Most Coloradans are going to save money when the tax reform bill passed by Congress takes effect in 2018.

The bill passed on Wednesday doubled the standard deduction, increased the child tax credit and lowered the percentage of income tax paid by everyone. But it also eliminated the $4,000 personal exemption and several commonly used deductions.

How much a person will owe the government at the end of 2018 will depend on how much they earn, how many people are in their family and how they earn their income.

It will also depend on where that person lives.

People who live in states with higher local taxes like California and Connecticut may see an increase because the bill eliminates a series of deductions for state and local taxes.

“I don’t think that will affect us,” Colorado accountant Mark Suokup said. “I think in Colorado almost everyone universally is going to have a tax cut.”

To get an estimate specific to your tax situation, 9NEWS checked the math for two online calculators: (Both calculators linked below ask for the numbers on any itemized deductions, so you might need to grab your 2016 return or estimate the numbers you have for 2017.)

- Click here to use a tax plan calculator from MarketWatch.

- Click here for a tax plan calculator put together by Maxim Lott.

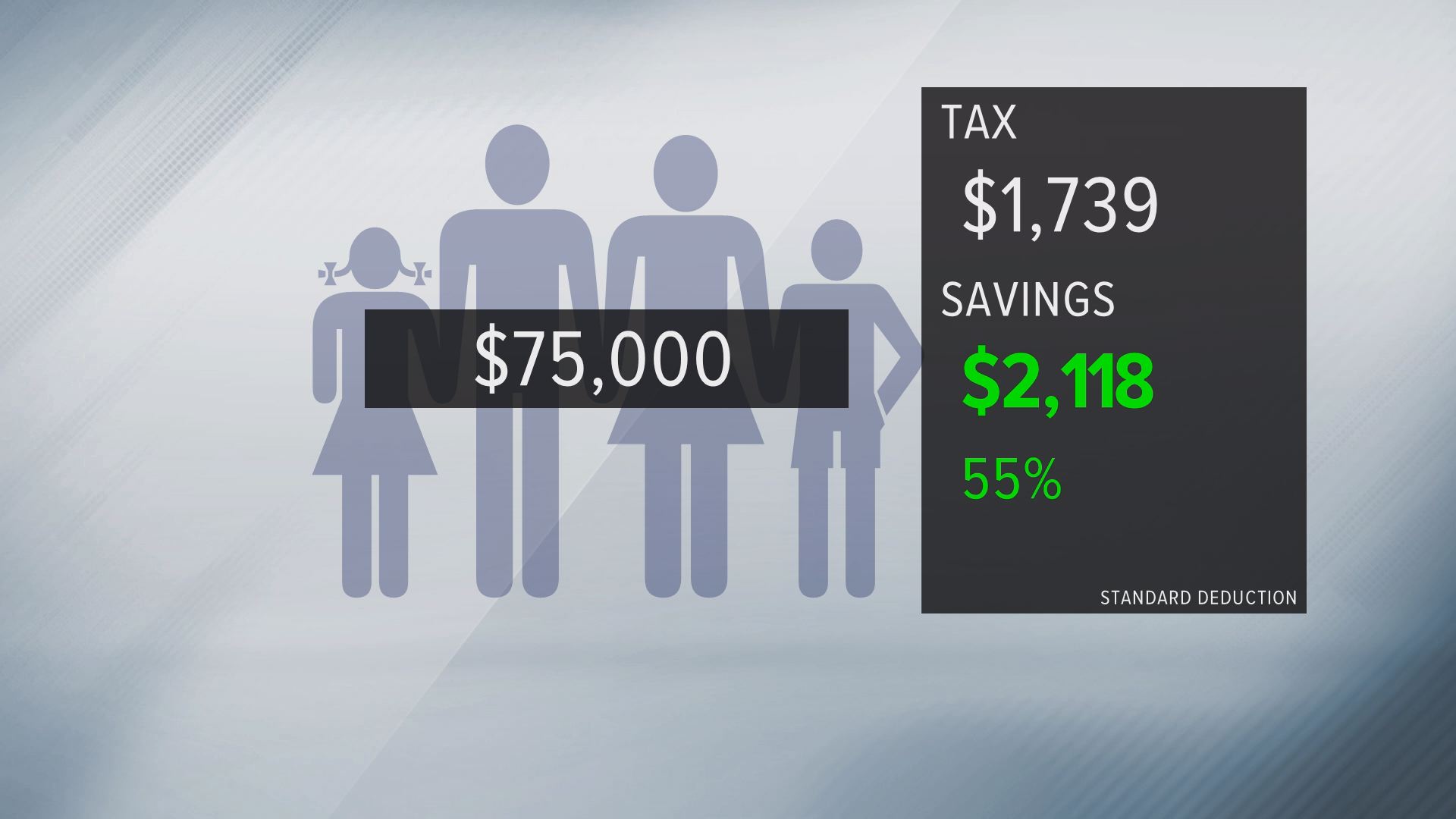

Here are some examples of what people might pay under the new system:

A single person living in Colorado who earns $50,000 and takes the standard deduction would save about $1,100 on his or her taxes under the new system.

A married couple with two children who earns $75,000 would save about $2,100.

That same four-person family would see that savings increase to about $9,500 if their income is $250,000.

And it would jump to nearly $59,000 in savings if they earned $2.5 million.

The bill represents a “paradigm shift” in the way the country approaches taxes, Suokup said.

And it’s going to take some time to figure out what works best for individual filers and businesses.

“In 1986, when we had [President Ronald Reagan’s tax cuts], it two years for us all to sort out what we should be doing and how to do it,” Soukup said. “Same thing is going to happen this time. It’s as complicated and extensive a law as we had in 1986.”

The IRS won’t have new withholding tables until February.

Soukup’s advice on that front was to keep your withholding where it is until the new tables are released.

“And then when you get the new tables you can adjust it and maybe take a little less withholding the rest of the year,” Soukup said.

There are a couple of questions Coloradans should ask their tax preparer now.

The first is simply whether he or she would accept payment in advance for future years. The deduction for the cost of preparing your taxes goes away in 2018, so you need to pay your tax professional now if you want to deduct it.

The second question you should ask is whether a technique called “grouping” would save you money.

Grouping involves prepaying certain bills in order to itemize one year and then take the standard deduction the next.

And the last question is for people who own a small business. The taxes for businesses changed dramatically, and it’s possible people could be looking at 20 percent reductions in their tax bills.

Experts also advise retirees to consider reaching out to tax professional because different sources of retirement income come with different tax implications.