DENVER — Colorado's Democratic governor and a conservative economist faced off against a Republican legislator and the head of a conservative-leaning advocacy organization Monday in a debate over a multibillion-dollar ballot question to offer property tax relief by using dollars earmarked for taxpayer refund.

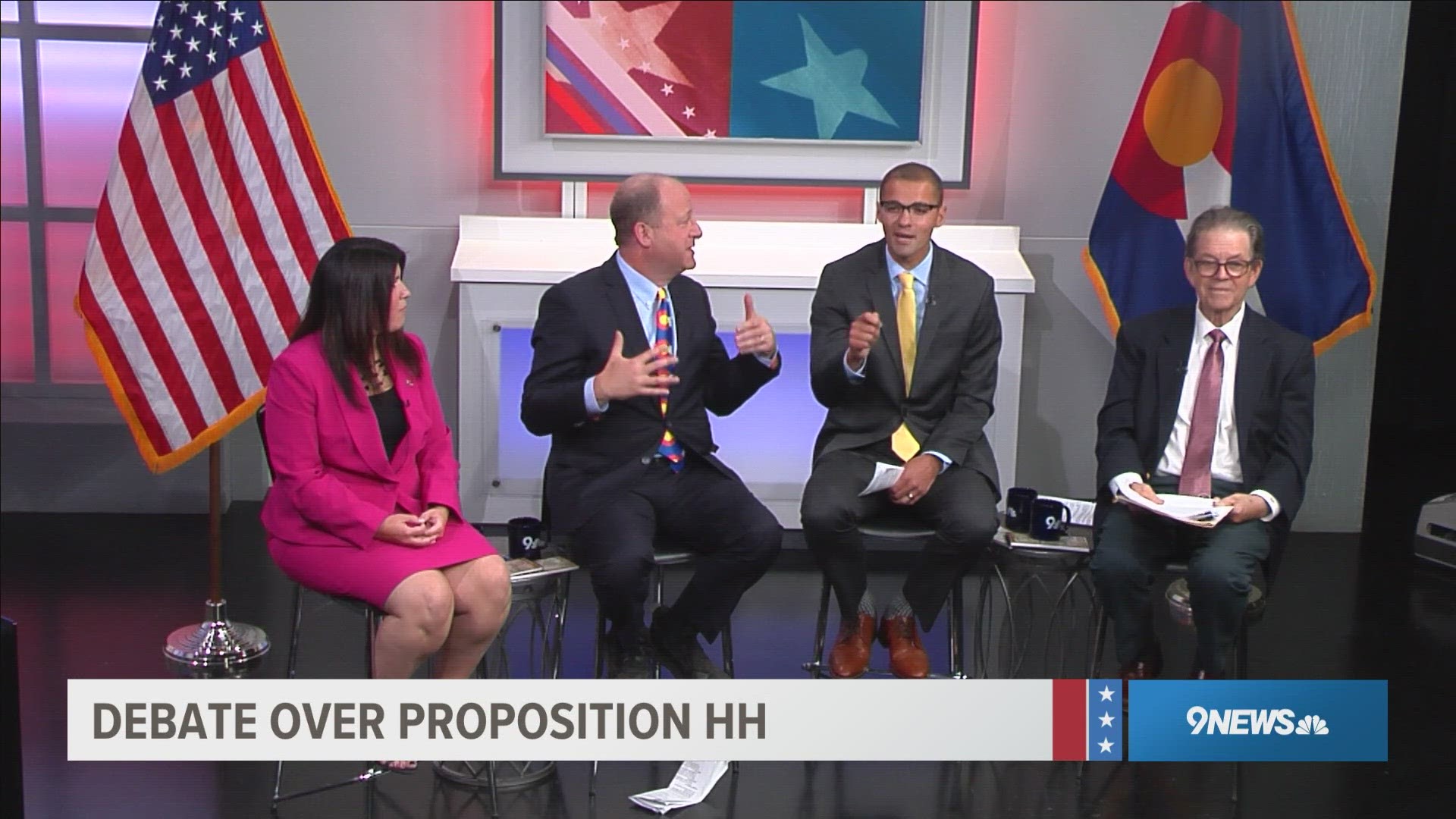

With just over two weeks remaining until ballots are due, Gov. Jared Polis teamed up with economist Arthur Laffer to urge passage of the statewide ballot measure, while Assistant House Minority Leader Rose Pugliese, R-Colorado Springs, and Michael Fields of Advance Colorado Action argued against it.

The lively, hour-long debate, sponsored by The Denver Gazette, Colorado Politics and 9NEWS, was moderated by 9NEWS political reporter Marshall Zelinger and streamed live online. It can be viewed here:

The ballot question, which was referred to the November ballot by the Democratic-controlled legislature, asks voters to let the state keep surplus revenue under the Taxpayer's Bill of Rights for a 10-year period. If it passes, the funds — estimated at about $170 million in the first year and growing in subsequent years — would go to local governments to offset reductions in property tax revenue.

