professional, printed a paper tax return as required by state law and mailed the return to the state in late March.

Nearly three months since he mailed that document to the state, Scott Jr. is still waiting for his refund of $2,200.

“In the past of sending it in online, it would happen within days, or worst case, a week or so,” he said. “I have no clue why it’s taking so long.”

Scott Jr. is one of several taxpayers who’ve reached out to Steve On Your Side in the past month wondering why their refunds haven’t come yet.

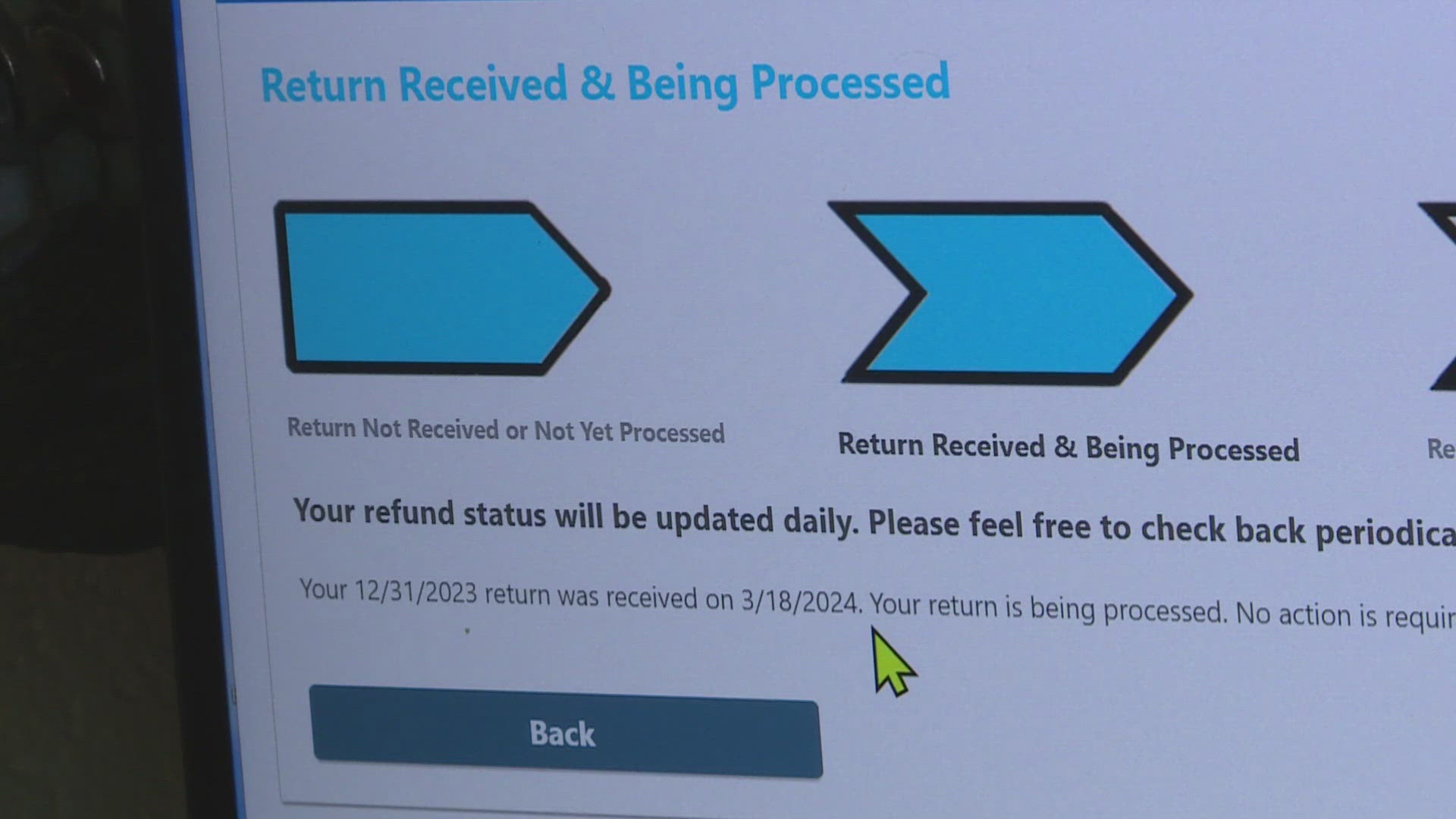

Dwight Hall, who also lost his wife last year, said he mailed his taxes on March 15. The state’s return tracker shows the state received it on March 18. But that same tracker says the return has been in processing since that date. He is still waiting on a refund of about $1,700.

“Longer than you would expect,” Hall said.

> TRACK YOUR COLORADO TAX REFUND: Colorado Income Tax Refund Tracker

Both men said they’ve tried hard to reach the Colorado Department of Revenue, with no luck.

“I'm trying to call,” Scott Jr. said. “That's impossible.”

“There's no way to get a hold of them,” Hall said. “I mean, they're like a secret society. You know, they're out there. You know they're there, but you don't whatever they're doing or anything.”

In a statement to Steve On Your Side, a spokesman for the Colorado Department of Revenue’s Taxation Division said the state has seen a historic number of tax returns filed -- about 3 million. That's up 7% year over year. He said the department has already issued 2.1 million refunds – up 11% from the previous year.

“This volume means that more tax returns need to be reviewed,” spokesman Derek Kuhn said by email. “This means that some taxpayers’ refunds will take additional time to approve than in previous years due to the historically large volume of tax returns. The Department is working as quickly as it can to accurately process all tax returns that require additional attention. We ask affected Coloradans for patience as we work to review and approve all tax returns.”

Hall said the state’s website promised the refund in two to six weeks.

“After that six weeks, maybe they ought to pay the same penalty they would charge you and I if we missed April 15,” he said.

This story is the result of a number of tips to Steve On Your Side. If you have a consumer problem, tell Consumer Investigator Steve Staeger about it.

SUGGESTED VIDEOS: Steve on Your Side