The complicated measure would also redirect TABOR refund money to rental assistance and K-12 education, and expand property tax relief enjoyed by seniors, among other provisions.

Supporters call the ballot question a comprehensive, long-term response to soaring property tax increases resulting from recent double-digit property values. Opponents say it's a bait-and-switch attempt to grow government by cutting into future TABOR refunds without meaningfully softening the blow on property tax bills.

Both sides agreed that property taxes are going up next year, but the HH proponents argued Monday that the measure will help reduce the rate of increase and give taxpayers relief on other fronts, while the measure's opponents insisted that taxpayers will be saddled with a net loss by seeing their TABOR refunds dwindle over the next decade.

"Property taxes are about to skyrocket, and instead of simply cutting the rates, the governor and the General Assembly decided to use this crisis an opportunity to go after our TABOR tax refunds," Fields said.

Charging that the measure and its supporters are "intentionally misleading voters," Fields added that the governor could solve the problem by calling a special legislative session to cut property tax rates without involving TABOR.

Arguing that Colorado property owners are "in many ways a victim of our own success," since housing prices have risen at record rates, Polis said the measure "solves that in many ways."

"The immediate crisis people face without HH passing is a 40% increase on their property tax bills," he said. By passing the referendum, Polis said, voters can reduce the property rate and contain the growth of property taxes over time.

"It'll prevent us from ever again having this kind of huge hike that people face," Polis said. "I think it's better not to tax money from people in the first place rather than over-collect and refund via TABOR. It's better to simply cut taxes on the outset. This cuts the rates and saves people money."

Polis said he would support lawmakers imposing further property tax cuts but declined to say what his backup plan is if the measure fails at the ballot box.

Under the measure, state government would send up to 20% of the money it retains from money that would otherwise go to TABOR refunds to local governments to offset their lost property tax revenue. The state would set aside up to $20 million for rental assistance programs to help residents who aren’t homeowners. The vast majority of the funds available if HH passes, however, would go to education funding, rising to a projected $2.1 billion a year within a decade.

Pugliese disputed Polis' contention that the measure would provide significant savings. She also complained that local officials, who collect and spend property taxes, weren't consulted by statehouse Democrats when they wrote the referendum.

"I will say, when I did the calculator, it was not a significant property tax savings," she said. "And when I talk to people on the street and people door-to-door, they don't think it's a significant property tax savings at all. And remember, it's just a decrease on the increase — your property taxes are still going up, regardless."

She blamed legislative Democrats, who hold historic majorities in both chambers of the General Assembly, for confusing two unrelated tax policy questions in the ballot measure.

"We did not need to go to the ballot," Pugliese said. "We did not have to take a property tax crisis and use it to take your TABOR refunds — TABOR has nothing to do with the property tax issue — and we should have addressed it in April, as good leaders, but we didn't."

Polis countered that lawmakers couldn't have crafted a solution nearly as sweeping — particularly in the scope of potential tax relief — as the one before voters.

Calling himself a "wild-eyed optimist," Polis said, "There's absolutely no way I would see you guys doing a $13 billion tax cut package."

"The legislature can do a Band-aid, but only the people can solve this by passing a change," he said.

Polis' pronouncement prompted criticism from Fields, who accused the governor of shirking his leadership role in a Capitol controlled entirely by Democrats.

"We all do better if we cut property taxes in Colorado," Polis responded.

Pugliese said the solution is to bring local governments to the table, including school districts.

"I'm asking the people of Colorado, please, first vote no on HH, and, second, demand that the governor be a leader and call a special session, bringing the right people to the table, and all of the voices," she said.

Best known as the chief architect behind the Reagan administration's supply-side approach to taxation — arguing that lower tax rates pay for themselves by encouraging increased economic activity — Laffer maintained that HH is the right approach, primarily because it helps to keep taxes down.

"The reason you're such a successful state right now is you have very low property tax rates," he said. "This will add fuel and growth to the state, period."

Acknowledging that he is a long-time friend of Polis and his family — Polis interned in Laffer's office when he was 13 — Laffer said his fondness for the governor's policies transcended partisan differences.

"I know tax cuts better than anything. I am a Republican, and I'm a tax-cutting Republican who completely agrees with his tax rate reduction policies, both on income taxes and on property (tax)," Laffer said. "You don't have to put this always in Democrat or Republican (terms). Sometimes good policies are just plain good."

Added Laffer: "This is a general win for the state of Colorado, and I wholly endorse you people doing this for the benefit of Colorado. It's just the right thing to do."

Colorado voters have until 7 p.m. on Nov. 7 to return ballots to their county clerks.

SUGGESTED VIDEOS: Politics